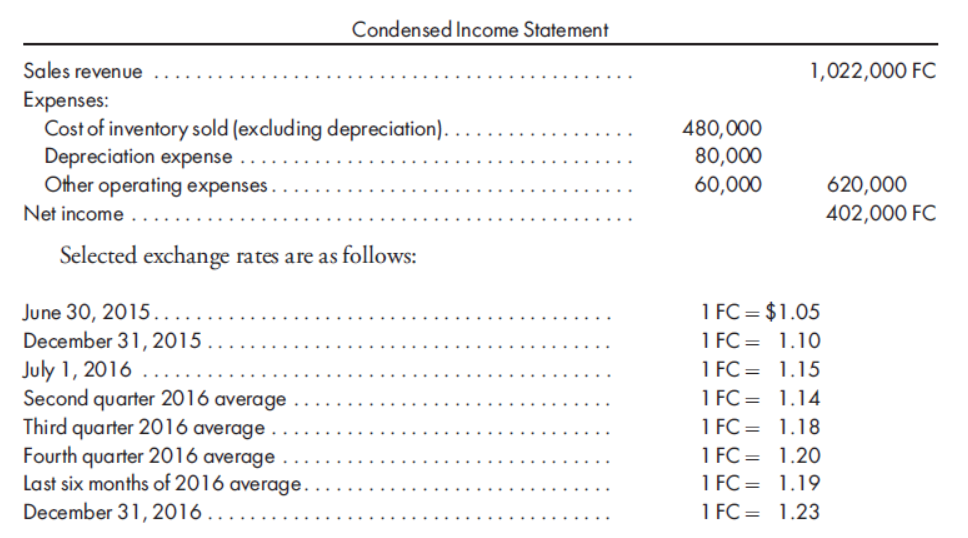

Condensed Income Statement Sales revenue 1,022,000 FC Expenses: Cost of inventory sold (excluding depreciation). Depreciation expense Other operating expenses. 480,000 80,000 60,000 620,000 Net income 402,000 FC Selected exchange rates are as follows: 1 FC= $1.05 1 FC = 1.10 1 FC = 1.15 1 FC = 1.14 1 FC = 1.18 1 FC= 1.20 1 FC= 1.19 1 FC = 1.23 June 30, 2015. December 31, 2015 July 1, 2016 Second quarter 2016 average Third quarter 2016 average Fourth quarter 2016 average Last six months of 2016 average. December 31, 2016

Champos Corporation is a foreign corporation that was formed on June 30, 2015. On July 1, 2016,Magnum Ventures, a U.S. venture capital firm, paid $700,000 to acquire a 30%interest in the equity of Champos. At the time of the acquisition, Champos had net assets as follows:

Monetary net assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200,000 FC

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150,000

Land. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500,000

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,800,000

For the 6-month period ending December 31, 2016, Champos reported the following condensed income statement: (attached)

Campos employs the FIFO inventory method, and inventory layers during the second half of 2016 consisted of the following: 150,000 FC, 220,000 FC, and 210,000 FC, acquired during the second through fourth quarters of 2016, respectively. All depreciable assets were acquired on June 30, 2015. Of the excess over book value paid by Magnum Ventures, $54,000 is to be allocated to depreciable assets with a remaining useful life of nine years, and the balance is traceable to

Determine the amount thatMagnum Ventures should report for its investment in Champos Corporation as of December 31, 2016, under the sophisticated equity method.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images