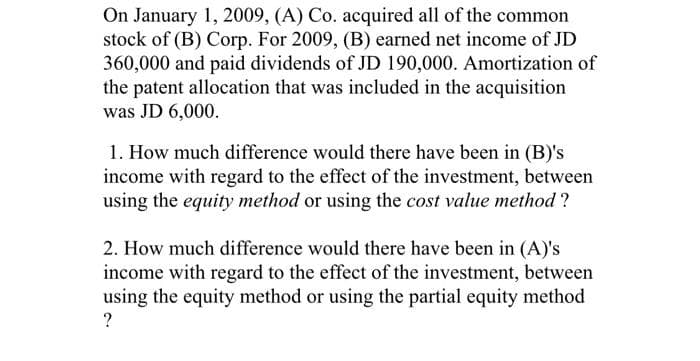

On January 1, 2009, (A) Co. acquired all of the common stock of (B) Corp. For 2009, (B) earned net income of JD 360,000 and paid dividends of JD 190,000. Amortization of the patent allocation that was included in the acquisition was JD 6,000. 1. How much difference would there have been in (B)'s income with regard to the effect of the investment, between using the equity method or using the cost value method? 2. How much difference would there have been in (A)'s income with regard to the effect of the investment, between using the equity method or using the partial equity method

On January 1, 2009, (A) Co. acquired all of the common stock of (B) Corp. For 2009, (B) earned net income of JD 360,000 and paid dividends of JD 190,000. Amortization of the patent allocation that was included in the acquisition was JD 6,000. 1. How much difference would there have been in (B)'s income with regard to the effect of the investment, between using the equity method or using the cost value method? 2. How much difference would there have been in (A)'s income with regard to the effect of the investment, between using the equity method or using the partial equity method

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

100%

Transcribed Image Text:On January 1, 2009, (A) Co. acquired all of the common

stock of (B) Corp. For 2009, (B) earned net income of JD

360,000 and paid dividends of JD 190,000. Amortization of

the patent allocation that was included in the acquisition

was JD 6,000.

1. How much difference would there have been in (B)'s

income with regard to the effect of the investment, between

using the equity method or using the cost value method ?

2. How much difference would there have been in (A)'s

income with regard to the effect of the investment, between

using the equity method or using the partial equity method

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning