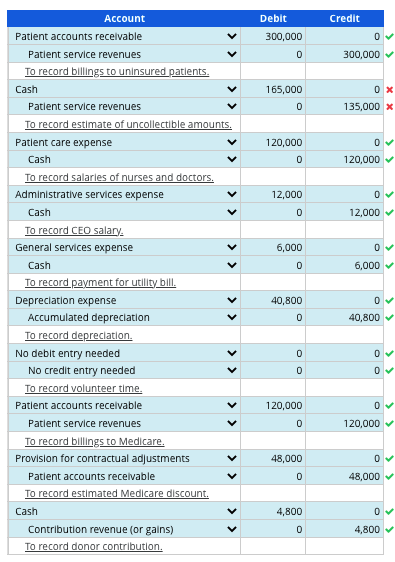

Prepare journal entries to record the following transactions of a nonprofit hospital, with expense transactions categorized by function: 1. The hospital billed its uninsured patients for $300,000. Based on historical experience, it expects to collect 45 percent of that amount over time. 2. Nurses and doctors employed by the hospital were paid their salaries, $120,000. 3. The chief administrative officer was paid her salary of $12,000. 4. The hospital paid its utility bill, $6,000. 5. Depreciation on the equipment was $40,800. 6. Several adults donated their time (worth $6,000) selling merchandise in the hospital gift shop. 7. The hospital billed Medicare $120,000 for services provided at its established rates. The prospective billing arrangement gives Medicare a 40 percent discount from these rates. 8. A contribution without donor restrictions of $4,800 was received. If no adjustment is necessary, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields.

Prepare

categorized by function:

1. The hospital billed its uninsured patients for $300,000. Based on historical experience, it expects to

collect 45 percent of that amount over time.

2. Nurses and doctors employed by the hospital were paid their salaries, $120,000.

3. The chief administrative officer was paid her salary of $12,000.

4. The hospital paid its utility bill, $6,000.

5.

6. Several adults donated their time (worth $6,000) selling merchandise in the hospital gift shop.

7. The hospital billed Medicare $120,000 for services provided at its established rates. The prospective

billing arrangement gives Medicare a 40 percent discount from these rates.

8. A contribution without donor restrictions of $4,800 was received.

If no adjustment is necessary, select 'No debit (or credit) entry needed' in the account fields and enter 0 in the amount fields.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images