Consider a zero coupon bond that promises to pay $100 each year for the next three years. Suppose we observe the set of zero coupon bond prices and its yields as below a) What is the price of this zero coupon bond? What is its yield to maturity? b) If the observe yield on two-year zero coupon bonds falls to 6% per year, but the other rates remain unchanged. What is your estimation of the value of the three-year annuity paying $100 per year? What is its yield to maturity?

Consider a zero coupon bond that promises to pay $100 each year for the next three years. Suppose we observe the set of zero coupon bond prices and its yields as below a) What is the price of this zero coupon bond? What is its yield to maturity? b) If the observe yield on two-year zero coupon bonds falls to 6% per year, but the other rates remain unchanged. What is your estimation of the value of the three-year annuity paying $100 per year? What is its yield to maturity?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.2.1MBA

Related questions

Question

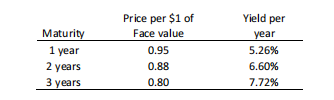

Consider a zero coupon bond that promises to pay $100 each year for the next three years. Suppose we observe the set of zero coupon bond prices and its yields as below

a) What is the price of this zero coupon bond? What is its yield to maturity?

b) If the observe yield on two-year zero coupon bonds falls to 6% per year, but the other rates remain unchanged. What is your estimation of the value of the three-year annuity paying $100 per year? What is its yield to maturity?

Transcribed Image Text:Price per $1 of

Yield per

Maturity

Face value

year

1 year

2 years

0.95

5.26%

0.88

6.60%

3 years

0.80

7.72%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning