Concept check. Use the following question set for prectice. For each transaction, tell whether the assets, liabilities and equity will increase (I), decrease (D) or is not affected (NE). A L E 1. The owner invests personal cash in the business. 2. The owner withdraws business assets for personal use. 3. The company receives cash from a bank loan. 4. The company repays the bank that had lent money. 5. The company purchases equipment with its cash. 6. The owner contributes her personal truck to the business. 7. The company purchases supplies on credit. 8. The company purchases land by paying half in cash and signing a note. 9. The owner withdraws cash for personal use. 10. The company repays the suppliers. || | |||

Concept check. Use the following question set for prectice. For each transaction, tell whether the assets, liabilities and equity will increase (I), decrease (D) or is not affected (NE). A L E 1. The owner invests personal cash in the business. 2. The owner withdraws business assets for personal use. 3. The company receives cash from a bank loan. 4. The company repays the bank that had lent money. 5. The company purchases equipment with its cash. 6. The owner contributes her personal truck to the business. 7. The company purchases supplies on credit. 8. The company purchases land by paying half in cash and signing a note. 9. The owner withdraws cash for personal use. 10. The company repays the suppliers. || | |||

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 2PA: To demonstrate the difference between cash account activity and accrual basis profits (net income),...

Related questions

Question

Transcribed Image Text:9:17 l ?

94

Screenshot (52...

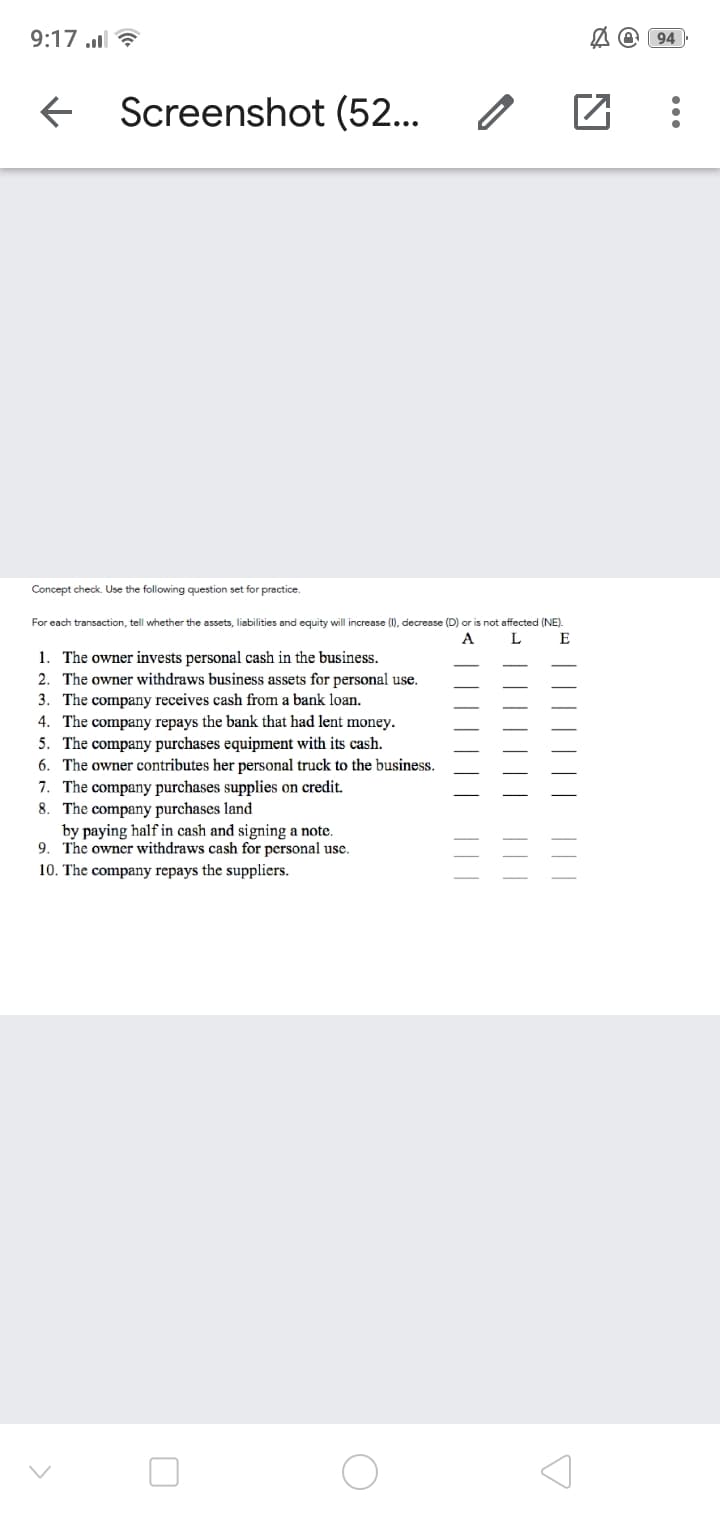

Concept check. Use the following question set for practice.

For each transaction, tell whether the assets, liabilities and equity will increase (I), decrease (D) or is not affected (NE).

E

1. The owner invests personal cash in the business.

2. The owner withdraws business assets for personal use.

3. The company receives cash from a bank loan.

4. The company repays the bank that had lent money.

5. The company purchases equipment with its cash.

6. The owner contributes her personal truck to the business.

7. The company purchases supplies on credit.

8. The company purchases land

by paying half in cash and signing a note.

9. The owner withdraws cash for personal use.

10. The company repays the suppliers.

|| |

|||

|||

Transcribed Image Text:9:17 l

94

Screenshot (52...

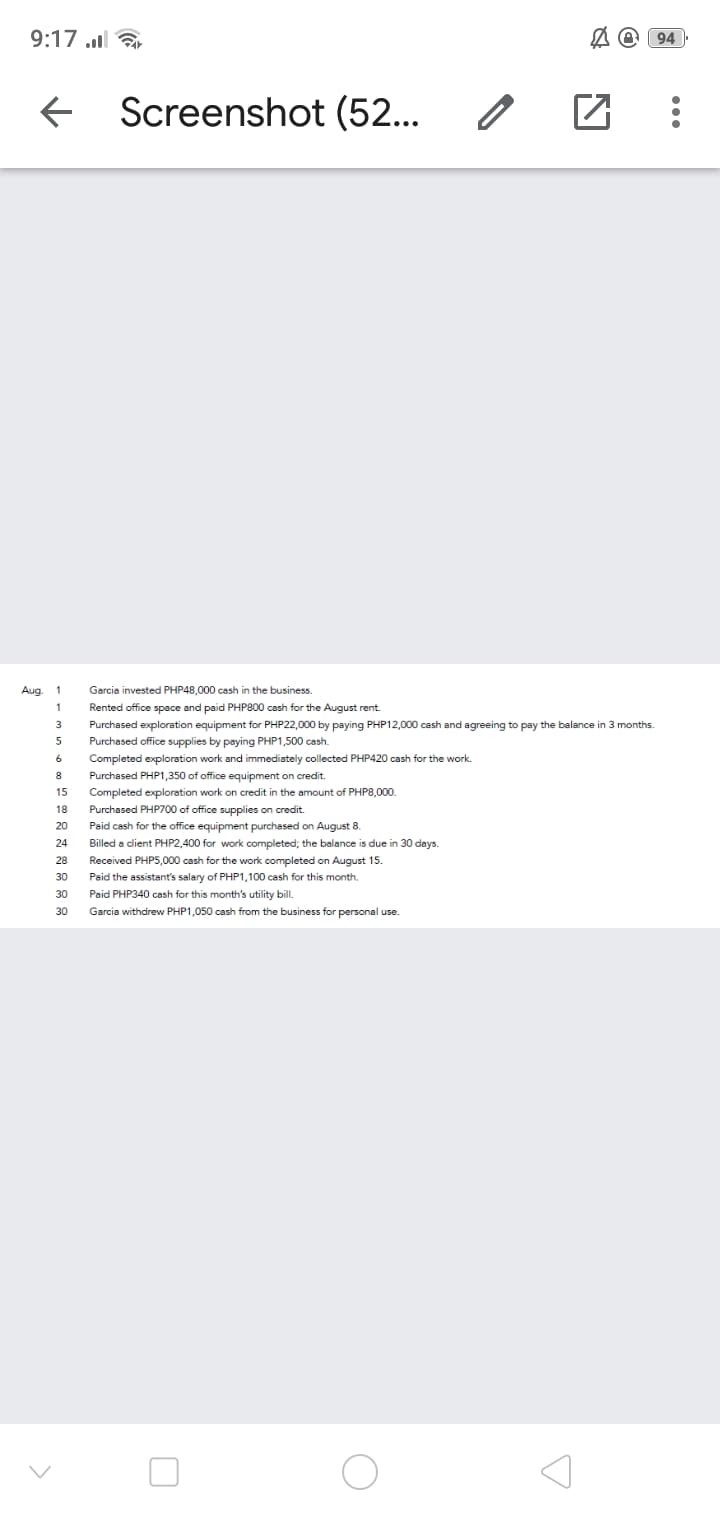

Aug.

1

Garcia invested PHP48,000 cash in the business.

1

Rented office space and paid PHP800 cash for the August rent.

3.

Purchased exploration equipment for PHP22,000 by paying PHP12,000 cash and agreeing to pay the balance in 3 months.

Purchased office supplies by paying PHP1,500 cash.

Completed exploration work and immediately collected PHP420 cash for the work.

8

Purchased PHP1,350 of office equipment on credit.

Completed exploration work on credit in the amount of PHP8,000

Purchased PHP700 of office supplies on credit.

15

18

20

Paid cash for the office equipment purchased on August 8.

24

Billed a client PHP2,400 for work completed; the balance is due in 30 days.

28

Received PHP5,000 cash for the work completed on August 15.

30

Paid the assistant's salary of PHP1,100 cash for this month.

30

Paid PHP340 cash for this month's utility bil.

30

Garcia withdrew PHP1,050 cash from the business for personal use.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,