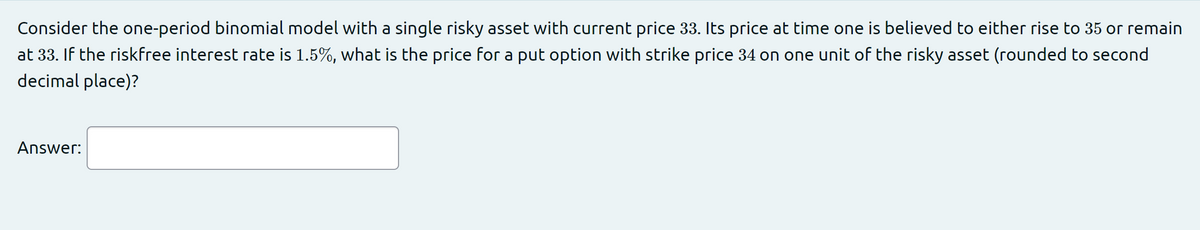

Consider the one-period binomial model with a single risky asset with current price 33. Its price at time one is believed to either rise to 35 or remain at 33. If the riskfree interest rate is 1.5%, what is the price for a put option with strike price 34 on one unit of the risky asset (rounded to second decimal place)?

Q: Based on quarterly compounding, what would be yield-to-maturity (YTM) be on a 12-year, zero-coupon, ...

A: Given Information : Par value of Bond = $1000 Current traded price = $456.78 Number of years to mat...

Q: The day Jared was born, his parents invest P20,000 at 5.5% m=4. Find the value of the fund on Jared'...

A:

Q: Allegra Inc. has one million shares outstanding. The company is considering the issue of debt of $10...

A: Let the breakeven EBIT = EBIT Number of shares initially (n1) = 1 million Number of shares after add...

Q: Stock market analyst. Explain Types of share analysis to value a stock.

A: Stock market analysis is the method used by traders or investors for analyzing the decisions related...

Q: Consider the following investment alternatives: Investment Rate Compounding A 6.502% Annual Daily Qu...

A: The real interest that an investor earns on the investment and a borrower pays on the loan after con...

Q: 1. Calculate the effective annual interest rate for 15% corresponding to each of the following: a) c...

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for...

Q: When Microsoft went public, the company sold 2 million new shares (the primary issue). In addition, ...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: Insurance companies perform functions that are similar to those of investment companies. * True or ...

A: Insurance companies are those companies that have been formed in order to cover the loss of an asset...

Q: Remember, an agency relationship can degenerate into an agency conflict when an agent acts in a mann...

A: The problem or conflict of the entity occurs as a result of conflict between two parties, principal ...

Q: What is the expected return on a portfolio? How can the expected return on a portfolio be manipulate...

A:

Q: How important is the ability to borrow money from an individual and what is the primary risk of incu...

A: Borrowing money is the act of obtaining money from the lender in order to fulfill a financial goal w...

Q: d? What is the minimum interest rate that would allow her to spend €120,500 in the

A: A) current period formula:- FV= PV*(1+r)^n interest rate is 'r' 55000+60000(1+r) = 105000 1+r = 1....

Q: what is the role of the Insurance Core Principles as it relates to underwriting risks, in the effect...

A: It is very important to evaluate and regulate the insurance supervision. There will be flaws in the ...

Q: If Rex wants to be a millionaire by the time he retires (45 years from now), how much does he need t...

A: Present Value: It represents the present worth of the future amount and is computed by the multipli...

Q: Suppose that $1,000 is invested for 4 years at an interest rate of 12%, compounded quarterly. How mu...

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified...

Q: sing a financial calculator yields a present value for option 2 of approximately and a present value...

A: The present value of an annuity: When a fixed amount of money is received or paid at constant interv...

Q: Mr. Jones will invests P 5,000 in a fund at the end of each 6 months to accumulate P 100,000 to buy ...

A: When an investor makes regular periodic deposits in an investment, this is known as an annuity. The ...

Q: 8. An investment was made two years and three months ago at 7% simple interest. The investor has jus...

A: The given question relates to the time value of money wherein the total interest received is 30,000 ...

Q: 12 . Consider a T-bill that will have a 125 days to maturity at the time of forward contract ...

A: A treasury bill is a debt obligation which is backed by the Treasury Department. It has maturity of ...

Q: Scenario 1. John invests $10,000 in a 3-year CD. The earning is 8% APR compounded monthly. (a) What ...

A: "Hi, Thanks for the Question. Since you asked multiple questions, we will answer first question for ...

Q: Find the future value for the ordinary annuity with the given payment and interest rate. PMT = $2,00...

A: PMT = $2000 r = 1.1% per annum = 0.09167% per month n = 6 years = 72 months

Q: Jokalet Inc. is running on a P2 million equity and needs Php500,000 additional funds to expand the b...

A: The net income is the net profit of the company earned during the period. The net income includes al...

Q: 3. Consider the following cash flow series. Determine the required annual deposits (end of year) tha...

A: Let the annual deposits = A Interest rate = 6% compounded monthly

Q: Suppose you currently own 3,000 shares of AZZ Incorporated stock that you purchased for S50 per shar...

A: Here, No. of Shares owned is 3,000 Purchase Price of Shares of $50 Selling Call Option at strike Pr...

Q: Orchid Biotech Company is evaluating several different development projects for experimental drugs. ...

A: Before investing in new assets or projects, profitability of the project is evaluated by using vario...

Q: Emma runs a small factory that needs a vacuum oven for brazing small fittings. She can purchase the ...

A: Lease or buy decision is one of the important capital budgeting decisions that the management has to...

Q: A.Jenevive who is in the 36 percent tax bracket can earn 9 percent annually on her investments in a...

A: Solution:- We know, Future value = Present value x (1+r) ^n where r = periodic interest rate n= num...

Q: Seth's parents gave him $5000 to invest for his 16th birthday. He is considering two investment opti...

A: Data given: Investment amount = $5000 Investment option: Option A: 4.5% interest compounded annually...

Q: 8. Risk identification and management are the responsibility of: A. The Board. B. The Risk Manager. ...

A: Risk Identification: Risk Management is the method involved with recognizing, following, and overse...

Q: It is a fact that teachers receive very meager salaries. Do you think this is an injustice? Explain ...

A: Teachers are the foundation of a nation's future as they educate children and guarantee a society of...

Q: Miller is currently 35 years old and thinking about his pension fund and his income when he retired ...

A: Present Value of Ordinary Annuity refers to a concept which determines the value of cash flows at pr...

Q: Can someone help me figure out this problem? Complete the following homework scenario: Compare t...

A: Payback period means the period upto which the original cost of the investment is recovered. It is c...

Q: eBook Brandtly Industries invests a large sum of money in R&D; as a result, it retains and reinvests...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: Tori is dining out with some friends. The restaurant 1 cannot split the bill. Tori offers to pay for...

A: Prepaid cards, like debit and credit cards, can be used to make transactions and pay expenses. Becau...

Q: Mr. Jones will invests P 5,000 in a fund at the end of each 6 months to accumulate P 100,000 to buy ...

A: Compounding of interest means, interest is received on principal as well as the earned interest amou...

Q: Question 6 Shayma Bank PLC Bond has a Par Value of $1,000 and a coupon of $135. The Shayma Bank PLC ...

A: Par value = $1000 Coupon amount = $135 Bond price = $900

Q: 1. A 2 year bond that pays 4% semi-annual coupon was issued when the yield was 10%. If the yield goe...

A: Note : As per the Honor Code , we are allowed to answer first question in case of multiple unspecif...

Q: n of P 2,000.00 was made at 8% simple interest. How long would it take in years for the amount of th...

A: Simple interest is interest without compounding that means no interest on interest and only interest...

Q: 12.000$ loan is being repaid by installments of 700$ at the end of each mont for as long as necessar...

A: For loans, outstanding balance refers to amount which is payable towards lender at a given point of ...

Q: Suppose you receive cashflows of $10 at year 1, $12 at year 2, $14 at year 3 and $16 at year 4. What...

A: Solution:- Value of cash flows at year 2 = Future value of year 1 cash flow for 1 year + Year 2 cash...

Q: We are interested in making a bid for Privately Held Automotive Group (PAG). PAG is an up-and- oming...

A: Unlevered or asset beta When a company has only equity and no debt, its beta is known as unlevered o...

Q: Solve the problem this with the long explanation. Im needed max in 30 minutes thank u What is a stoc...

A: A stock is a security that entitles its holders the ownership in a corporation in terms of getting a...

Q: Parker borrowed $283,000 at 7.5% compounded quarterly to finance the purchase of a pizza franchise. ...

A: The loan which is discharged by making installment payments consist of two components as interest mo...

Q: You are given a bond with a yield to maturity of 16%, Macaulay duration of 12 and a convexity of 52....

A: Given, The yield to maturity is 16% Macaulay duration is 12 Convexity is 52 % change in yield is 2%

Q: I. Direction. Fill in the blanks of the table involving a simple interest А. PRINCIPAL RATE TIME INT...

A: Simple interest is calculated directly on the given principal amount. The formula for calculating si...

Q: k. Five banks offer nominal rates of 9% on deposits, but A pays interest annually, B pays semiannual...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: Brian opened an RRSP account and deposited $3,300 into it. He then deposited $800 at the end of the ...

