Condensed balance sheet and income statement data for Jergan Corporation are presented here. Jergan Corporation Balance Sheets December 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan Corporation Income Statement For the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales 698,900 575,600 Cost of goods sold 425,600 367,000 Gross profit 273,300 208,600 Operating expenses (including income taxes) 182,443 151,040 Net income $ 90,857 $ 57,560 Additional information: 1. The market price of Jergan’s common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 2. You must compute dividends paid. All dividends were paid in cash.

Condensed balance sheet and income statement data for Jergan Corporation are presented here. Jergan Corporation Balance Sheets December 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan Corporation Income Statement For the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales 698,900 575,600 Cost of goods sold 425,600 367,000 Gross profit 273,300 208,600 Operating expenses (including income taxes) 182,443 151,040 Net income $ 90,857 $ 57,560 Additional information: 1. The market price of Jergan’s common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 2. You must compute dividends paid. All dividends were paid in cash.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 8EA: Using the following select financial statement information from Black Water Industries, compute the...

Related questions

Question

Condensed balance sheet and income statement data for Jergan Corporation are presented here.

|

Jergan Corporation

Balance Sheets December 31 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

2020

|

2019

|

2018

|

|||||||

|

Cash

|

$ 30,800 | $ 17,600 | $ 18,700 | ||||||

|

|

50,500 | 44,200 | 47,100 | ||||||

|

Other current assets

|

89,600 | 94,900 | 63,900 | ||||||

|

Investments

|

55,300 | 71,000 | 45,100 | ||||||

|

Plant and equipment (net)

|

500,500 | 370,000 | 358,500 | ||||||

| $726,700 | $597,700 | $533,300 | |||||||

|

Current liabilities

|

$85,500 | $79,800 | $69,400 | ||||||

|

Long-term debt

|

144,300 | 84,100 | 50,300 | ||||||

|

Common stock, $10 par

|

348,000 | 316,000 | 304,000 | ||||||

|

|

148,900 | 117,800 | 109,600 | ||||||

| $726,700 | $597,700 | $533,300 |

|

Jergan Corporation

Income Statement For the Years Ended December 31 |

||||||

|---|---|---|---|---|---|---|

|

2020

|

2019

|

|||||

|

Sales revenue

|

$738,000 | $605,500 | ||||

|

Less: Sales returns and allowances

|

39,100 | 29,900 | ||||

|

Net sales

|

698,900 | 575,600 | ||||

|

Cost of goods sold

|

425,600 | 367,000 | ||||

|

Gross profit

|

273,300 | 208,600 | ||||

|

Operating expenses (including income taxes)

|

182,443 | 151,040 | ||||

|

Net income

|

$ 90,857 | $ 57,560 |

Additional information:

| 1. | The market price of Jergan’s common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. | |

| 2. | You must compute dividends paid. All dividends were paid in cash. |

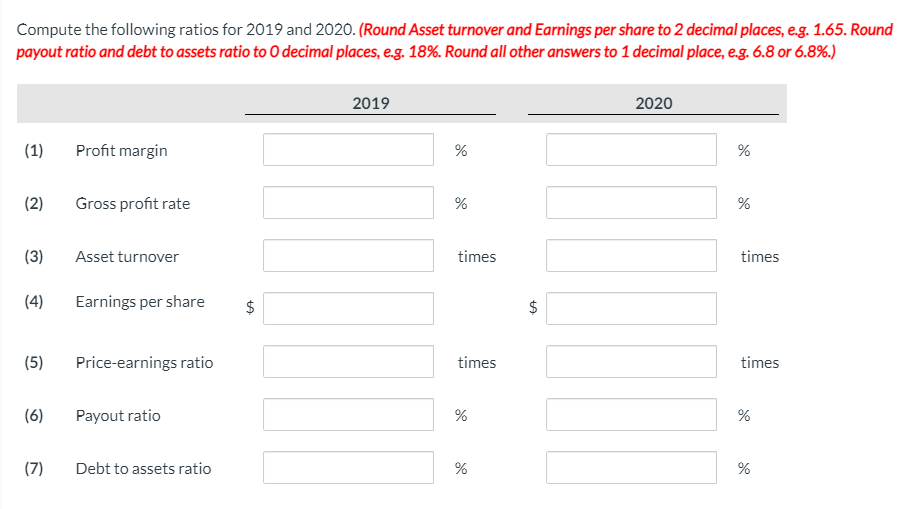

Transcribed Image Text:Compute the following ratios for 2019 and 2020. (Round Asset turnover and Earnings per share to 2 decimal places, e.g. 1.65. Round

payout ratio and debt to assets ratio to 0 decimal places, e.g. 18%. Round all other answers to 1 decimal place, e.g. 6.8 or 6.8%.)

2019

2020

(1)

Profit margin

%

(2)

Gross profit rate

%

(3)

Asset turnover

times

times

(4)

Earnings per share

(5)

Price-earnings ratio

times

times

(6)

Payout ratio

%

(7)

Debt to assets ratio

%

%

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning