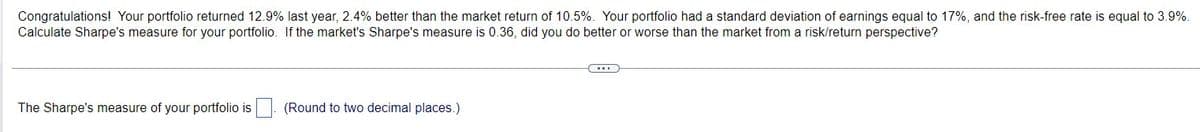

Congratulations! Your portfolio returned 12.9% last year, 2.4% better than the market return of 10.5%. Your portfolio had a standard deviation of earnings equal to 17%, and the risk-free rate is equal to 3.9%. Calculate Sharpe's measure for your portfolio. If the market's Sharpe's measure is 0.36, did you do better or worse than the market from a risk/return perspective?

Q: 6. (14pts) When purchasing a $210,000 house, a borrower is comparing two loan alternatives. The…

A: The objective of the question is to calculate the incremental cost of borrowing extra money between…

Q: a) If the dividend yield is 1.40% annualized, the interest rate is -0.10% annualized, and the index…

A: Derivatives are financial instruments whose value is derived from the value of an underlying asset,…

Q: On January 1, 2020, Simon Love's portfolio of 15 common stocks had a market value of $263,000 At the…

A: HPR for the investment made can be determined by determining the value of capital gains on the…

Q: H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed…

A: NOTE : Depreciation per year under the straight line method = Cost / useful lifeNOTE : After tax…

Q: If you purchase a 3-year, 9% coupon bond for $950, how much could it be sold for 2 years later if…

A: Zero coupon bonds are bonds which do not pay coupons and sold at discount to face value

Q: Weston Corporation just paid a dividend of $2.5 a share (i.e., Do = $2.5). The dividend is expected…

A: The first three years show supernormal growth in dividends. This growth rate is higher than the cost…

Q: Problem 9-5 Calculating Monthly Mortgage Payments [LO9-4] Based on Exhibit 9-9, or using a financial…

A: Loan amount = Present value (PV) = $120,000Year = 15Periods (N) = Year*12 = 15*12 = 180 (because…

Q: eBook Problem Walk-Through A stock is expected to pay a dividend of $2.00 at the end of the year…

A: The stock price is the price that one share of a corporation costs on the stock market. It increases…

Q: Suppose you purchase a 10-year bond with 6.19% annual coupons. You hold the bond for 4 years, and…

A: Coupon rate = 6.19%Years to maturity = 10Par value = $100Market yield = 5.34%To find: Cash flow…

Q: Pete Air wants to buy a used Jeep in 5 years. He estimates the Jeep will cost $15,300. Assume Pete…

A: To calculate the maturity value at the end of year 5, we have to use the future value formula.Future…

Q: If 1) the expected return for Mindy's Mending stock is 14.61 percent; 2) the dividend is expected to…

A: The current price of the stock can be obtained by adding the present value of a stock's future cash…

Q: Bond P is a premium bond with a 9 percent coupon. Bond D is a 4 percent coupon bond currently…

A: Current yieldCurrent yield measures the annual income generated by a bond in relation to the current…

Q: 1. (10 Percent) Ryan Enterprises forecasts the free cash flows (in millions) shown below. Assume the…

A: The objective of the question is to calculate the total corporate value of Ryan Enterprises given…

Q: The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past…

A: a. To calculate the price of a 6-month put option on P.U.T.T. stock at an exercise price of $120, we…

Q: PLS HELP ASAP

A: “Since you have posted multiple questions, we will provide the solution only to the first question…

Q: According to four - drive theory, social norms, personal values, and Choice past experience…

A: According to four-drive theory, the desire to:Acquire and achieve,Bond and belong,Challenged and…

Q: Question at position 1 What is the present value of a stream of $390 cash flow that occurs from year…

A: The ordinary annuity starts at the end of year 1.But in our case, the annuity starts at the end of…

Q: The following information will be used to answer questions 8, 9, and 10. Your company can invest in…

A: The objective of the question is to calculate the payback period for each project and then determine…

Q: Bond P is a premium bond with a coupon rate of 8.4 percent. Bond D is a discount bond with a coupon…

A: Current yield of bond shows return generated by bond in one year in proportion to market value of…

Q: You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner…

A: Here, Cost of Asset $ 5,100,000.00Life of Asset in years4Annual Depreciation $…

Q: Determinant of Interest Rates The real risk-free rate of interest is 3%. Inflation is expected to be…

A: Treasury Yield:Treasury Yield refers to the interest rate paid by the government to borrow money for…

Q: Marisol took out a fully amortizing 30 year mortgage with the initial balance of $5086 and monthly…

A:

Q: A game of chance offers the following odds and payoffs. Each play of the game costs $125, so the net…

A: When returns is determined without accounting for the cost of investment, it will be considered as…

Q: Shi Import-Export's balance sheet shows $300 million in debt, $50 million in preferred stock, and…

A: WACC means weighted average cost of capital of the company. It means combined cost of capital for…

Q: Laurel Enterprises pays annual dividends, and the next dividend is expected to be in one year.…

A: Current stock price = present value of the future cash flows from the stock.As per the constant…

Q: Your firm has a Return on Assets of 8.00 % , the firm can issue debt at 3.50% regardless of the…

A: The objective of the question is to calculate the cost of equity capital using the 1963 Miller &…

Q: Francis Inc.'s stock has a required rate of return of 10.25%, and it sells for $30.00 per share. The…

A: The model depicts the relationship between the stock price, required return, dividend and the…

Q: -----he following information about two computer software firms and the S&P Industrials: Activity…

A: The growth duration is a term that helps in enabling the assumption that post-investment cash flow…

Q: How much interest revenue will the company

A: Calculate the interest revenue,which is received on note receivable for Six months

Q: Vijay

A: The objective of the question is to determine whether Paul Stetson should borrow money from his bank…

Q: IBM is planning to produce an expert system based on artificial intelligence and expects the…

A: Profitability index (PI) refers to a method which is used in the capital budgeting process to rank…

Q: Bay Beach Industries wants to maintain their capital structure of 40% debt and 60% equity. The…

A: A company's commitment to internal equity is demonstrated by its efforts to pay and treat employees…

Q: United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make…

A: Under straight line depreciation method,Depreciation per year = (Cost - salvage value) / useful life…

Q: We are evaluating a project that costs $630,700, has a seven-year life, and has no salvage value.…

A: Net present value is the evaluation metric used in the process of capital budgeting which computes…

Q: Your eccentric Aunt Claudia has left you $50,000 in BP shares plus $50,000 cash. Unfortunately, her…

A: Given Data: StocksStandard DeviationCorrelation with BPBHP…

Q: Investment advisors recommend risk reduction through international diversification. International…

A: a). EuropeAsiaExpected value3.20 %5.00 %Standard Deviation6.21 %11.53 %b). Investment in…

Q: McConnell Corporation has bonds on the market with 19 years to maturity, a YTM of 8.6 percent, a par…

A: Bonds are a type of debt instrument which are usually issued by the borrower to the issuer,…

Q: During the last four years, a certain mutual fund had the following rates of return: Year Rate of…

A: Amount invested by Alice: 2942Yearly rates from 2014 to 2017: 3.5%, 4.2%, 4.9%, 5.3%Difference in…

Q: Blooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a…

A: Equivalent Annual Cost (EAC) is widely used by businesses to assess the economic feasibility of…

Q: a. What is the NPV of the project? (Do not round intermediate calculations and round your answer to…

A: The net present value is the amount that an investment will profit or lose in current dollars. It…

Q: Consider the following information: Rate of Return if State Occurs State of Economy Probability of…

A: Here, State of EconomyProbabilityReturn-Stock AReturn- Stock BReturn-Stock…

Q: Quad Enterprises is considering a new 4-year expansion project that requires an initial fixed asset…

A: Operating Cash Flow is the cash flow earned in the normal course of business, without taking into…

Q: What does the insurer agree to pay for in addition to covering losses in an insurance policy?…

A: Insurance is a contract between the insurer and insured. In this contract, the insurer agrees to…

Q: The financial statements of Eagle Sport Supply are shown in the table below. For simplicity, "Costs"…

A: Internal growth rate refers to the growth increase up to maximum level from the available resources…

Q: Unlevering the Equity Cost of Capital-Low Leverage & High Leverage Companies: Below, we show the…

A: Imagine two companies with similar operations but different capital structures. One might be heavily…

Q: percent. Assume the annualized volatility of the Swiss franc is 14.20 percent. Use the European…

A: Options provide the option to purchase or sell assets at a predetermined price before a specific…

Q: A-Winery produces bottled wines for the hospitality industry in a four-stage process -Pumping,…

A: Solved Explanation:Step 1: Step 2: Step 3: Step 4:

Q: Consider the following table: Scenario Severe recession Mild recession Normal growth Boom Required:…

A: Given values:To find: Mean return, variance of stock fund, and covariance between stock and bond…

Q: Suppose that there are many stocks in the security market and that the characteristics of stocks A…

A: The term "risk-free rate" refers to the rate of return on an investment that is assumed to have no…

Q: An investment pays an annual cash flow of $1 forever. The appropriate discount rate is 4% per year.…

A: Annual cash flow (C) = $1Discount rate (r) = 0.04Present value = ?Present value will be the…

Step by step

Solved in 4 steps

- A portfolio returned 11% last year, 2% better than the market return of 9%. the portfolio’s return had a standard deviation equal to 18%, and the risk-free rate is 3%. Calculate Sharpe’s measure for the portfolio. If the market’s Sharpe’s measure is 0.3, will it be better or worse than the market from a risk/return perspectiveUsing the data in the table, consider a portfolio that maintains a 35% weight on stock A and a 65% weight on stock B. a. What is the return each year of this portfolio? (2010-2015) b. Based on your results from part (a), compute the average return and volatility of the portfolio. c. Show that (i) the average return of the portfolio is equal to the (weighted) average of the average returns of the two stocks, and (ii) the volatility of the portfolio equals the same result as from the calculation in Eq. 11.9. d. Explain why the portfolio has a lower volatility than the average volatility of the two stocks.Recently, Kellie determined that the required rate of return for Stock Q is 11 percent. In her analysis she determined that the risk-free rate of return, r is 4 percent and that the required return on the market portfolio, r is 9 percent. Today, however, Kellie received new information that indicates the market risk premium, RP is actually 1 percent higher than she estimated in her original analysis. Based on this new information, what should be the required rate of return for Stock Q?

- You are given the following data: Risk-free rate is 4.1 percent, market return is 6.5 per cent, and market volatility is 12.2 per cent. The return of a portfolio is 11 per cent, its volatility is 15.2214 per cent, and its beta is 0.7. Calculate the measure called the Information ratio. A. 0.193 B. 0.414 C. 0.548 D. 4.500Here are some historical data on the risk characteristics of Ford and Harley Davidson. Ford Harley Davidson β (beta) 1.26 0.69 Yearly standard deviation of return (%) 30.9 16.9 Assume the standard deviation of the return on the market was 12.0%. a. The correlation coefficient of Ford’s return versus Harley Davidson is 0.27. What is the standard deviation of a portfolio invested half in each share? b. What is the standard deviation of a portfolio invested one-third in Ford, one-third in Harley Davidson, and one-third in risk-free Treasury bills? c. What is the standard deviation if the portfolio is split evenly between Ford and Harley Davidson and is financed at 50% margin, that is, the investor puts up only 50% of the total amount and borrows the balance from the broker? d-1. What is the approximate standard deviation of a portfolio composed of 100 stocks with betas of 1.26 like Ford? d-2. What is the approximate standard deviation of a portfolio composed of…A portfolio returned 13% last year, with a beta equal to 1.5. The market return was 10%, and the risk-free rate was 4%. Did the person earn more or less than the required rate of return on your portfolio? (Use Jensen’s measure.)

- During the past 5-year, the monthly average return and standard deviation of Netflix (NFLX) stock were 3.5% and 10%, respectively. For the same period, the monthly average return and standard deviation of Verizon (VZ) were 0.6% and 4.6%, respectively. The correlation between NFLX and VZ was -0.1. Assume that the monthly risk-free rate is 0.1%. ) What is the Sharpe ratio for NFLX? What is the Sharpe ratio for VZ? Show your calculation steps briefly and clearly. Find the minimum-variance portfolio (MVP), i.e., the weight of NFLX and VZ in the MVP. You do not need to show your calculation steps for this subquestion. Find the optimal risky portfolio P*, i.e., the weight of NFLX and VZ in P*. You do not need to show your calculation steps for this subquestion. Calculate the Sharpe ratio for the optimal risky portfolio P*. Verify that P* offers a higher Sharpe ratio than NFLX and VZ.Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 38% per year. Assume these values are representative of investors' expectations for future performance and that the current T-bill rate is 5%. Calculate the expected return and variance of portfolios invested in T-bills and the S&P 500 index with weights as shown below. (Enter your answers as decimals rounded to 4 places. Leave no cells blank - be certain to enter "0" wherever required.) WBills: WIndex: Expected Return: Variance: 0.0 1.0 0.1300 0.1444 Example 0.2 0.8 0.4 0.6 0.6 0.4 0.8 0.2 1.0 0.0A portfolio with a 25% standard deviation generated a return of 15% last year when T-bills were paying 4.5%. This portfolio had a Sharpe measure of ____.

- The stock of Jones Trucking is expected to return 16 percent annually with a standard deviation of 7 percent. The stock of Bush Steel Mills is expected to return 21 percent annually with a standard deviation of 13 percent. The correlation between the returns from the two securities has been estimated to be +0.4. The beta of the Jones stock is 1.1, and the beta of the Bush stock is 1.4. The risk-free rate of return is expected to be 6 percent, and the expected return on the market portfolio is 16 percent. The current dividend for Jones is $5. The current dividend for Bush is $7. What is the expected return from a portfolio containing the two securities if 30 percent of your wealth is invested in Jones and 70 percent is invested in Bush? Round your answer to one decimal place. % What is the expected standard deviation of the portfolio of the two stocks? Round your answer to two decimal places. % Which stock is the better buy in the current market? Round your answers to one decimal…The stock of Jones Trucking is expected to return 16 percent annually with a standard deviation of 7 percent. The stock of Bush Steel Mills is expected to return 21 percent annually with a standard deviation of 13 percent. The correlation between the returns from the two securities has been estimated to be +0.4. The beta of the Jones stock is 1.1, and the beta of the Bush stock is 1.4. The risk-free rate of return is expected to be 6 percent, and the expected return on the market portfolio is 16 percent. The current dividend for Jones is $5. The current dividend for Bush is $7. What is the expected return from a portfolio containing the two securities if 30 percent of your wealth is invested in Jones and 70 percent is invested in Bush? Round your answer to one decimal place. % What is the expected standard deviation of the portfolio of the two stocks? Round your answer to two decimal places. % Which stock is the better buy in the current market? Round your answers to one decimal…Suppose you owned a portfolio consisting of $250,000 of long-term U.S. government bonds. Would your portfolio be riskless? Explain. What is the least risky security you can think of? Explain. Stock A has an expected return of 7%, a standard deviation of expected returns of 35%, a correlation coefficient with the market of −0.3, and a beta coefficient of −0.5. Stock B has an expected return of 12%, a standard deviation of returns of 10%, a 0.7 correlation with the market, and a beta coefficient of 1.0. Which security is riskier? Why?