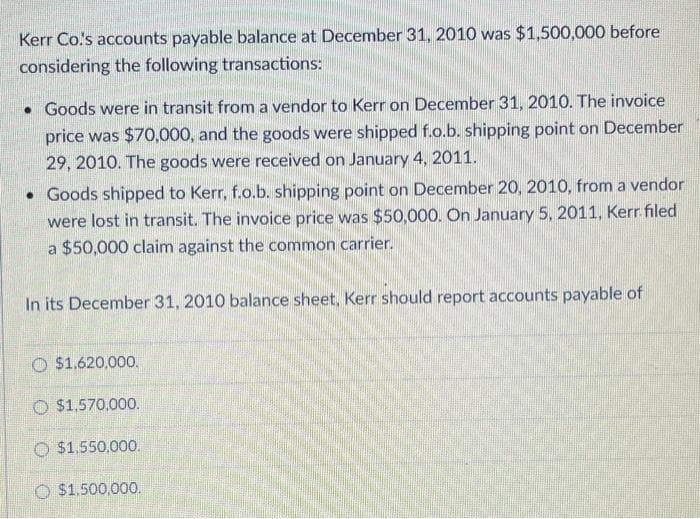

Kerr Co.'s accounts payable balance at December 31, 2010 was $1,500,000 before considering the following transactions: • Goods were in transit from a vendor to Kerr on December 31, 2010. The invoice price was $70,000, and the goods were shipped f.o.b. shipping point on December 29, 2010. The goods were received on January 4, 2011. • Goods shipped to Kerr, f.o.b. shipping point on December 20, 2010, from a vendor were lost in transit. The invoice price was $50,000. On January 5, 2011, Kerr.filed a $50,000 claim against the common carrier. In its December 31, 2010 balance sheet, Kerr should report accounts payable of

Q: Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common…

A: A consolidated financial statement refers to a statement that presents grouped information of a…

Q: All of the following are determinants of cap rates in the property asset market, except: Select…

A: Factors of Determination Of CAP Rates :— Cap Rates are Determined in three Major Factors :—…

Q: Cost Flow Relationships The following information is available for the first month operations of…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Instructions Date Dec. 4 7 14 18 20 21 27 28 31 Transaction Made cash sales of $3,000; the cost of…

A: According to the given question, we are required to prepare the income statement of Davis company…

Q: The ordering cost for a certain product is $8 per order and the holding cost is $1 per year. The…

A: Ordering Cost :— It is the expenses incurred by company for ordering of product. Holding cost :—…

Q: On 1 April 2019 White Bhd issued 1 million 5% convertible loan stock at RM1 million. The loan stock…

A: The conversion of loans and other liabilities into common shares of the business seems to be the…

Q: Operation Margin, Current Ration, Mark-up Ratio Part 1: Explain the meaning and the purpose of each…

A: An accounting technique called ratio analysis uses financial data like income and balance sheets to…

Q: The totals line from Nix Company’s payroll register for the week ended March 31, 20--, is shown:…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Airport Parking incurred the following costs to acquire land, make land improvements, and construct…

A: The land improvement includes the cost incurred by the business entity in order to improve the land…

Q: Andre incorporated his sole proprietorship by transferring the following assets and debts to Raiders…

A: A sole proprietorship is an unincorporated business with only one owner who is responsible for…

Q: Describe the accounting for bonds payable, including bonds issued at face amount, bonds issued at a…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: You are the staff accountant working at a local tutoring center. The monthly financial statements…

A: Accounting is frequently referred to as the language of business since it informs people of the…

Q: A motor vehicle, which was purchased on 1 June 2018 for £16,000, is being depreciated using the…

A: Depreciation is the reduction in the value of an asset over a period of time due to wear and tear.…

Q: Assessing Financial Statement Effects of Transactions and Adjustments Selected accounts of Piotroski…

A: Introduction: Financial statements include specific information about a company's operations and…

Q: The $/£ spot exchange rate is currently $1.50 per pound and is expected to fall to $1.42 per pound…

A: Return on investment: Return on investment is a measure of an investment's profitability. It…

Q: Dash (Pty) Ltd provided the following information that was extracted from the financial records for…

A: The cash flow statement shows the cash inflow and cash outflow which include the cash flow from…

