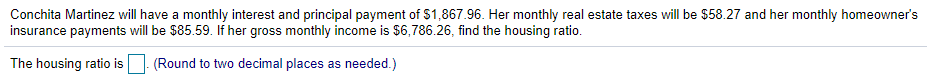

Conchita Martinez will have a monthly interest and principal payment of $1,867.96. Her monthly real estate taxes will be $58.27 and her monthly homeowner's insurance payments will be $85.59. If her gross monthly income is $6,786.26, find the housing ratio.

Q: Yvette purchased a car and she obtained an 7 year term loan with an annual interest rate of 3.12%.…

A: An amortization schedule of a loan provides the breakdown of the monthly payments into their…

Q: To help Janette cover her college expense, parents provide Janette with a monthly allowance of $340.…

A:

Q: Home ownership has other expenses, including taxes, homeowner's insurance and utilities. The annual…

A: Amount borrowed = $145,000 a) Annual property tax = 1% of amount borrowed = $145,000×1%=$1,450…

Q: Gary has a 15 year mortgage on his house. His monthly principal and interest payment is $1373 . His…

A: Monthly payment of principal, interest, taxes, and insurance (PITI) can be calculated by using this…

Q: Carlos earns a gross income of $5,680 per month and applies for a mortgage with a monthly PITI of…

A: Given Gross income =$5680 Other financial obligations = $ 1005.36 Applied for a mortgage = $ 1249.60…

Q: Sherry rents her vacation home for 6 months and lives in it for 6 months during the year. Her gross…

A: The resultant amount after reducing all expenses of the company whether direct or indirect for the…

Q: YVette purchased a car and she obtained a seven year term loan with an annual interest rate of 3.84%…

A: Time Period of loan = 7 years or 84 months Interest Rate = 3.84%/12 = 0.32% per month Balance due…

Q: John and his wife, Joanne, both work and have a combined gross income of $115000 per year. They…

A: Here,

Q: Jacque's total monthly loan payments are 1020 while her gross income is 3939 per month. What is her…

A: The debt service ratio is the ratio that depicts a companies ability to repay its short-term debt…

Q: A has been paying rent of $850 at the beginning of each month for the last 12 years. If he had…

A: Annuity refers to series of equalized payments that are paid or received at start or ending of…

Q: Ed and Marta are paid $2,460 after taxes every month. Monthly expenses include $834 on housing and…

A: Savings ratio shows the proportion/ratio of savings to the respective income.

Q: Martin has $4,200 in doctor bills for the year. His deductible is $300. His policy pays 80% once he…

A: Martin pay including his deductible=$4,200-$300×80100+$300=$3,420

Q: Ed and Marta are paid $4,130 after taxes every month. Monthly expenses include $1,397 on housing…

A: The monthly savings would be computed by deducting the monthly expenses from the monthly after-tax…

Q: Michael needs to keep his back-end DTI at 39% (at most). He pays monthly rent of $925, monthly car…

A: The debt amount in DTI ratio or debt-to-income ratio includes the aggregate sum of all expenditures…

Q: what is Ben's total monthly payment?

A: Insurance is the security taken by a person against life or asset. Against the insurance or security…

Q: When Should Michael Pay Housing Costs? On April 1 of next year, Michael is purchasing a $225,000…

A: The LTV ratio is calculated using the following formula: LTV =Principal amountMarket Value of the…

Q: Jake has total fixed monthly expenses of $1,300 and his gross monthly income is $3,900. What is his…

A: given, fixed monthly expenses = $1300 gross monthly income =$3900

Q: Jackie and Joanie take out a mortgage. Their annual property taxes are $1688 and their annual…

A: The answer is stated below:

Q: Vincent was receiving rental payments of $3,000 at the beginning of every month from the tenants of…

A: The capitalization rate: The capitalization rate or cap rate is used to determine the rate of return…

Q: Gabriela has the following income for the quarter

A: As per the provisions of Burau of Internal Revenue , Phillipines , quarterly…

Q: John estimates he can afford a total of $8000 a year in rent. What can he afford as a monthly…

A: Maximum affordable monthly Rental Payment = Maximum Affordable Annual Rental Payment/ 12

Q: According to the housing recommendations from this book of the family has a gross annual income of…

A: Given, Meaning of mortgage loan:- It is that type of a loan which is secured and which helps to get…

Q: Abby also has a $400/month car loan payment and a $150/month student loan payment. If her lender…

A: The portion of monthly income that goes into paying the loan installments is known debt-to-income…

Q: Chloe Young is evaluating her debt safety ratio. Her monthly take-home pay is $3,320. Each month,…

A: Given data her take-home pay = $3320 total monthly payments = auto loan payment + personal line of…

Q: Suppose Gretchen's health insurance has a $500 annual deductible. Gretchen is responsible for 20…

A: A copay (or copayment) is a one-time cost that you pay when you see your doctor or fill a…

Q: Your cousin and her partner have a combined gross income of $10,111 and monthly expenses totaling…

A: A Federal Housing Administration (FHA) loan is a mortgage that is insured by the Federal Housing…

Q: Would a person with the following income and expenses qualify for a home based on the front end…

A: The front-end affordability ratio is an accounting method that represents the proportion of gross…

Q: What is the amount of his child and dependent care credit?

A: Given Jack paid = $5000 in day care as expenses Daughter age = 5 years His AGI = $37500

Q: %

A: Total Earning = Total Expenditure + Savings Expenditures:- 1.Income on Housing = 23% 2.Food…

Q: Jim has a house payment of $2,000 per month of which $1,700 is deductible interest and real estate…

A:

Q: Carlos earns a gross income of $5,580 per month and applies for a mortgage with a monthly PITI of…

A: The economic ability of the borrower can be ascertained from lenders using various ratios. The house…

Q: Carlos earns a gross income of $5,680 per month and applies for a mortgage with a monthly PITI of…

A: Given: Carlos earns a gross income of $5,680 per month and applies for a mortgage with a monthly…

Q: Lori earns $3,898 per month. She has a monthly rent payment of $980 along with average credit card…

A: Car payment refers to the amount which is paid to financial institution or car dealer that has…

Q: Maria earned $250, $3,900, $8,940, $2,340, and $5,620 from her home buisiness during the last five…

A: Average means a value which is central value of the date and which represent the whole data. Average…

Q: A homeowner has a mortgage payment of $996.60, an annual property tax bill of $594, and an annual…

A: EMI (EQUATED MONTHLY INSTALLMENT)- It is a fixed payment made by a borrowing party to the lending…

Q: To help Janette cover her college expense, parents provide Janette with a monthly allowance of $340.…

A: Present value denotes the present worth of money by discounting the future cash flows whereas future…

Q: Mary, who is married and the mother of three, is 35 years and expects to work until 75. She earns…

A: The life insurance is a protection for family members of insured as they received the insurance…

Q: Conchita Martinez will have a monthly interest and principal payment of $1,846.74. Her monthly real…

A: Housing ratio = [ Total Housing expense / Pre tax income ] * 100 Where Total Housing expense…

Q: Jake has total fixed monthly expenses of $1,320 and his gross monthly income is $3,950. What is his…

A: Debt to income ratio is calculated by dividing monthly debt by the gross monthly income.

Q: Ann is single and works full-time. In 2020, Ann paid child care expenses of $6,000 for someone to…

A:

Q: Conchita Martinez will have a monthly interest and principal payment of $1,850.13. Her monthly real…

A: The question gives the following information:

Q: Determine the amount of the child- and dependent-care credit to which each of the following…

A: The answer is stated below: Note: Answering the first three subparts as there are multiple…

Q: Amy earns $5,891 per month. She pays a monthly mortgage of $1,230, a monthly car payment of $195,…

A: Back-End DTI (debt to income) ratio shows the proportion of total debt of an individual in…

Q: Ted Phillips has monthly take-home pay of $1,685; he makes payments of $410 a month on his…

A: Credit is an integral part of daily life. Credit payment occurs when the individual or the…

Q: The annual insurance premium on Maria's home is $1,986 and the annual property tax is $1,407. If her…

A: A mortgage is a loan scheme offered by banks and financial institutions to the buyers of homes or…

Q: Ann's average income tax rate is 30%, and her marginal income tax rate is 37%. Her property tax bill…

A: Solution:- Given, Average tax rate = 30% Marginal tax rate = 37% Tax bill = 12,000 Interest payment…

Q: Julie’s monthly net salary is $6500, and she budgets $1820 for housing expenses. What percent of her…

A: Housing expenses as a percentage of monthly Net Salary = Monthly Housing expenses/ Monthly Net…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The annual insurance premium on Maria's home is $1,964 and the annual property tax is $1,434. If her monthly principal and interest payment is $1,624, find the adjusted monthly payment including principal, interest, taxes, and insurance (PITI).Carl’s house payment is $2,574 per month and his car payment is $871 per month. If Carl's take-home pay is $5,200 per month, what percentage does Carl spend on his home? (Enter your answer as a percent rounded to 1 decimal place.)Carl’s house payment is $1,270 per month and his car payment is $465 per month. If Carl's take-home pay is $4,200 per month, what percentage does Carl spend on his home and car? (Enter your answer as a percent rounded to 2 decimal places.)

- Carl’s house payment is $1,750 per month and his car payment is $393 per month. If Carl's take-home pay is $3,800 per month, what percentage does Carl spend on his home and car? Note: I am not sure how to enter the answer as a percent rounded to 2 decimal places.Mark makes $82,420 per year and pays about 23% of his gross monthly income in federal and state taxes. He wants to find an apartment to rent. Estimate how much he can afford to pay for rent each month. Then determine how much money he will have after taxes and rent are paidHelen Meyer receives a travel allowance of $210 each week from her company for time away from home. If this allowance is taxable and she has a 10 percent income tax rate, what amount will she have to pay in taxes for this employee benefit annually? (Round your final answer to 2 decimal places.)

- Peter was receiving rental payments of $1,050 at the end of each month from his tenants of his commercial property What would be the value of his property in the market if he wants to sell it, assuming money earns 4.4% compounded quarterly?Ed and Marta are paid $4,130 after taxes every month. Monthly expenses include $1,397 on housing and utilities, $674 for auto loans, $216 on food, and an average of $1,246 on clothing and other variable expenses. Calculate and interpret their savings ratio. The amount of Ed and Marta's income available for savings and investment is $?. Round to the nearest dollar.Mike and Teresa have a monthly gross income of $6,167, but they pay $502 per month in taxes. They also pay $2,974 per month in various loan payments. What is their debt service ratio? (Keep 2 decimal places)

- Ed and Marta are paid $2 comma 410 after taxes every month. Monthly expenses include $777 on housing and utilities, $395 for auto loans, $164 on food, and an average of $713 on clothing and other variable expenses. Assuming that they save excess funds, calculate and interpret their savings ratio. Hint: Prepare an income statement, and then compute the ratio.Alan and Samantha Brown have a mortgage with the Bank of America. The bank requires the Browns to pay their homeowner's insurance, property taxes, and mortgage in one monthly payment to the bank. Their monthly mortgage payment is $1,450.30, their semi-annual property tax bill is $6,470, and their annual homeowner's insurance bill is $980. How much is the monthly payment they make to Bank of America?Ann earns $95,000 per year in salary. She pays 25% federal income tax, 6% state income tax, 6.2% social security, 1.45% medicare, 5% for health insurance, $50 per month for life insurance, $30 per month for dental, and 8% per month for retirement.a. What is her gross monthly salary? b. What is her net monthly salary?