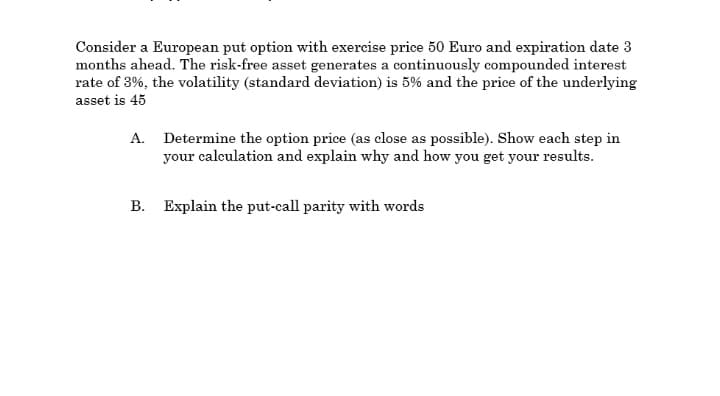

Consider a European put option with exercise price 50 Euro and expiration date 3 months ahead. The risk-free asset generates a continuously compounded interest rate of 3%, the volatility (standard deviation) is 5% and the price of the underlying asset is 45 A. Determine the option price (as close as possible). Show each step in your calculation and explain why and how you get your results. B. Explain the put-call parity with words

Q: The table below provides the premiums for one-year European options on an underlying asset with a…

A: Current Spot Price is 130 To Create: A butterfly spread using: 120-140 strangle ATM Straddle To…

Q: Use the European option pricing formula to find the value of a six-month call option on Japanese…

A: When valuing a european call option exchange rate the formula to determine the same is:…

Q: Consider a European Call Option with a strike of 82. The current price of the underlying asset is…

A: Call option price is 6.22 Risk free rate is 4.1% TIme to expiry is 5 months Strike price is 82 Stock…

Q: Suppose you have the following information concerning a particular options. Stock price, S = RM 21…

A: Call option Value "C" is 3.7739 Put option Value "P" is 1.8101 Time in years is 0.5 years Stock…

Q: Using the Black model, calculate the price of a call option on a forward contract.

A: Option contract is an agreement between two parties that allow the buyer of the contract to buy or…

Q: Consider a European call option struck "at-the-money", meaning the strike price equals current stock…

A: With the given information, we will try to find out the precise value of delta,

Q: Assume that the price of a forward contract is 127.87. The European options on the forward contract…

A: Given: Spot price St = 127.87 Exercise price K = 150 Time "t"= 60 days = 60/365 =0.164383561643836…

Q: Assume the spot Swiss franc is $0.7085 and the six-month forward rate is $0.7120. What is the Value…

A: given that: spot rate=$0.7085 forward rate=$0.7120 then the spot rate =$14144.28 forward…

Q: Use the Black-Scholes formulas to determine the price of a) a European call option b) a European put…

A: Stock option: A contract between the two people that provides the holder the right to buy or sell a…

Q: An investor is considering to sell European call options on XYZ Company for $1.50 per option. Curren…

A: Answer Total capital required $1,260,000 Option premium = $1.50 per option

Q: Consider a one-period binomial model in which the underlying is at 65 Euros, and can go up 30% or…

A: Note: This question has two questions. The first has been solved below: The single period binomial…

Q: ppose you buy a 100-strike call at a premium of $19.46, sell a 120-strike call at a premium of…

A: Put call parity Put call parity gives the relationship between put and call option that have the…

Q: A stock currently trades at price of $ 65 for 2-year European option with a strike price of $60. The…

A:

Q: Use the Black-Scholes pricing formula to calculate the price today of a European call option with…

A: Black Scholes model: Black Scholes model is widely use to determine the value of call option and a…

Q: Consider the following data (interest rate is per period): S = 100; K = 75;R= 1.20; u = 1.5; d = .5.…

A: (1). Two Period Binomial Modal: (a). Binomial Price of European call option (2 Periods) Stock Price…

Q: Suppose you have the following information concerning a particular options. Stock price, S = RM 21…

A: Hai there! Thanks for the question. Question has multiple sub parts. As per company guidelines…

Q: What is the risk-neutral valuation of a six-month European put option to sell a security for a price…

A: We will straight way use the Black Schole Model to value the put option.Inputs are:Current stock…

Q: A European-style put option that expires two periods from now has an exercise price of $125. The…

A: Given: Given: Stock price 107.5 Interest rate 5% Exercise price 125

Q: Consider the option on currency HKD against the USD: • Current spot rate is HKD7.50 for 1 USD •…

A: To Find: Value of Call Option(using Garman Kohlgen )

Q: Consider the option on currency HKD against the USD: • Current spot rate is HKD7.50 for 1 USD •…

A: To Find: Value of Call Option (using Garman Kholgen model) Minimum terminal exchange rate for Call…

Q: You have the following information about LearnMore Inc.'s stock and a two-month call option with a…

A: Here, Current Stock Price is $100 Strike Price is $140 u is 1.5032 d is 0.5467 πd is 0.5494 πu is…

Q: Assume that the price of a forward contract is 127.87. The European options on the forward contract…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Assume that the price of a forward contract is 127.87. The European options on the forward contract…

A: To Find: Price of put option

Q: Consider the one-period binomial model with a single risky asset with current price 33. Its price at…

A: Current price (S) = 33 Up price after 1 period (Su) = 35 Down price after 1 period (Sd) = 33 r =…

Q: Suppose for simplicity that the price of frozen concentrated orange juice is currently at $1000 per…

A: The futures price will depend upon the spot price, the risk-free rate, and the time to maturity.

Q: The prices of a certain security follow a geometric Brownian motion with parameters mu=.12 and…

A: Let's pull together all the variables of Black Scholes Model:S = Current stock price = 40K = Strike…

Q: Consider an European put option. Suppose Exercise price=$60. Expiration date=50 (and we assume 360…

A: given, K=$60t=50 days =50360S0= $100r=5%

Q: Consider the non-dividend paying asset with a current value of 100 kr that is described by the…

A: Option holder will purchase the stock, if stock spot price greater than strike price. Or else option…

Q: Consider a European Call Option with a strike of 82. The current price of the underlying asset is…

A: Here, Strike Price is $82 Current Price is $80 Time To Expiry is 5 months Value of Call Option is…

Q: What is the risk-neutral valuation of a six-month Euro- pean put option to sell a security for a…

A: The Black Scholes model is the mathematical model used for the risk-neutral valuation of options.

Q: a) On the 10th of December 2020, an investor buys a call option (European) with a strike price of…

A: The contract sold by the option writer to the option holder is represented by an option. The holder…

Q: Consider Commodity Z, which has both exchange-traded futures and option contracts associated with…

A: There is a specific relationship that exists between the call premium and the put premium for an…

Q: You are planning to make a hedging. The standard deviation of semiannual changes in a futures price…

A: optimal hedge ratio =coefficient of correlation x standard deviation of spot price/standard…

Q: Put together a Black–Scholes option calculator in Excel to answer the following.(a) What is the…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Assume that the value of a call option using the Black-Scholes model is $8.94. The interest rate is…

A: Call price - Put Price = Spot price - PV of exercise price

Q: The futures price of an asset is currently 80 and the risk-free rate is 4%. A six-month put on the…

A: given information risk free rate = 4% strike price = 85 currently worth 6.5

Q: Assume that K=61, St =65, t = 0.25 (i.e. time to expiry is 3 months), and the risk-free rate is…

A: Strike price K is 61 Spot Price S is 65 Time t is 0.25 Risk free rate is 4% Current price of Put…

Q: Assume the spot Swiss franc is $0.7030 and the six-month forward rate is $0.7010. What is the Value…

A: Here, Spot Price is $0.7030 Six Month Forward rate is $0.7010 Strike Price is $0.6830 Risk Free Rate…

Q: The prices of a certain security follow a geometric Brownian motion with parameters mu=.12 and…

A: The question has two parts:The probability that a call option will get exercised in 4 months - this…

Q: A 3-month European call on a futures has a strike price of $100. The futures price is $100 and the…

A: Strike Price (S)= $100 Future price (K)= $100 Volatility= 20% Risk-free rate (r)= 2% per annum with…

Q: Use a 3-step binomial tree to value a put option that expires in 6 months’ time. The interest rate…

A: Spot Price $ 100.00 Risk-Free Rate 7% Strike $ 95.00 Maturity 6 Months…

Q: Consider a six-month European call option on the spot price of gold, that is, an option to buy one…

A: The options typically valued using the Black -scholes formula Facts The six-month futures price of…

Q: A European call that will expire in one year is currently trading for $3. Assume the risk-free rate…

A: Note: No intermediate rounding is done, as atleast 4 decimal places is asked in the question. Call…

Q: The following information is given: Time to expiration 1 year. Standard deviation 40% per year.…

A: Formulas:

Q: A European call and put option on the same security both expire in threemonths, both have a strike…

A: Arbitrage is the process of taking advantage of a mis pricing of a security by buying and selling it…

8

Step by step

Solved in 6 steps with 2 images

- You are considering a European put option and a European call option on ABC Ltd and have available the following information. The put option with an exercise price of $15 and time to maturity of 60 days is priced at $2.00. The call option with the same exercise price and time to maturity is priced at $3.00. The underlying asset price is $15. The risk-free rate is 2% per 60 days. Could an arbitrage profit be earned? If so, how much the arbitrage profit is? Show your works (Hint: use discrete put-call parity equation and consider two scenarios for stock price at maturity of the options: $10 or $20).Consider a one-period binomial model in which the underlying is at 65 Euros, and can go up 30% or down 22% each period. The risk-free rate is 8%. Determine the price of a European put option with exercise price of 70. Assume that the put is selling for 9 Euros. Demonstrate how to execute an arbitrage transaction and calculate the rate of return. Use 10000 puts.Consider a European Call Option with a strike of 82. The current price of the underlying asset is 80, and the time to expiry is 5 months. The current market price of the option is 6.22. The risk-free rate is 4.1%. (b) You believe the true volatility is 28.4%. Is the option under-priced or overpriced? Hence what position should you take in option to make money. Explain. (Please provide Screenshots.)

- Consider an American put option with time to expiry 15 months, and a strike of 74. The current price of the underlying is 71. Divide the time to expiry into three 5-months intervals. Assume that in each 5-months interval, the price can either rise by 5, or fall by 5, with unknown probability. The risk-free (continuously compounding) rate is 0.042. Using a binomial tree, identify the circumstances under which early exercise would be rational for the holder of this option. Draw the binomial tree and show the necessary calculation and briefly explain the answer.Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33.A. Using the Black model, calculate the price of a call option on a forward contract.B. Calculate the underlying asset's price. Using the Black-Scholes-Merton model, determine the price of a call option on the underlying asset. Should this pricing be any different from the one calculated in letter A? Explain your answer.C. Using the Black model, calculate the price of a put option on a forward contract.D. Using the Black-Scholes-Merton model, compute the price of a put option on the underlying asset. Should this pricing be any different from the one calculated in letter C? Explain your answer.Suppose we have both a European call option and put option with an exercise price of $53 and the underlying stock is currently priced at $50. We are to note also that both options will expiry in six months. Further, market surveys suggest that the price of the stock can either go up by 20% or decrease by 25%. The current risk-free rate of interest is 2% per annum. Required: (a) What is the expected price of the underlying asset at expiry date? (b) What is the value of the call option, using the binomial model? (c) If the put option is selling for $4.80, what should be the price of the call option to avoid arbitrage?

- Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Using the Black-Scholes-Merton model, compute the price of a put option on the underlying asset.Suppose we have both a European call option and put option with an exercise price of $53 and the underlying stock is currently priced at $50. We are to note also that both options will expiry in six months. Further, market surveys suggest that the price of the stock can either go up by 20% or decrease by 25%. The current risk-free rate of interest is 2% per annum. (a) What is the expected price of the underlying asset at expiry date? (b) What is the value of the call option, using the binomial model? (c) If the put option is selling for $4.80, what should be the price of the call option to avoidarbitrage?Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Calculate the underlying asset's price. Using the Black-Scholes-Merton model, determine the price of a call option on the underlying asset.

- Using put-call parity formula, derive expressions for the lower bounds for European call and put options. What is a lower bound for the price of (i) a three-month call option on a non-dividend-paying stock when the stock price is R860, the strike price is R760, and the risk-free interest rate is 10% per annum? (ii) a three-month European put option on a non-dividend-paying stock when the stock price is R500, the strike price is R610, and the discrete risk-free interest rate is 9% per annum?Use the Black-Scholes pricing formula to calculate the price today of a European call option with strike £518.23, maturing in 12 months, if the spot price of the underlying is £534.35, its volatility is 25.13% and the risk-free rate is 4%. Give your answer correct to 2 decimal placesuse binomial option pricing model for this question. suppose the current spot rate for USD/CHF is 0.7. you need to find the one-year call option price of USD/CHF with the exercise price of 0.68 USD/CHF. Assume that our future states will be either 0.7739 U&SD/CHF or 0.6332 USD/CHF. 1) What are the payoffs of a call option (for both states) 2) what is the hedge ratio of the call option?