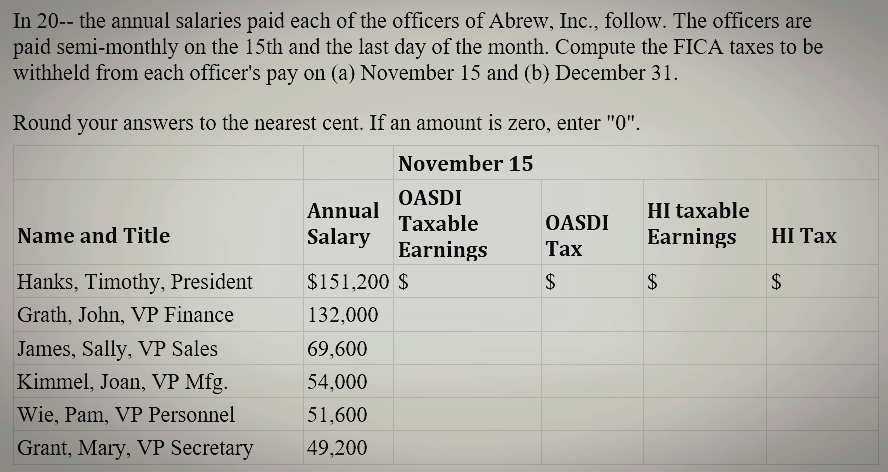

In 20-- the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semi-monthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0".

In 20-- the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semi-monthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0".

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 32E

Related questions

Question

.

Transcribed Image Text:In 20-- the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are

paid semi-monthly on the 15th and the last day of the month. Compute the FICA taxes to be

withheld from each officer's pay on (a) November 15 and (b) December 31.

Round your answers to the nearest cent. If an amount is zero, enter "0".

November 15

Name and Title

Hanks, Timothy, President

Grath, John, VP Finance

James, Sally, VP Sales

Kimmel, Joan, VP Mfg.

Wie, Pam, VP Personnel

Grant, Mary, VP Secretary

Annual

Salary

OASDI

Taxable

Earnings

$151,200 $

132,000

69,600

54,000

51,600

49,200

OASDI

Tax

$

HI taxable

Earnings

$

HI Tax

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning