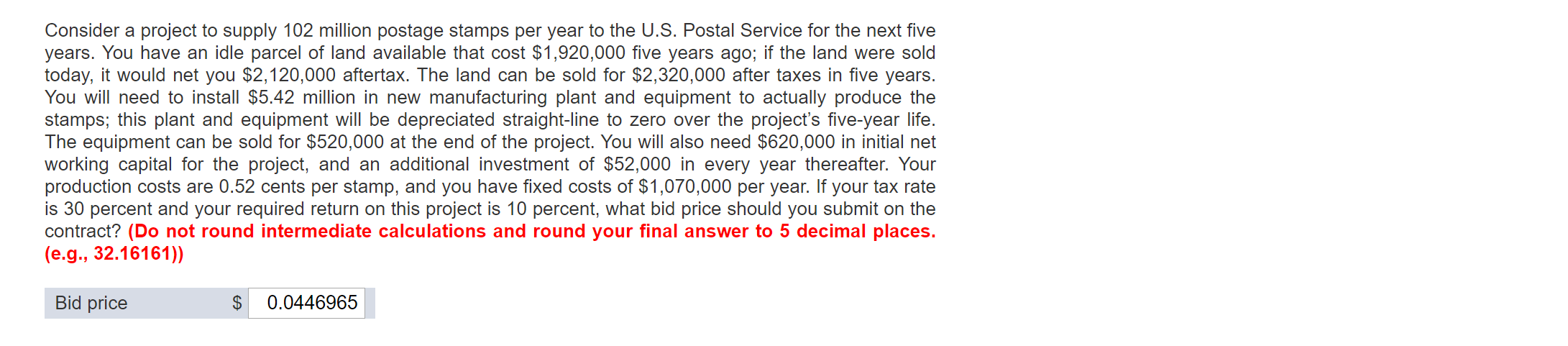

Consider a project to supply 102 million postage stamps per year to the U.S. Postal Service for the next five years. You have an idle parcel of land available that cost $1,920,000 five years ago; if the land were sold today, it would net you $2,120,000 aftertax. The land can be sold for $2,320,000 after taxes in five years. You will need to install $5.42 million in new manufacturing plant and equipment to actually produce the stamps; this plant and equipment will be depreciated straight-line to zero over the project's five-year life. The equipment can be sold for $520,000 at the end of the project. You will also need $620,000 in initial net working capital for the project, and an additional investment of $52,000 in every year thereafter. Your production costs are 0.52 cents per stamp, and you have fixed costs of $1,070,000 per year. If your tax rate is 30 percent and your required return on this project is 10 percent, what bid price should you submit on the contract? (Do not round intermediate calculations and round your final answer to 5 decimal places. (e.g., 32.16161)) Bid price 0.0446965

Consider a project to supply 102 million postage stamps per year to the U.S. Postal Service for the next five years. You have an idle parcel of land available that cost $1,920,000 five years ago; if the land were sold today, it would net you $2,120,000 aftertax. The land can be sold for $2,320,000 after taxes in five years. You will need to install $5.42 million in new manufacturing plant and equipment to actually produce the stamps; this plant and equipment will be depreciated straight-line to zero over the project's five-year life. The equipment can be sold for $520,000 at the end of the project. You will also need $620,000 in initial net working capital for the project, and an additional investment of $52,000 in every year thereafter. Your production costs are 0.52 cents per stamp, and you have fixed costs of $1,070,000 per year. If your tax rate is 30 percent and your required return on this project is 10 percent, what bid price should you submit on the contract? (Do not round intermediate calculations and round your final answer to 5 decimal places. (e.g., 32.16161)) Bid price 0.0446965

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 16P: Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of...

Related questions

Question

Need help

Transcribed Image Text:Consider a project to supply 102 million postage stamps per year to the U.S. Postal Service for the next five

years. You have an idle parcel of land available that cost $1,920,000 five years ago; if the land were sold

today, it would net you $2,120,000 aftertax. The land can be sold for $2,320,000 after taxes in five years.

You will need to install $5.42 million in new manufacturing plant and equipment to actually produce the

stamps; this plant and equipment will be depreciated straight-line to zero over the project's five-year life.

The equipment can be sold for $520,000 at the end of the project. You will also need $620,000 in initial net

working capital for the project, and an additional investment of $52,000 in every year thereafter. Your

production costs are 0.52 cents per stamp, and you have fixed costs of $1,070,000 per year. If your tax rate

is 30 percent and your required return on this project is 10 percent, what bid price should you submit on the

contract? (Do not round intermediate calculations and round your final answer to 5 decimal places.

(e.g., 32.16161))

Bid price

0.0446965

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning