Compute the use tax that Heliot owes to State H for the property purchased in S Pre credit use tax Sales tax paid to State K Use tax owed to State H Amount Compute the use tax that Heliot owes to State H for the property purchased in S Pre credit use tax Sales tax paid to State L Use tax owed to State H Amount

Compute the use tax that Heliot owes to State H for the property purchased in S Pre credit use tax Sales tax paid to State K Use tax owed to State H Amount Compute the use tax that Heliot owes to State H for the property purchased in S Pre credit use tax Sales tax paid to State L Use tax owed to State H Amount

Chapter16: Multistate Corporate Taxation

Section: Chapter Questions

Problem 45P

Related questions

Question

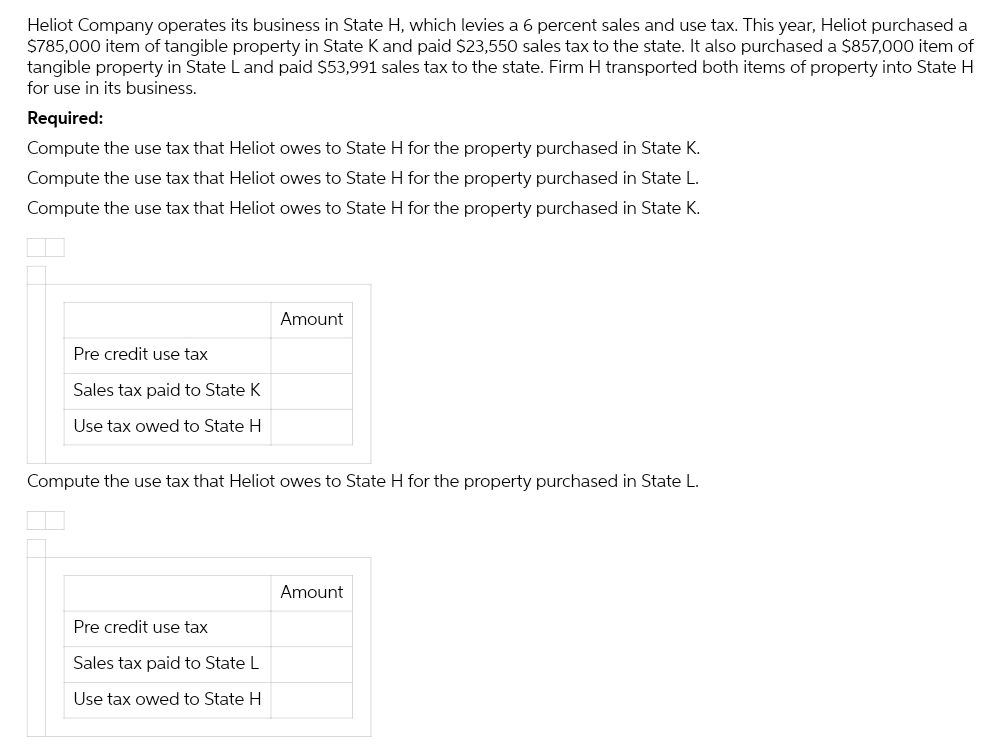

Transcribed Image Text:Heliot Company operates its business in State H, which levies a 6 percent sales and use tax. This year, Heliot purchased a

$785,000 item of tangible property in State K and paid $23,550 sales tax to the state. It also purchased a $857,000 item of

tangible property in State L and paid $53,991 sales tax to the state. Firm H transported both items of property into State H

for use in its business.

Required:

Compute the use tax that Heliot owes to State H for the property purchased in State K.

Compute the use tax that Heliot owes to State H for the property purchased in State L.

Compute the use tax that Heliot owes to State H for the property purchased in State K.

Pre credit use tax

Sales tax paid to State K

Use tax owed to State H

Amount

Compute the use tax that Heliot owes to State H for the property purchased in State L.

Pre credit use tax

Sales tax paid to State L

Use tax owed to State H

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you