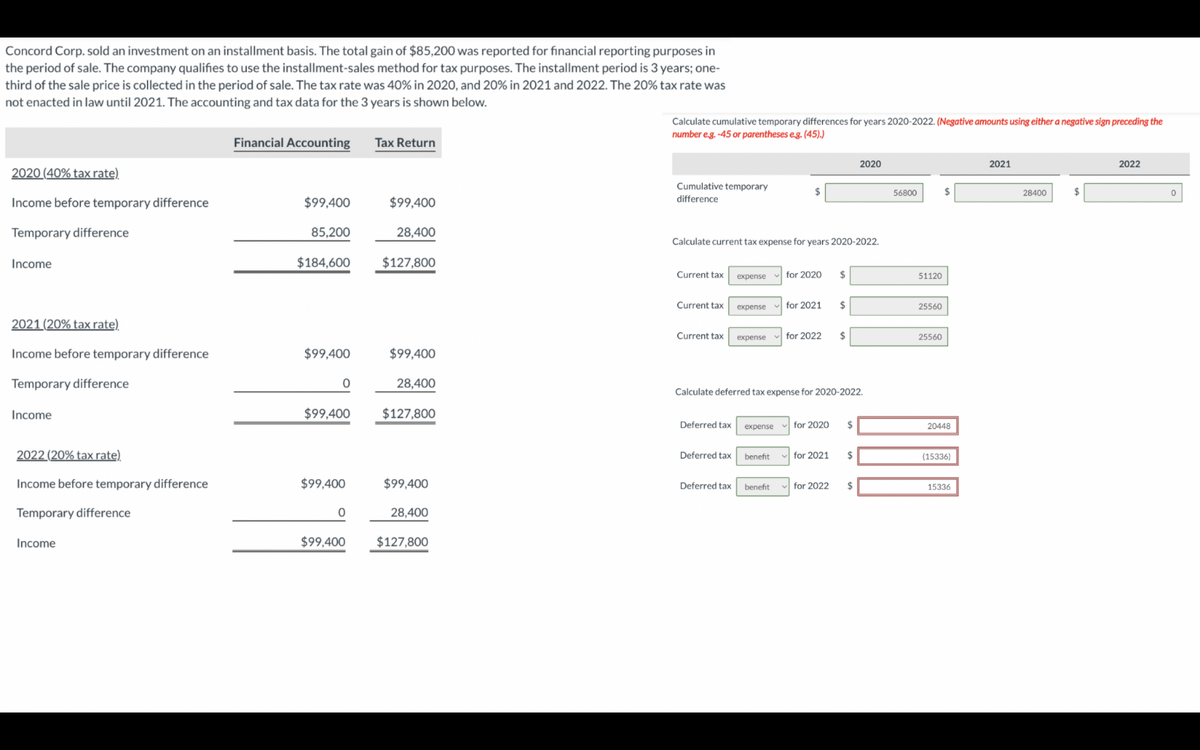

Concord Corp. sold an investment on an installment basis. The total gain of $85,200 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one- third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax rate was not enacted in law until 2021. The accounting and tax data for the 3 years is shown below. Calculate cumulative temporary differences for years 2020-2022. (Negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 2020 (40% tax rate). Income before temporary difference Temporary difference Income 2021 (20% tax rate). Income before temporary difference Temporary difference Income Financial Accounting Tax Return $99,400 $99,400 85,200 28,400 $184,600 $127,800 Cumulative temporary difference $ 2020 Calculate current tax expense for years 2020-2022. 56800 Current tax expense for 2020 $ 51120 Current tax expense for 2021 $ 25560 Current tax expense for 2022 $ 25560 $99,400 $99,400 0 28,400 Calculate deferred tax expense for 2020-2022. $99,400 $127,800 Deferred tax expense for 2020 $ 20448 Deferred tax benefit for 2021 $ (15336) 2022 (20% tax rate) Income before temporary difference $99,400 $99,400 Deferred tax benefit for 2022 $ 15336 Temporary difference 0 28,400 Income $99,400 $127,800 2021 28400 $ 2022 0

Concord Corp. sold an investment on an installment basis. The total gain of $85,200 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one- third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax rate was not enacted in law until 2021. The accounting and tax data for the 3 years is shown below. Calculate cumulative temporary differences for years 2020-2022. (Negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 2020 (40% tax rate). Income before temporary difference Temporary difference Income 2021 (20% tax rate). Income before temporary difference Temporary difference Income Financial Accounting Tax Return $99,400 $99,400 85,200 28,400 $184,600 $127,800 Cumulative temporary difference $ 2020 Calculate current tax expense for years 2020-2022. 56800 Current tax expense for 2020 $ 51120 Current tax expense for 2021 $ 25560 Current tax expense for 2022 $ 25560 $99,400 $99,400 0 28,400 Calculate deferred tax expense for 2020-2022. $99,400 $127,800 Deferred tax expense for 2020 $ 20448 Deferred tax benefit for 2021 $ (15336) 2022 (20% tax rate) Income before temporary difference $99,400 $99,400 Deferred tax benefit for 2022 $ 15336 Temporary difference 0 28,400 Income $99,400 $127,800 2021 28400 $ 2022 0

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter13: Corporations: Earning & Profits And Distributions

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Concord Corp. sold an investment on an installment basis. The total gain of $85,200 was reported for financial reporting purposes in

the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one-

third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax rate was

not enacted in law until 2021. The accounting and tax data for the 3 years is shown below.

Calculate cumulative temporary differences for years 2020-2022. (Negative amounts using either a negative sign preceding the

number e.g. -45 or parentheses e.g. (45).)

2020 (40% tax rate).

Income before temporary difference

Temporary difference

Income

2021 (20% tax rate).

Income before temporary difference

Temporary difference

Income

Financial Accounting

Tax Return

$99,400

$99,400

85,200

28,400

$184,600

$127,800

Cumulative temporary

difference

$

2020

Calculate current tax expense for years 2020-2022.

56800

Current tax

expense

for 2020

$

51120

Current tax

expense

for 2021

$

25560

Current tax expense

for 2022

$

25560

$99,400

$99,400

0

28,400

Calculate deferred tax expense for 2020-2022.

$99,400

$127,800

Deferred tax expense

for 2020

$

20448

Deferred tax

benefit

for 2021

$

(15336)

2022 (20% tax rate)

Income before temporary difference

$99,400

$99,400

Deferred tax

benefit

for 2022

$

15336

Temporary difference

0

28,400

Income

$99,400

$127,800

2021

28400

$

2022

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning