Computing Cost of Sales and Ending Inventory Howell Company has the following financial records for the current period. Units Unit Cost Beginning Inventory Purchases: #1 150 600 $100 96 #32 500 92 #3 250 06 Ending inventory is 350 units. Compute the ending inventory and the cost of goods sold for the current period using (a) first-in, first out, (b) average cost, and (c) last-in, first out. (Hint: For average cost, round average cost per unit to two decimal places for calculation of ending inventory. Round to the nearest whole number. Cost of goods sold = Cost of goods available for sale less ending inventory.) (a) First-in, first-out Ending inventory $ 180000 Cost of goods sold $ (b) Average cost Ending inventory $4 Cost of goods sold $ (c) Last-in, first-out Ending inventory Cost of goods sold $

Computing Cost of Sales and Ending Inventory Howell Company has the following financial records for the current period. Units Unit Cost Beginning Inventory Purchases: #1 150 600 $100 96 #32 500 92 #3 250 06 Ending inventory is 350 units. Compute the ending inventory and the cost of goods sold for the current period using (a) first-in, first out, (b) average cost, and (c) last-in, first out. (Hint: For average cost, round average cost per unit to two decimal places for calculation of ending inventory. Round to the nearest whole number. Cost of goods sold = Cost of goods available for sale less ending inventory.) (a) First-in, first-out Ending inventory $ 180000 Cost of goods sold $ (b) Average cost Ending inventory $4 Cost of goods sold $ (c) Last-in, first-out Ending inventory Cost of goods sold $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

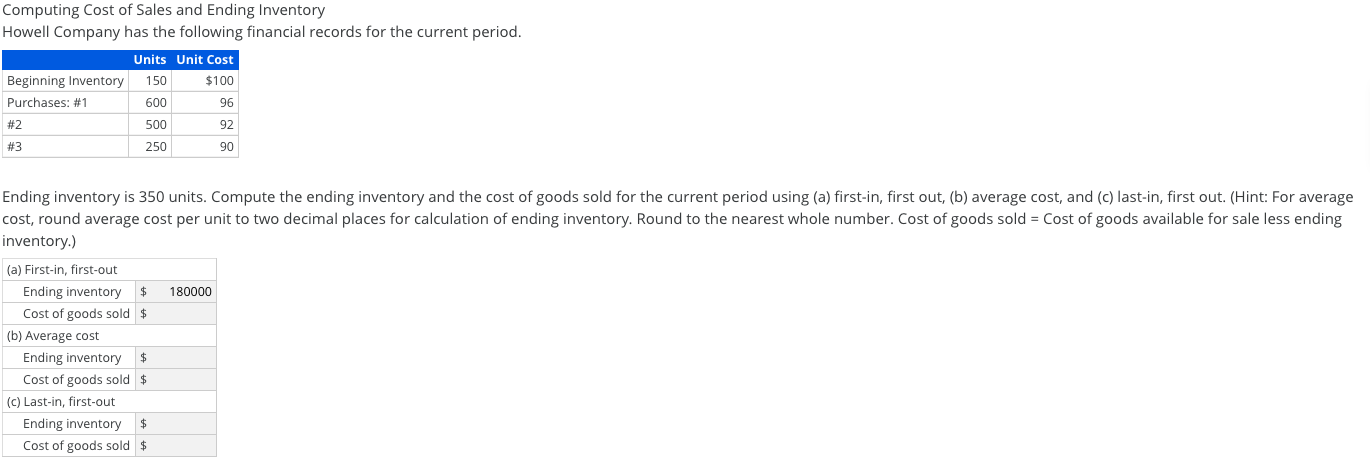

Transcribed Image Text:Computing Cost of Sales and Ending Inventory

Howell Company has the following financial records for the current period.

Units Unit Cost

Beginning Inventory

Purchases: #1

150

600

$100

96

#32

500

92

#3

250

06

Ending inventory is 350 units. Compute the ending inventory and the cost of goods sold for the current period using (a) first-in, first out, (b) average cost, and (c) last-in, first out. (Hint: For average

cost, round average cost per unit to two decimal places for calculation of ending inventory. Round to the nearest whole number. Cost of goods sold = Cost of goods available for sale less ending

inventory.)

(a) First-in, first-out

Ending inventory $

180000

Cost of goods sold $

(b) Average cost

Ending inventory

$4

Cost of goods sold $

(c) Last-in, first-out

Ending inventory

Cost of goods sold $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,