Q: The price that the buyer of a call option pays for the underlying asset if she executes her option…

A: Call Option :— Call Option Which Gives the Holders the Right to Buy an Assets, But not an Obligation…

Q: Match the concept that closely describes a particular depreciation method. Choose the correct answer…

A: Lets understand the basics. Double declining balance method is a accelerated depreciation method…

Q: Dana Point Company Balance Sheet % Change Yr 2 Balance Sheet Common Size Yr 2 Yr 1 Balance Sheet…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: Xavier and Yolanda have original investments of $50,000 and $100,000, respectively, in a…

A: In case of a partnership firm, the profits or losses are divided among partners as per terms laid…

Q: Shown here is an income statement in the traditional format for a firm with a sales volume of 7,500…

A: Operating income refers to the revenue that is earned by the company after deducting all the…

Q: How is skimming scheme fraud carried out?

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Springwater Brewery has two main products: premium and regular ale. Its operating results and master…

A: Lets understand the basics. Sales mix variance is a variance between the percentage of particular…

Q: A car manufacturer incurs the following costs. Classify each cost as either a product or period…

A: Introduction: Cost classification is the process of categorizing a company's costs so that the…

Q: H2 Advice Ben of all the tax consequences he will have to face because of the following (as per the…

A: The fringe benefits tax is the taxes levied on the benefits received. FBT may apply to fringe…

Q: 28. Assuming the following balance sheet, what is the Bank's CAR? ASSETS ($1,000,000s) Cash Fed…

A: According to the given question, we are required to compute the Bank's CAR. Capital Adequacy Ratio:…

Q: billing

A: Billing fraud- It aims to have a business make a payment to the employee and record that payment as…

Q: How much is the total cost of inventory to be presented in the financial position of XYZ?

A: Inventory valuation is done by the Business Entity as per the rules prescribed under the Relevant…

Q: Given the following information, what is the amount of Equity. Buildings £50,000, Inventory £7,500,…

A: Stockholders' equity: Stockholders' equity means the net assets available to shareholders after…

Q: Q3. ANZ Company accepts from Nike a €3,600, 90-day, 6% note dated May 10 in settlement of Nike's…

A: The note receivable is the asset for the business. If note receivable is due within one year then it…

Q: Calculate the following: a. Determine the cash receipts for April based on the following data: Cash…

A: Cash account balances and account receivable balances are identified in cash budgets. The cash…

Q: Which of the following A. Capital + Liabilities = Assets B. Assets - Liabilities = Capital C. Assets…

A: The general accounting equation is Assets = Liabilities + Capital.

Q: Accounts Payable Cash Advertising Expense Service Revenue Equipment $3,200 Salaries and Wages…

A: Net income :— It is the difference of revenue and expenses. First we have to calculate total…

Q: Correction of Balance Sheet You may use the attached spreadsheet to help you complete this…

A: Introduction: A balance sheet is a financial statement that depicts a firm's assets and liabilities…

Q: The balance sheet of Morgan and Rockwell was as follows immediately prior to the partnership's…

A: The partners share profits and losses in the profit sharing ratio. The profits may be distributed…

Q: -S The Stilton Company has the following inventory and credit purchases during the fiscal year ended…

A: FIFO Method :— It is one of the method of inventory valuation in which beginning Inventory and first…

Q: The information is as below: Month Units 1 1000 2 2000 3 3000 Total costs K1,000,000 K1,200,000…

A: Variable cost per unit = Total cost in Month 2 - Total cost in Month1 / Units in month 2- Units in…

Q: 2.75) The financial statement that uses cost accounting is called: - statement of cash flows -…

A: Preparation of financial statements is the last step that a company performs in its books. But the…

Q: Frank and Bob are equal members in Soxy Socks, LLC. When forming the LLC, Frank contributed $44,000…

A: The original Amount of built-in gain on the contributed land must be allocated to the contributing…

Q: Discuss the effect of absorption and marginal costing on inventory valuation and profit…

A: Absorption costing also written as full costing. Under this method, all costs are considered in…

Q: At the beginning of the current year, CPA Co, leased a machine to CMA Co. The machine had an…

A: Finance Lease :— A lease is an agreement whereby the Lessor conveys to the Lessee in return for a…

Q: Prepare estimated unit product costs for Product A and Product B where overhead costs are charged to…

A: Under Absorption Costing, Product cost is computed by allocating the indirect overheads, on the…

Q: Use the following information for the Exercises below. (Algo) [The following information applies to…

A: Lets understand the basics. Cost of goods manufacture calculate how much cost is incurred to…

Q: Lita Lopez started Biz Consulting, a new business, and completed the following transactions during…

A: Accounting Equation :— It is the basic relationship between assets, liabilities and owner's equity.…

Q: Victor is a one-third partner in the VRX Partnership, with an outside basis of $228,200 on January…

A: Introduction: As a small business owner, you must account for your company's usual income. Ordinary…

Q: A company is proposing the introduction of an activity-based costing (ABC) system

A: Introduction Activity-Based Costing (ABC) A method of allocating extra and indirect expenses to…

Q: Which of the following is the best definition of a variable cost?

A: Types of Costs 1. Variable Cost: The cost which changes with the change in the level of activity is…

Q: docs.google.com/forms/d/e/1FAlpQLSdhx7wkRBg-5ysLm-AeX919m2L5F4Jxzbwov4D68iWUmoFzSg/formResponse?pli=…

A: Every business wants to know and check profitability of the company and for that the income…

Q: Classify each cost as either direct materials, direct labor, factory overhead, selling expenses, or…

A: Direct material cost- It is the cost of material added to product directly. Direct Labour cost- it…

Q: Determine the dividend payout ratio for the common stock. Round the payout ratio to four decimal…

A: It has been given in the question that common shareholders have the right on the total income of…

Step by step

Solved in 2 steps

- The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before any necessary year-end adjustment relating to the following: Goods were in transit from a vendor to Ashwood on December 31, 2019. The invoice cost was 85,000, and the goods were shipped FOB shipping point on December 29, 2019. The goods were received on January 2, 2020. Goods shipped FOB shipping point on December 20, 2019, from a vendor to Ashwood were lost in transit. The invoice cost was 40,000. On January 5, 2020, Ashwood filed a 40,000 claim against the common carrier. Goods shipped FOB destination on December 22, 2019, from a vendor to Ashwood were received on January 6, 2020. The invoice cost was 20,000, What amount should Ashwood report as accounts payable on its December 31,2019, balance sheet? a. 1,260,000 b. 1,285,000 c. 1,325,000 d. 1,345,000The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalThe following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services rendered on December 31, 20Y7. How would you record the January 24 transaction, using the accrual basis? A. Increase Cash, $5,700; decrease Fees Earned, $5,700 B. Increase Accounts Receivable, $5,700; increase Fees Earned, $5,700 C. Increase Cash, $5,700; decrease Accounts Receivable, $5,700 D. Increase Cash, $5,700; increase Fees Earned, $5,700Transaction Analysis Pollys Cards $ Gifts Shop had the following transactions during the year: Pollys purchased inventory on account from a supplier for $8,000. Assume that Pollys uses a periodic inventory system. On May 1, land was purchased for $44,500. A 20% down payment was made, and an 18-month, 8% note was signed for the remainder. Pollys returned $450 worth of inventory purchased in (a), which was found broken when the inventory was received. Pollys paid the balance due on the purchase of inventory. On June 1, Polly signed a one-year, $15,000 note to First State Bank and received $13,800. Pollys sold 200 gift certificates for $25 each for cash. Sales of gift certificates are recorded as a liability. At year-end, 35% of the gift certificates had been redeemed. Sales for the year were $120,000, of which 90% were for cash. State sales tax of 6% applied to all sales must be remitted to the state by January 31. Required Record all necessary journal entries relating to these transactions. Assume that Pollys accounting year ends on December 31. Prepare any necessary adjusting journal entries. What is the total of the current liabilities at the end of the year?

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.The accounts and their balances in the ledger of Markeys Mountain Shop as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows. Assume that Markeys Mountain Shop uses the perpetual inventory system. a. Merchandise Inventory at December 31, 140,357. b. Store supplies inventory (on hand) at December 31, 540. c. Depreciation of building, 3,400. d. Depreciation of store equipment, 3,800. e. Salaries accrued at December 31, 1,250. f. Insurance expired during the year, 1,480. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 63.