Concept Description 1. Cash-basis accounting. 2. Fiscal year. 3. Revenue recognition principle. Recognize revenue in the accounting period in which a performance obligation is satisfied 4. Expense recognition principle.

Concept Description 1. Cash-basis accounting. 2. Fiscal year. 3. Revenue recognition principle. Recognize revenue in the accounting period in which a performance obligation is satisfied 4. Expense recognition principle.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.4P: Transactions Reconstructed from Financial Statements The following financial statements are...

Related questions

Question

Use the list of concepts given to match the description of the concept to the concept.

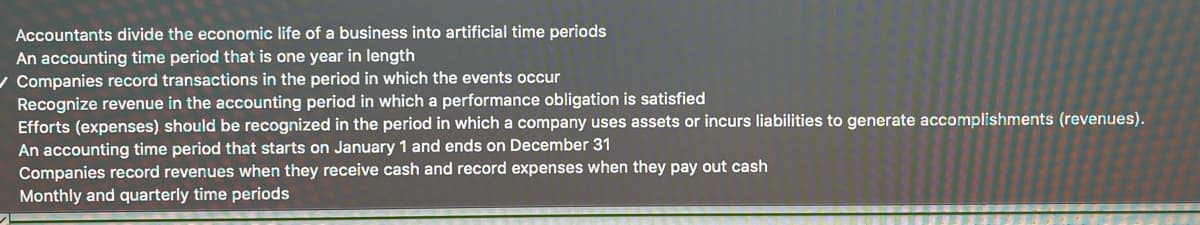

Transcribed Image Text:Accountants divide the economic life of a business into artificial time periods

An accounting time period that is one year in length

/ Companies record transactions in the period in which the events occur

Recognize revenue in the accounting period in which a performance obligation is satisfied

Efforts (expenses) should be recognized in the period in which a company uses assets or incurs liabilities to generate accomplishments (revenues).

An accounting time period that starts on January 1 and ends on December 31

Companies record revenues when they receive cash and record expenses when they pay out cash

Monthly and quarterly time periods

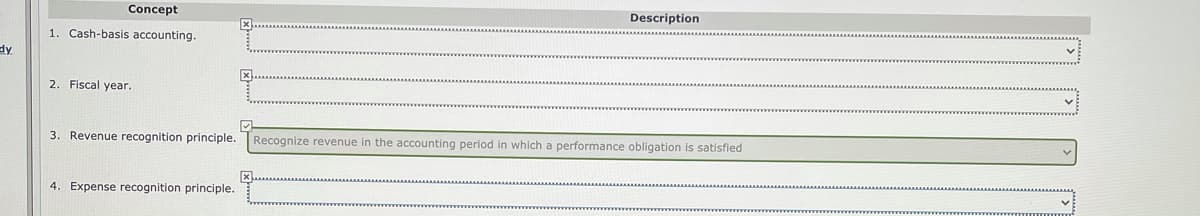

Transcribed Image Text:Concept

Description

Cash-basis accounting.

dy.

2. Fiscal year.

3. Revenue recognition principle.

Recognize revenue in the accounting period in which a performance obligation is satisfied

4. Expense recognition principle.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College