Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its current fair value at t=0. (only one possible answer) $55.00 $ 57.09 $58.09 $60.00 $100.00 b. Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its DV01 at t=0. (only one possible answer)

Q: On October 1, 2020 John's Barber Shop borrowed $14,000 at 8% interest, with principal and interest…

A: Interest will be booked on proportionate basis, which means that the interest shall be booked for…

Q: What is/are the reason/s or cause/s of the 2007 Financial Crisis? What did the government do or how…

A: The 2007-08 Financial Crisis was the largest recession of the 21st century. It is also referred to…

Q: Draper College predicts that in 18 years it will take $300,000 to attend the college for four years.…

A: We can determine the amount that Emma needs to set aside today to pay for her child's college 18…

Q: You plan to deposit $700 in a bank account now and $100 at the end of the year. If the account earns…

A: First we have tor calculate the future value of $700 deposit today and then we will add the second…

Q: offer 30-year mortgage that requires annual payments and has an interest rate of 5% per year. What…

A: Mortgage amount are paid by monthly payment or annual payment these are fixed periodic instalments…

Q: Find the amount at the end of 2 years and 7 months if 425000 is invested at 8% compounded quarterly…

A: Simple interest method is one in which the interest earned during a period does not earn interest.…

Q: How much would you need to pay on the 5th year to completely pay off the item if interest is…

A: Since year 4 is the focal point, we need to discount every cash flow to year 4 to determine how much…

Q: XYZ pty Ltd is considering investing in one of two outstanding bonds. The bonds offer 11% coupon…

A: Value of bond is the present value of the future coupon payments and the present value of the bond…

Q: important to have an FMS option

A: FMS Stock Options refers to all outstanding options to buy stocks of FMS Common Stock bestowed under…

Q: sults of the previous income statement calculations, complete the following statements: In Year 2,…

A: As per the given information: To complete the Year 2 Income statement, we have been provided with…

Q: E8

A: Given, APR = 8% (Quaterly) 17.0(Monthly) 13.0(Daily) 10.0(Infinite)

Q: If you place a stop-loss order to sell at $52 on a stock currently selling for $55.50 per share,…

A: Stop loss- This is a method adopted by an investor to limit the loss on a security position. The…

Q: Calculate the average daily balance and finance charge on the statement below. Note: Round your…

A: In Average daily balance method, daily balance in the credit card account is calculated and then is…

Q: 14. Mr. Reyes borrows P600,000 at 12% compounded annually. agreeing to repay the loan in 15 equal…

A: A loan is an agreement where a lump sum amount is forwarded by one party in exchange for periodic…

Q: 2. The value of one of the funds in your 401(k) plan (your pri- mary source of retirement savings)…

A: Risk tolerance is a factor that measures how far an investor can bear investment loss arising due to…

Q: Ryan plans to deposit his annual bonus into a savings account that pays 3% interest compounded…

A: The compounding term refers to the interest on interest. The simple interest means the interest is…

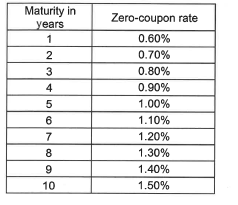

Q: Your company is AA-rated by a credit-rating agency, and must borrow money according to the table 1…

A: Projects should be accepted when expected return is greater than interest on money borrowed In…

Q: , has requested that Mutual of Seattle present an investment seminar to the mayors of the…

A: Price of bond is the present value of coupon payment and present value of the par value of bond…

Q: Suppose that you decide to buy a car for $63,000, including taxes and license fees. You saved…

A: Monthly payments The monthly payment of the borrowed amount, or the payment of a debt, is called a…

Q: Suppose UZALO and MUVHANGO are involved in a Heritage Day project. They need to hire two acting…

A: Here, To Find: NPV =?

Q: Please calulate the Clean Bank's maturity gap.What does the maturity gap imply about the interest…

A: Maturity Gap is the difference between the interest sensitive assets and liabilities with respect to…

Q: What amount should be paid on October 5, 2022, on a loan of P100,000 made on December 13, 2021 with…

A: Simple Interest = Principal amount * Interest rate * ( Number of days/365) = 100,000 * 4.7% *…

Q: ou are examining three different shares. Share A has expected return 5.40%, beta 0.41, and…

A: CAPM is used to determine the value of share by calculating the required rate of return of each…

Q: You expect to have $12,000 in one year. A bank is offering loans at 5.5% interest per year. How much…

A: In this question we have to calculate present value of $ 12,000 in one year at 5.5% interest rate.…

Q: The father of a Junior High School Student wants to make sure that his son will be able to enroll…

A: Equivalent interest rates are interest rates that produce the same return as the given annual…

Q: Taxes are costs, and, therefore, changes in tax rates can affect consumer prices, project lives, and…

A: Net present value is the difference between the present value of cash inflows and initial…

Q: Required information An electric switch manufacturing company is trying to decide between three…

A: Method A First cost=47000 AOC=8000 Life=2years Discount rate=14% To calculate future worth first we…

Q: | Using this table as needed, calculate the required information for the mortgage. (Round dollars to…

A: EMI or monthly mortgage payments are the fixed amount paid by the borrower to the lender that…

Q: Your small startup wants to take out a loan for 5 years for a piece of equipment. The bank offers 6%…

A: Payment per period refers to the time which is used for calculating the wages that are earned and…

Q: How much must be deposited at 12% each year beginning on January 1, year 1, in order to accumulate…

A: Future value The method that helps to calculate the future worth of an investment made today is…

Q: From the data below for the Dow Jones Industrial Average, calculate the three-day simple moving…

A: Date Adj Close 3/25/2019 25,516.99 3/26/2019 25,657.89 3/27/2019 25,625.75 3/28/2019…

Q: Your bank pays 2.3% interest per year. You put $1.100 in the bank today and $500 more in the bank in…

A: Year 0 Deposit = $1,100 Year 1 Deposit = $500 Interest rate = 0.023 Amount in the bank in 2 years =…

Q: Barney and Alyson agree on the price calculated above. Ignoring tax and any other expenses, what is…

A: Given: Purchase price = $984.31767830979 Payments received = $37 Number of payments = 2 Sale value =…

Q: Suppose that you decide to buy a car for $28,635, including taxes and license fees. You saved $7000…

A: concept. formula to find monthly payment is where , pmt = monthly payment r = interest rate t =…

Q: What are agency problems, and why do they exist within a corporation? Discuss how agency conflicts…

A: Shareholders: Shareholders are the owners of a corporation, where they purchase the ownership in the…

Q: The difference between oral auctions and second-price auctions

A: Oral auctions-In this type of auction the bidder is either present physically or electronically and…

Q: (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 19-year, $1,000…

A: Solution:- Bond price means the price at which the bond is currently trading in the market. It is…

Q: NAMPAK has issued five-year bonds, with R1000 par value and a coupon interest rate of 12% paid…

A: Maturity value (Z) = R1,000 (Equal to par value) Semiannual coupon amount (C) = R1000 * 0.12 / 2 =…

Q: IBOR. In addition, the loan adjusted weekly based on the closing value of the index fo Date LIBOR…

A: Given: The floating point of the 27 base point in lIBOR. The maximum and minimum interest is 2.19…

Q: There are five name stages in the Financial Service Market Study: Problem Definition, Design of…

A: Financial services refer to the activities like banking, insurance, etc that are being provided by…

Q: Bronco Electronics' current assets consist of cash, short-term investments, accounts receivable, and…

A: Current ratio = Current asset / Current liability Current ratio = 3.6 Acid test ratio = (Current…

Q: Question 12 Interest rates spreads between corporate and government bonds O are countercyclical are…

A: Countercyclical means the measures that are against or counter effects on the economic cycle. For…

Q: Currently, your credit card has a balance of $14,000. The credit card has an effective monthly…

A: The number of monthly payments may be calculated through following formula Present value =…

Q: Which change models are suitable for farmers insurance companies for change management? and provide…

A: Change Management is defined as dynamic factors which may provide a plan to execute as per market…

Q: 1. The owner of a company plans to expand his firm 6 years from now so he plans to make quarterly…

A: Cash Flow Diagram: A financial tool called a cash-flow diagram is used to show the cashflows related…

Q: 3. Don Magellan borrowed today from Ginoong Lapulapu P300,000.00 and agreed to repay the loan with 4…

A: Loan amount (PV) = P300,000 Number of monthly payments (n) = 4 Interest rate = 12% Monthly interest…

Q: 7. Assume that today you made an initial deposit in the amount of $16,000 into a savings account…

A: Future value of an initial deposit paying simple interest is calculated using following equation…

Q: X Corp plans to invest in new equipment costing 290,000 with no salvage value. The project will save…

A: Cost of Equipment is 290,000 Operating cost saving is 160,000 Time period is 3 years Tax rate is 40%…

Q: On 2020-05-01, Eduardo buys a T-bill with a face value of $45,000.00 that matures on 2021-03-06. He…

A: Purchase Date 01-05-2020 Maturity Date 06-03-2021 Face Value $ 45,000.00 Tbill…

a. Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its current fair value at t=0.

(only one possible answer)

- $55.00

- $ 57.09

- $58.09

- $60.00

- $100.00

b. Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its DV01 at t=0.

(only one possible answer)

- $0.0098

- $0.0500

- $0.0283

- $0.0471

- $0.6000

Step by step

Solved in 2 steps

- Consider Bond F250 Coupon rate (half yearly) 10,5% per year Yield to maturity 7,955% per year Maturity date 8 October 2054 Settlement date 29 May 2021 The all-in-price is [1] R129,73733%. [2] R126,13814%. [3] R123,49852%. [4] R134,98733%. [5] R131,24248%.Bond QuoteDEERE, Inc.Current Price: $98.00Face Value: $100.00Annual Coupon Rate: 3%Coupons Per Year: 2Issue Price $99.77Issue Date: Jan 1, 2017Maturity Date: Jan 1, 2024Next Coupon Date: June 30, 2022Coupon Payments Remaining: 4Please fill in the following information to determine the current Yield to Maturity. The rate and YTM canbe estimated to two decimal places (i.e. 1.23%). Fill In N I PV FV PMT Yield to Maturity8. On January 28, 2011 a T-bill was issued with a face value of $170000 and a maturity date of July 22, 2011. If it was purchased for $164862.17 on the date it was issued, what yield is the investor realizing?

- Bond Value Coupon rate Interest Due Maturity Require Rate of Return Offered Price 10,000 8% Semi-Annual 10 yrs 10% 98 3/4 Required: Calculate the Exact and Approximate YTM.1 Consider BOND AAA Coupon rate: 9,4% per year Yield to maturity: 10,6% per year Settlement date: 16 July 2022 Maturity date: 9 October 2048 The all-in price is? 1. R89,45121%. 2. R91,91965%. 3. R87,33105%. 4. R82,63215%.FV = 1000; Coupon rate = 0; maturity 20 years; bond yield = 12% Commission = 4% Calculate Sale proceeds and yield to maturity.

- Q24 A bond OMR 100 face value, 10 years to maturity, 4% annual coupon rate, and a annual required rate of return of 8%. What is the coupon payment amount of the Bond; assume that coupons are compounded monthly? a. OMR 2.000 b. OMR 1.000 c. OMR 0.333 d. OMR 4.000Assuming semiannual compundingwith 15 years to maturity paying 1,000.00 at maturity for YTM of 7%, 11%, and 15% what is the price of a zero coupon bond for each YTM? Financial Calculator for 7%: n = 30, I/Y = 7%, CPT PV, PMT = 0, FV = 1000. Price = $131.37. Financial Calculator for 11%: n = 30, I/Y = 11%, CPT PV, PMT = 0, FV = 1000. Price = $43.68. Financial Calculator for 15%: n = 30, I/Y = 15%, CPT PV, PMT = 0, FV = 1000. Price = $15.10.Two-year Treasury securities yield 6.7 percent, while 1-year Treasury securities yield 6.3 percent. Assume that the maturity risk premium (MRP) equals zero. What does the market anticipate will be the yield on 1-year Treasury securities one year from now?

- Bond Value Coupon rate Interest Due Maturity Require Rate of Return Offered Price 20,000 11% Every 3 months 5yrs 12% 88 1/4 Required: Calculate the Exact and Approximate YTM.Umberto Consulting Limited Convertible Bond Common Equity Par Value $1,000.00 Coupon (Annual Payment) 0.03 Current Market Price $975.00 $30.50 Straight Bond Value $935.00 Conversion Ratio 30 Conversion Option Any Time Dividend $1.00 Expected Market Price in One Year $38.25 Required: Using the information in the tables above, please calculate the current market conversion price and the following expected rates of return. Assume coupons are received before any conversion takes place. (Use cells A3 to C10 from the given information to complete this question.) Umberto Consulting Limited Market Conversion Price Expected Rate of Return, Convertible Bond Expected Return of Return, Common EquityConsider the following balance sheet (in millions) for an FI: Assets Liabilities Duration = 10 years $950 Duration = 2 years $860 Equity $90 What is the FI's duration gap, and FI's interest rate risk exposure ? How can the FI use futures and forward contracts to put on a macrohedge? What is the impact on the FI's equity value if the relative change in interest rates is an increase of 1 percent? That is, DR/(1+R) = 0.01. Suppose that the FI in part (c) macrohedges using Treasury bond futures that are currently priced at 96. What is the impact on the FI's futures position if the relative change in all interest rates is an increase of 1 percent? That is, DR/(1+R) = 0.01. Assume that the deliverable Treasury bond has a duration of nine years. If the FI wants to macrohedge, how many Treasury bond futures contracts does it need?