A:

Q: Four years ago, SONO Ltd. raised $30 million by issuing 15-year $1,000 par value bonds that carry 6....

A: The price for bond implies to the consideration amount paid by investor for purchasing bond. In prov...

Q: ering making a movie. The movie is expected to cost $10.6 million upfront and take a year to make. A...

A: Capital budgeting is the process through which a corporation examines potential large projects or in...

Q: With a reserve requirement of 7.81% and an initial deposit of $2,840, the total amount of money that...

A: Given Information : Reserve Requirement = 7.81% Initial Deposit = $2,840

Please answer with explanation.

I will really upvote

Step by step

Solved in 2 steps

- In a binomial model, a call option and a put option are both written on the same stock. The exercise price of the call option is 30 and the exercise price of the put option is 40. The call option’s payoffs are 0 and 5 and the put option’s payoffs are 20 and 5. The price of the call is 2.25 and the price of the put is 12.25. a. What is the riskless interest rate? Assume that the basic period is one year. b. What is the price of the stock today?Consider a one-period binomial model in which the underlying is at 65 and can go up 30% and down 22%. The risk-free rate is 8%. The price of the call option with exercise prices of 70 would be: a. 84.50 b. 0.5769 c. 0 d. 7.75 Refer to Problem #1. Suppose that the call is selling for 9 in the market and assume that we would execute an arbitrage transaction, the rate of return on a 10,000 call option would be: a. 16.20% b. 18.19% c. 15.17% d. 16.78%The prices of a certain security follow a geometric Brownian motion with parameters mu=.12 and sigma=.24. If the security's price is presently 40, what is the probability that a call option, having four months until its expiration time and with a strike price of K=42, will be exercised? (A security whose price at the time of expiration of a call option is above the strike price is said to finish in the money.) If the interest rate is 8%, what is the risk-neutral valuation of the call option?

- Consider an American put option with time to expiry 15 months, and a strike of 74. The current price of the underlying is 71. Divide the time to expiry into three 5-months intervals. Assume that in each 5-months interval, the price can either rise by 5, or fall by 5, with unknown probability. The risk-free (continuously compounding) rate is 0.042. Using a binomial tree, identify the circumstances under which early exercise would be rational for the holder of this option. Draw the binomial tree and show the necessary calculation and briefly explain the answer.The prices of a certain security follow a geometric Brownian motion with parameters mu=.12 and sigma=.24. If the security's price is presently 40, what is the probability that a call option, having four months until its expiration time and with a strike price of K=42, will be exercised? (A security whose price at the time of expiration of a call option is above the strike price is said to finish in the money).Consider a one-period binomial model in which the underlying is at 65 Euros, and can go up 30% or down 22% each period. The risk-free rate is 8%. Determine the price of a European put option with exercise price of 70. Assume that the put is selling for 9 Euros. Demonstrate how to execute an arbitrage transaction and calculate the rate of return. Use 10000 puts.

- With all other variables being equal (the same excerise price, underlying asset, implied volatility, interest rate, etc.), an at-the-money option with 30 days to expiration will tpyically have a gamma that is higher than an at-the-moeny option with 180 days to expiration (hint: think of the different shapes of the associated probability distribution and the change in delta) True or False?Assuming a risk-free rate of 8 percent and a market return of 12 percent, would it be wise for investors to acquire an asset with a Beta of 1.5 and a rate of return of 14 percent given the facts above?If the T Bill rate is 1.1% and the market risk premium is 10.8%, what is the CAPM-implied expected return on a portfolio invested 50% in the risk-free asset and 50% in the market?Enter your answer as a percentage rounded to 2 decimal places.

- Suppose that the standard deviation of quarterly changes in the prices of a commodity is $0.65, the standard deviation of quarterly changes in a futures price on the commodity is $0.81, and the coefficient of correlation between the two changes is 0.8. What is the optimal hedge ratio for a three-month contract? What does it mean? Explain what is meant by basis risk when futures contracts are used for hedging.The Treasury bill rate is 4.9%, and the expected return on the market portfolio is 11.1%. Use the capital asset pricing model. What is the risk premium on the market? (Enter your answer as a percent rounded to 1 decimal place.) What is the required return on an investment with a beta of 1.2? (Enter your answer as a percent rounded to 2 decimal places.) If an investment with a beta of 0.46 offers an expected return of 8.7%, does it have a positive NPV? If the market expects a return of 12.2% from stock X, what is its beta? (Round your answer to 2 decimal places.)A call option with an exercise price of $10 and 3 months to maturity has a price offer of $0.75. The stock price is $10.90 and the risk-free rate is 5%. Is this a boundary violation? If so, calculate the arbitrage profit available.