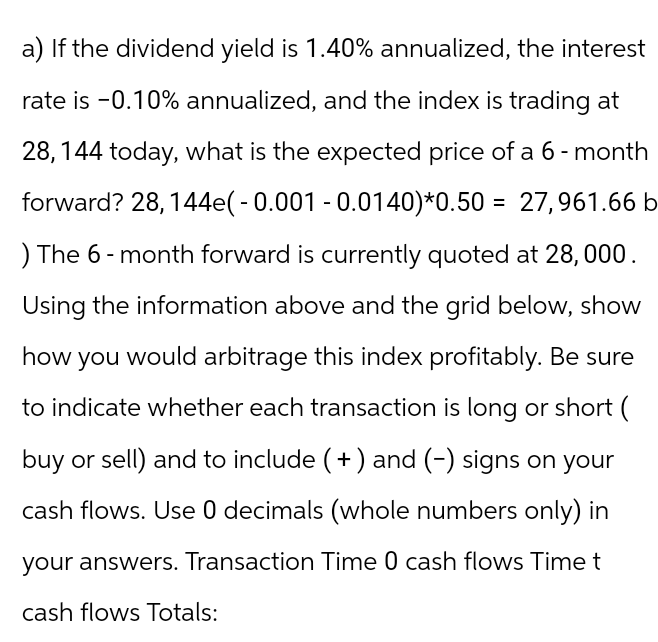

a) If the dividend yield is 1.40% annualized, the interest rate is -0.10% annualized, and the index is trading at 28, 144 today, what is the expected price of a 6-month forward? 28, 144e(-0.001 -0.0140)*0.50 = 27,961.66 ) The 6-month forward is currently quoted at 28,000. Using the information above and the grid below, show how you would arbitrage this index profitably. Be sure to indicate whether each transaction is long or short ( buy or sell) and to include (+) and (-) signs on your cash flows. Use 0 decimals (whole numbers only) in your answers. Transaction Time 0 cash flows Time t cash flows Totals:

a) If the dividend yield is 1.40% annualized, the interest rate is -0.10% annualized, and the index is trading at 28, 144 today, what is the expected price of a 6-month forward? 28, 144e(-0.001 -0.0140)*0.50 = 27,961.66 ) The 6-month forward is currently quoted at 28,000. Using the information above and the grid below, show how you would arbitrage this index profitably. Be sure to indicate whether each transaction is long or short ( buy or sell) and to include (+) and (-) signs on your cash flows. Use 0 decimals (whole numbers only) in your answers. Transaction Time 0 cash flows Time t cash flows Totals:

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:a) If the dividend yield is 1.40% annualized, the interest

rate is -0.10% annualized, and the index is trading at

28, 144 today, what is the expected price of a 6-month

forward? 28, 144e(-0.001 -0.0140)*0.50 = 27,961.66 b

) The 6-month forward is currently quoted at 28,000.

Using the information above and the grid below, show

how you would arbitrage this index profitably. Be sure

to indicate whether each transaction is long or short (

buy or sell) and to include (+) and (-) signs on your

cash flows. Use 0 decimals (whole numbers only) in

your answers. Transaction Time 0 cash flows Time t

cash flows Totals:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 7 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning