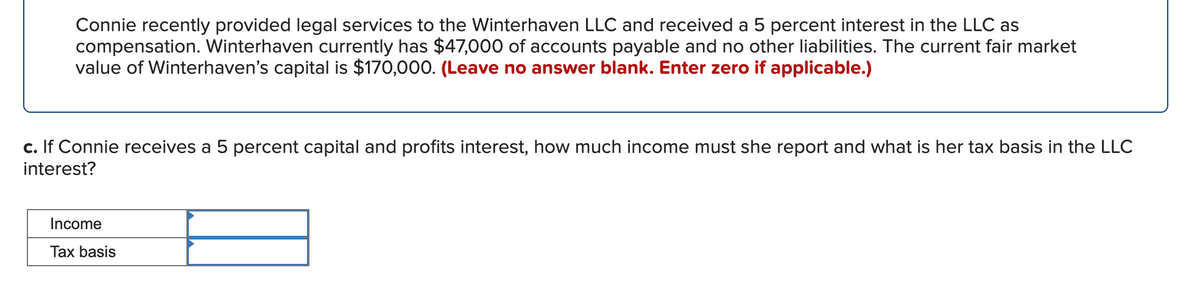

Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as compensation. Winterhaven currently has $47,000 of accounts payable and no other liabilities. The current fair market value of Winterhaven's capital is $170,000. (Leave no answer blank. Enter zero if applicable.) c. If Connie receives a 5 percent capital and profits interest, how much income must she report and what is her tax basis in the LLC interest? Income Tax basis

Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as compensation. Winterhaven currently has $47,000 of accounts payable and no other liabilities. The current fair market value of Winterhaven's capital is $170,000. (Leave no answer blank. Enter zero if applicable.) c. If Connie receives a 5 percent capital and profits interest, how much income must she report and what is her tax basis in the LLC interest? Income Tax basis

Chapter21: Partnerships

Section: Chapter Questions

Problem 33P

Related questions

Question

100%

Transcribed Image Text:Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as

compensation. Winterhaven currently has $47,000 of accounts payable and no other liabilities. The current fair market

value of Winterhaven's capital is $170,000. (Leave no answer blank. Enter zero if applicable.)

c. If Connie receives a 5 percent capital and profits interest, how much income must she report and what is her tax basis in the LLC

interest?

Income

Tax basis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you