Computing Fair Value of Environmental Liability Minerals Inc. anticipates environmental costs at the end of a 10-year production cycle. Due to the uncer Cash Outflow Probability $400,000 $440,000 $480,000 $560,000 30% 25% 25% 20% In answering the following questions, round your answers to the nearest whole number, using no negati a. Compute the expected cash outflow for the environmental costs. $ 462,000 b. Determine the fair value of the liability for environment costs assuming a risk-free interest rate of 5%. $ 4,029,441 x

Computing Fair Value of Environmental Liability Minerals Inc. anticipates environmental costs at the end of a 10-year production cycle. Due to the uncer Cash Outflow Probability $400,000 $440,000 $480,000 $560,000 30% 25% 25% 20% In answering the following questions, round your answers to the nearest whole number, using no negati a. Compute the expected cash outflow for the environmental costs. $ 462,000 b. Determine the fair value of the liability for environment costs assuming a risk-free interest rate of 5%. $ 4,029,441 x

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 38P: Porter Insurance Company has three lines of insurance: automobile, property, and life. The life...

Related questions

Question

100%

C3

Transcribed Image Text:Que to the uncertainties of the remedies available in 10 years, the company has developed the following estimates.

er, using no negative signs.

$ 462,000✔

5%. $ 4,029,441 *

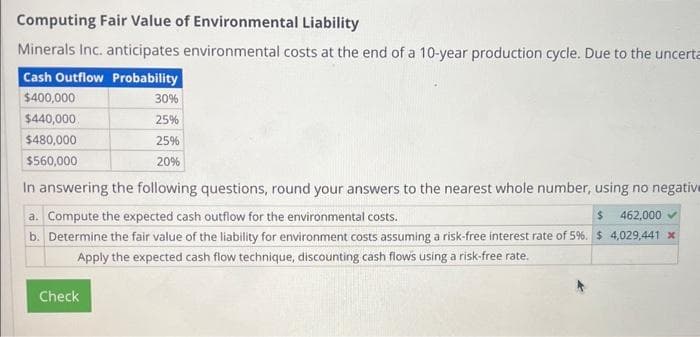

Transcribed Image Text:Computing Fair Value of Environmental Liability

Minerals Inc. anticipates environmental costs at the end of a 10-year production cycle. Due to the uncerta

Cash Outflow Probability

$400,000

$440,000

$480,000

$560,000

30%

25%

25%

20%

In answering the following questions, round your answers to the nearest whole number, using no negative

a. Compute the expected cash outflow for the environmental costs.

$ 462,000✔

b. Determine the fair value of the liability for environment costs assuming a risk-free interest rate of 5%. $ 4,029,441 x

Apply the expected cash flow technique, discounting cash flows using a risk-free rate.

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning