condensed financial statements of Vaughn Company for the years 2021 and 2022 are as follows. Vaughn Company Balance Sheets December 31 (in thousands) 2022 2021 Current assets Cash and cash equivalents $350 $350 Accounts receivable (net) 450 370 Inventory 470 420 Prepaid expenses 120 170 Total current assets 1,390 1,310 Property, plant, and equipment (net) 370 340 Investments 1 10 Other assets 490 470 Total assets $2,251 $2,130 Current liabilities $830 $730 Long-term liabilities 391 370 Stockholders’ equity—common 1,030 1,030 Total liabilities and stockholders’ equity $2,251 $2,130 Vaughn Company Income Statements For the Years Ended December 31 (in thousands) 2022 2021 Net sales $3,880 $3,530 Expenses Cost of goods sold 950 910 Selling and administrative expenses 2,420 2,340 Interest expense 10 20 Total expenses 3,380 3,270 Income before income taxes 500 260 Income tax expense 200 104 Net income $300 $156 Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were $1,910. Stockholders’ equity—common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal places, e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.) 2022 2021 (a) Current ratio enter ratio rounded to 2 decimal places :1 enter ratio rounded to 2 decimal places :1 (b) Inventory turnover enter a number of times rounded to 2 decimal places times enter a number of times rounded to 2 decimal places times (c) Profit margin enter percentages rounded to 1 decimal place % enter percentages rounded to 1 decimal place

condensed financial statements of Vaughn Company for the years 2021 and 2022 are as follows. Vaughn Company Balance Sheets December 31 (in thousands) 2022 2021 Current assets Cash and cash equivalents $350 $350 Accounts receivable (net) 450 370 Inventory 470 420 Prepaid expenses 120 170 Total current assets 1,390 1,310 Property, plant, and equipment (net) 370 340 Investments 1 10 Other assets 490 470 Total assets $2,251 $2,130 Current liabilities $830 $730 Long-term liabilities 391 370 Stockholders’ equity—common 1,030 1,030 Total liabilities and stockholders’ equity $2,251 $2,130 Vaughn Company Income Statements For the Years Ended December 31 (in thousands) 2022 2021 Net sales $3,880 $3,530 Expenses Cost of goods sold 950 910 Selling and administrative expenses 2,420 2,340 Interest expense 10 20 Total expenses 3,380 3,270 Income before income taxes 500 260 Income tax expense 200 104 Net income $300 $156 Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were $1,910. Stockholders’ equity—common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal places, e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.) 2022 2021 (a) Current ratio enter ratio rounded to 2 decimal places :1 enter ratio rounded to 2 decimal places :1 (b) Inventory turnover enter a number of times rounded to 2 decimal places times enter a number of times rounded to 2 decimal places times (c) Profit margin enter percentages rounded to 1 decimal place % enter percentages rounded to 1 decimal place

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

The condensed financial statements of Vaughn Company for the years 2021 and 2022 are as follows.

|

Vaughn Company

Balance Sheets December 31 (in thousands) |

||||

|---|---|---|---|---|

|

2022

|

2021

|

|||

|

Current assets

|

||||

|

Cash and cash equivalents

|

$350 | $350 | ||

|

Accounts receivable (net)

|

450 | 370 | ||

|

Inventory

|

470 | 420 | ||

|

Prepaid expenses

|

120 | 170 | ||

|

Total current assets

|

1,390 | 1,310 | ||

|

Property, plant, and equipment (net)

|

370 | 340 | ||

|

Investments

|

1 | 10 | ||

|

Other assets

|

490 | 470 | ||

|

Total assets

|

$2,251 | $2,130 | ||

|

Current liabilities

|

$830 | $730 | ||

|

Long-term liabilities

|

391 | 370 | ||

|

|

1,030 | 1,030 | ||

|

Total liabilities and stockholders’ equity

|

$2,251 | $2,130 |

|

Vaughn Company

Income Statements For the Years Ended December 31 (in thousands) |

||||

|---|---|---|---|---|

|

2022

|

2021

|

|||

|

Net sales

|

$3,880 | $3,530 | ||

|

Expenses

|

||||

|

Cost of goods sold

|

950 | 910 | ||

|

Selling and administrative expenses

|

2,420 | 2,340 | ||

|

Interest expense

|

10 | 20 | ||

|

Total expenses

|

3,380 | 3,270 | ||

|

Income before income taxes

|

500 | 260 | ||

|

Income tax expense

|

200 | 104 | ||

|

Net income

|

$300 | $156 |

Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were $1,910. Stockholders’ equity—common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal places, e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.)

|

2022

|

2021

|

|||||||

|---|---|---|---|---|---|---|---|---|

|

(a)

|

Current ratio

|

enter ratio rounded to 2 decimal places | :1 | enter ratio rounded to 2 decimal places | :1 | |||

|

(b)

|

Inventory turnover

|

enter a number of times rounded to 2 decimal places | times | enter a number of times rounded to 2 decimal places | times | |||

|

(c)

|

Profit margin

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(d)

|

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(e)

|

Return on common stockholders’ equity

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(f)

|

Debt to assets ratio

|

enter percentages rounded to 1 decimal place | % | enter percentages rounded to 1 decimal place | % | |||

|

(g)

|

Times interest earned

|

enter a number of times rounded to 1 decimal place | times | enter a number of times rounded to 1 decimal place | times |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

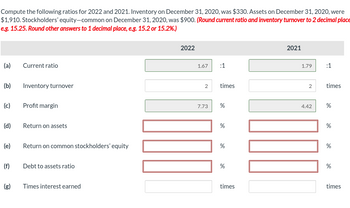

Transcribed Image Text:Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were

$1,910. Stockholders' equity-common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal place

e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.)

(a)

(b) Inventory turnover

(c)

(d)

(e)

(f)

Current ratio

(g)

Profit margin

Return on assets

Return on common stockholders' equity

Debt to assets ratio

Times interest earned

2022

1.67

2

7.73

:1

times

%

%

%

%

times

2021

1.79

2

4.42

:1

times

de

%

%

%

%

times

Solution

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning