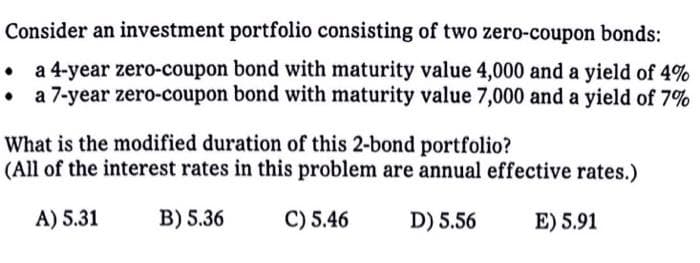

Consider an investment portfolio consisting of two zero-coupon bonds: a 4-year zero-coupon bond with maturity value 4,000 and a yield of 4% a 7-year zero-coupon bond with maturity value 7,000 and a yield of 7% What is the modified duration of this 2-bond portfolio? All of the interest rates in this problem are annual effective rates.) A) 5.31 B) 5.36 C) 5.46 D) 5.56 E) 5.91

Q: Once upon a time, there was an amazing group of students who studied at Cronfwoman University.…

A: To assess the investment opportunity for the sandwich shop, we need to analyze the potential revenue…

Q: What is personal spending? Enumerate the different personal expenses

A: Personal spending is the money spent by individuals on items, services, and experiences for…

Q: Barton Industries expects next year's annual dividend, D1, to be $2.00 and it expects dividends to…

A: When a company comes up with a new issue of securities, it incurs costs like underwriting, legal…

Q: Harold and Mavone plan to purchase furniture, appliances, some heirloom artifacts, as well as new…

A: Incremental ROR analysis is a technique used to evaluate two or more investment options by comparing…

Q: You own a portfolio consisting of the following stocks. Calculate the expected return of the…

A: Portfolio beta is a measure of the systematic risk of a portfolio of investments, which reflects the…

Q: Golden Dragon Restaurant obtained a $9000 loan at 9% compounded annually to replace some kitchen…

A: Given: Loan amount = $9,000 Interest = 9% compounded annually Semi annual payment = $1,800…

Q: The 30-day T-bill yield is currently 3.10%. You also know that the inflation premium today is 1.80%,…

A: Real risk-free rate is an important concept in finance. This measures the return of the portfolio…

Q: Morgan invested $1700 for four years compounded semi annually. If the future value of the investment…

A: Data given: PV= $1700 n=4 years rate=? (compounded semi-annually) FV=$2195.68 Required: Annual…

Q: Share Price $ 20.00 EPS $ 3.00 Shares outstanding (million) 10 Book Value $ 25.00 If the company…

A: A share repurchase, also known as a stock buyback, is a process in which a company buys back its own…

Q: Calculate Return on Equity (ROE) for 2021 using the Dupont Equation

A: Return on Equity: It represents a profitability measure and indicates the return made by the firm…

Q: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have…

A: In order to evaluate the effectiveness of a long-term investment in the present, the Net Present…

Q: Write a paragraph on each of the following topics: liquidity, asset management, debt management and…

A: There are different financial ratios that measure the company's' financial performance. These ratios…

Q: Which one of the following statements is correct? Seasonal needs are financed with short-term loans…

A: Introduction: The cost of financing is an important consideration for any business. Long-term and…

Q: You are an assistant analyst at a financial consulting company. You have been asked to prepare a…

A: Dear Manager, Regarding the client's request for advice on using interest rate derivatives to hedge…

Q: A bond paying 5% coupons semiannually and YTM of 4.5% and 12 years to maturity. If the last interest…

A: Sometimes, an investor may purchase a bond after the coupon payment date. In this case, he will not…

Q: Discuss how ross's condition be made better off without harming rosa

A: Introduction: Ross’s condition can be improved without harming Rosa if the appropriate steps are…

Q: A company has current, trailing earnings of 3.2 per share. The company plans to plowback 0.41, a…

A: The estimation of the current value per share of all future cash flows associated with growth…

Q: Allison's Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to…

A: It is a case where the net present values of the alternatives are calculated after adjusting the…

Q: DDY Ltd currently does not pay a dividend to its shareholders but equity analysts expect that the…

A: Share price refers to the amount which is used for trading the shares between the buyers and sellers…

Q: Palencia Paints Corporation has a target capital structure of 40% debt and 60% common equity, with…

A: Cost of common stock = D0×1+gP0+g Where, D0 is current dividend per share g is growth rate P0 is…

Q: Consider the following future value. (Round your answers to the nearest cent.)$4,472 at 10 3/4%…

A: The present value represents the amount of money that needs to be invested now to achieve the future…

Q: Kimberly Jensen of Storm Lake, Iowa, wants to buy some living room furniture for her new apartment.…

A: The annual percentage rate, or APR, is made up of the loan's stated interest rate plus fees,…

Q: Sarah the Company Secretary of Beta Plc, The company is a non-listed public company. She seeks your…

A: Companies issue shares to the general public to raise funds to support business expansionary…

Q: Parker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to…

A: Initial Investment: Cash flow at Initial investment signifies the cost of the investment that is…

Q: Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a…

A: Different risk components of a bond have different risk premia. The information has been provided on…

Q: Some credit repair companies have instant solutions to your credit problems. True O False

A: Credit repair companies are businesses that offer services to help consumers improve their credit.…

Q: For three 6-month American call options on a stock, you are given the following information: (i)…

A: To create an arbitrage, we need to find values of x and y that will result in a risk-free profit.…

Q: You buy a share of The Ludwig Corporation stock for $20.20. You expect it to pay dividends of $1.03,…

A: Growth Rate under dividend policy is that on which dividend is growing with same percentage with…

Q: Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely…

A: Soution 1: Computation of NPV - Holston Company Particulars Period Amount PV factor at…

Q: u bought a house for $400000 and made a downpayment of $100000. You make payments at the end of each…

A: we Need to calculate the payment at the end of year than the down payment is considered and…

Q: A company had $16 of sales per share for the year that just ended. You expect the company to grow…

A: The free cash flow to equity model is one of the ways to value a stock and is based on the idea that…

Q: Shi Import-Export's balance sheet shows $300 million in debt, $50 million in preferred stock, and…

A: In order to calculate weighted average cost of capital we consider the capital structure of the…

Q: DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to…

A: As per the guidelines, I am required to answer only the first three questions. The question is based…

Q: What is the effective cost of this loan if you pay it off at the end of year 2?

A: The effective cost of an Adjustable Rate Mortgage (ARM) if it is paid off at the end of year 2. An…

Q: . You manage an equity fund, Panda Eyes, with an expected risk premium of 10% and a standard…

A: Any sum infused into the multiple avenues available in the market with a motive to yield returns and…

Q: 2. * The effective interest rate is 5% p.a. for five years. Then, it jumps to a different value and…

A: Since you have asked multiple question , we will solve the first question for you. If you want any…

Q: 2 For each of the following programs, identify one or more "unintended" consequences: a Rent control…

A: a. Rent control can lead to reduced investment in rental housing and a shortage of available rental…

Q: You have two stocks. Stock A has a beta of 0.2, stock B has a beta of 0.7. If you want to form a…

A: Let the portfolio weight of stock A be a. Portfolio beta =Weight of stock A×Beta of stock A +…

Q: Which one is NOT a credit reporting company? O Equifax O Experian O Cooperative Extension Services O…

A: Credit reporting companies play a significant role in the financial lives of individuals and…

Q: Consider an asset that costs $635,000 and is depreciated straight-line to zero over its eight-year…

A: To calculate the after-tax salvage value, we need to determine the taxes owed or tax benefits…

Q: 1. Determine the weighted average cost of capital (WACC) for Vigour Pharmaceuticals. 2. Calculate…

A: To calculate WACC, we need to determine the cost of each component of capital and its weight in the…

Q: Parents wish to have 90,000 available for a child’s education.if the child is now 4 years old, how…

A: Given, Future Value (FV) =90000 Rate=5% Semiannually (r)=5%2=0.025 Total no. of years = (18-4)=14…

Q: You signed a 10-year interest swap (principal USD 1,000,000) with annual payments to pay LIBOR USD…

A: An interest rate swap is a financial contract between two parties that involves the exchange of…

Q: (Common stock valuation) Dubai Metro's stock price was at $90 per share when it announced that it…

A: Given, Current stock price = $90 Dividend (D1) = $8 Growth rate = 0.09

Q: Assume the risk-free rate is 5% and the market return is 12%. If inflation increases in the market…

A: A line that is drawn on a chart to depict the capital asset pricing model graphically is called the…

Q: You owe $1,032.56 on a credit card with an 11.25% APR. The minimum due is $150.00. What is the…

A: Interest amount refers to the minimum cost to be charged over the investment made by the investors…

Q: Northwestern Electronics has a 1.85 beta. If the overall stock market increases by 6 percent, how…

A: To calculate the change in stock price we will use the below formula Change in stock price =…

Q: Vigour Pharmaceuticals Ltd. is considering investing in a new production line for its pain-reliever…

A: A company's capital structure indicates all the sources from where the entity has acquired funding.…

Q: Risk-adjusted rates of return using CAPM Centennial Catering, Inc, is considering two mutually…

A: The NPV of a project is a measure of its profitability by accounting for the PV of the cash flows.…

Q: Assume that in 2021, Anthony sells all of his stock in Benson's Animal Care Center to Nicole for $1…

A: Assume that in 2021, Anthony sells all of his stock in Benson's Animal Care Center to Nicole for $1…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

- Suppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?What would be the value of the bond described in Part d if, just after it had been issued, the expected inflation rate rose by 3 percentage points, causing investors to require a 13% return? Would we now have a discount or a premium bond? What would happen to the bond’s value if inflation fell and rd declined to 7%? Would we now have a premium or a discount bond? What would happen to the value of the 10-year bond over time if the required rate of return remained at 13%? If it remained at 7%? (Hint: With a financial calculator, enter PMT, I/YR, FV, and N, and then change N to see what happens to the PV as the bond approaches maturity.)Suppose there is a large probability that L will default on its debt. For the purpose of this example, assume that the value of Ls operations is 4 million (the value of its debt plus equity). Assume also that its debt consists of 1-year, zero coupon bonds with a face value of 2 million. Finally, assume that Ls volatility, , is 0.60 and that the risk-free rate rRF is 6%.

- Bond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of 1,000, and has a yield to maturity equal to 9.6%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, what will be the price of each of the bonds at the following time periods? Fill in the following table:Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, A-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.3%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.83 % — AAA corporate 1.03 0.20 % AA corporate 1.39 0.56 A corporate 1.79 0.96 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: fill in the blank _ % 7-year Corporate yield: fill…Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.3%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.73 % — AAA corporate 0.93 0.20 % AA corporate 1.33 0.60 A corporate 1.75 1.02 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 10.533 % 7-year Corporate yield: 9.597% Given…

- Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.3%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.73 % — AAA corporate 0.93 0.20 % AA corporate 1.33 0.60 A corporate 1.75 1.02 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 6.553%----->correct 7-year Corporate yield: ? %…Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 3% for the next 2 years, 4% for the following 4 years, and 5% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.2%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.83 % — AAA corporate 1.03 0.20 % AA corporate 1.39 0.56 A corporate 1.75 0.92 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: fill in the blank 7 % 7-year Corporate yield: fill in the blank 8 %What is the duration of a three-year, $1,000 Treasury bond with a 12 percent semiannual coupon selling at par? Selling with a yield to maturity of 6 percent? 8 percent? Plot the relationship. What can you conclude about the relationship between duration and yield to maturity? Select one: a. Both the maturity periods have equal duration. b. When the yield to maturity is increasing the years to maturity will decrease. c. There is no relationship d. None of the other three answers are correct

- Suppose you are considering two possible investment opportunities: a 12-yearTreasury bond and a 7-year, A-rated corporate bond. The current real risk-free rateis 4%, and inflation is expected to be 2% for the next 2 years, 3% for the following4 years, and 4% thereafter. The maturity risk premium is estimated by this formula:MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimatedto be 0.3%. You may determine the default risk premium (DRP), given thecompany’s bond rating, from the table below. Remember to subtract the bond’s LPfrom the corporate spread given in the table to arrive at the bond’s DRP. Whatyield would you predict for each of these two investments?RateCorporate Bond YieldYou are a fixed income analyst with an active investment in two bonds. X and Y. Bond X has a coupon rate of 9% and Bond Y has a 10% annual coupon. Both bonds have 5 years to maturity. The yield to maturity for both bonds is now 10%. If the required return rises by 14%, by what percentage will the price of the bond X change? Please provide complete details of the calculations (formula/steps) of the above questionConsider a coupon bond with an 8% annual coupon rate, a 10% interest rate, and a$1000 face value. The bond will mature in 4 years. What is the duration of this bond? Duration isdefined as a weighted average of the maturities of the cash payments. Suppose the weightassigned to the maturity of 1 year is W. Show your work A: Duration=2.28 and W=7.77%B: Duration=3.56 and W=20.5%C. Duration=3.56 and W=23.1%D. Duration=3.56 and W=7.77%