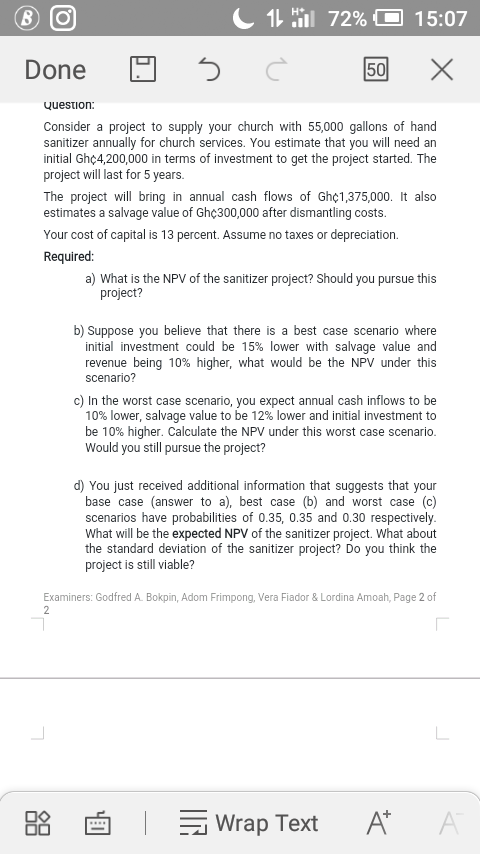

Consider a project to supply your church with 55,000 gallons of hand sanitizer annually for church services. You estimate that you will need an initial Gh¢4,200,000 in terms of investment to get the project started. The project will last for 5 years. The project will bring in annual cash flows of Gh¢1,375,000. It also estimates a salvage value of Ghç300,000 after dismantling costs. Your cost of capital is 13 percent. Assume no taxes or depreciation. Required: a) What is the NPV of the sanitizer project? Should you pursue this project? b) Suppose you believe that there is a best case scenario where initial investment could be 15% lower with salvage value and revenue being 10% higher, what would be the NPV under this scenario? c) In the worst case scenario, you expect annual cash inflows to be 10% lower, salvage value to be 12% lower and initial investment to be 10% higher. Calculate the NPV under this worst case scenario. Would you still pursue the project?

Consider a project to supply your church with 55,000 gallons of hand sanitizer annually for church services. You estimate that you will need an initial Gh¢4,200,000 in terms of investment to get the project started. The project will last for 5 years. The project will bring in annual cash flows of Gh¢1,375,000. It also estimates a salvage value of Ghç300,000 after dismantling costs. Your cost of capital is 13 percent. Assume no taxes or depreciation. Required: a) What is the NPV of the sanitizer project? Should you pursue this project? b) Suppose you believe that there is a best case scenario where initial investment could be 15% lower with salvage value and revenue being 10% higher, what would be the NPV under this scenario? c) In the worst case scenario, you expect annual cash inflows to be 10% lower, salvage value to be 12% lower and initial investment to be 10% higher. Calculate the NPV under this worst case scenario. Would you still pursue the project?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 15E: Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided...

Related questions

Question

Transcribed Image Text:Consider a project to supply your church with 55,000 gallons of hand

sanitizer annually for church services. You estimate that you will need an

initial Gh¢4,200,000 in terms of investment to get the project started. The

project will last for 5 years.

The project will bring in annual cash flows of Gh¢1,375,000. It also

estimates a salvage value of Ghç300,000 after dismantling costs.

Your cost of capital is 13 percent. Assume no taxes or depreciation.

Required:

a) What is the NPV of the sanitizer project? Should you pursue this

project?

b) Suppose you believe that there is a best case scenario where

initial investment could be 15% lower with salvage value and

revenue being 10% higher, what would be the NPV under this

scenario?

c) In the worst case scenario, you expect annual cash inflows to be

10% lower, salvage value to be 12% lower and initial investment to

be 10% higher. Calculate the NPV under this worst case scenario.

Would you still pursue the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 8 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning