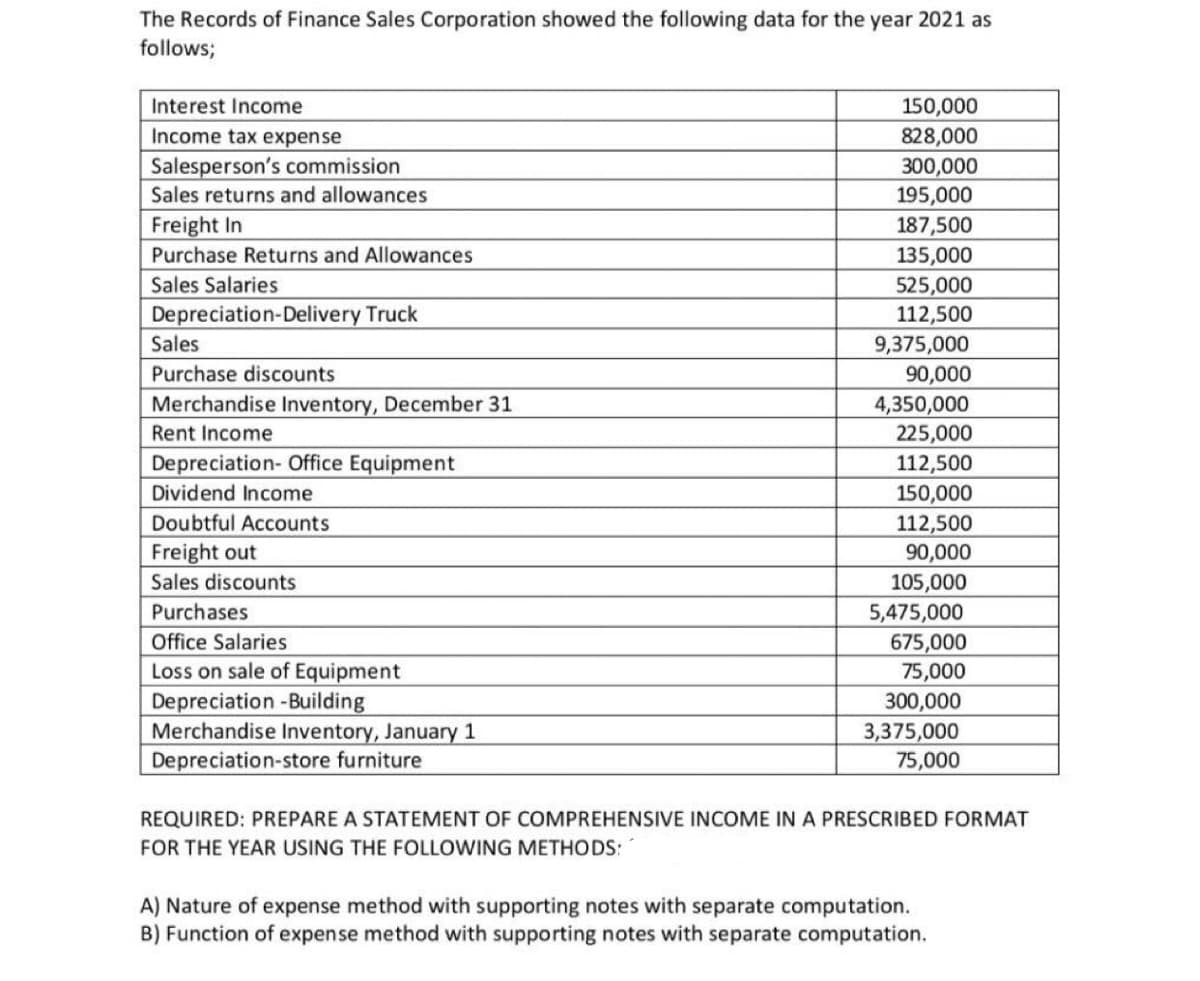

REQUIRED: PREPARE A STATEMENT OF COMPREHENSIVE INCOME IN A PRESCRIBED FORMAT FOR THE YEAR USING THE FOLLOWING METHODS: A) Nature of expense method with supporting notes with separate computation. B) Function of expense method with supporting notes with separate computation.

REQUIRED: PREPARE A STATEMENT OF COMPREHENSIVE INCOME IN A PRESCRIBED FORMAT FOR THE YEAR USING THE FOLLOWING METHODS: A) Nature of expense method with supporting notes with separate computation. B) Function of expense method with supporting notes with separate computation.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 48P

Related questions

Question

Transcribed Image Text:The Records of Finance Sales Corporation showed the following data for the year 2021 as

follows;

Interest Income

150,000

Income tax expense

Salesperson's commission

Sales returns and allowances

828,000

300,000

195,000

Freight In

Purchase Returns and Allowances

Sales Salaries

Depreciation-Delivery Truck

187,500

135,000

525,000

112,500

9,375,000

Sales

Purchase discounts

90,000

Merchandise Inventory, December 31

4,350,000

Rent Income

225,000

Depreciation- Office Equipment

112,500

Dividend Income

150,000

Doubtful Accounts

112,500

90,000

Freight out

Sales discounts

105,000

Purchases

5,475,000

Office Salaries

675,000

75,000

Loss on sale of Equipment

Depreciation -Building

Merchandise Inventory, January 1

Depreciation-store furniture

300,000

3,375,000

75,000

REQUIRED: PREPARE A STATEMENT OF COMPREHENSIVE INCOME IN A PRESCRIBED FORMAT

FOR THE YEAR USING THE FOLLOWING METHODS:

A) Nature of expense method with supporting notes with separate computation.

B) Function of expense method with supporting notes with separate computation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning