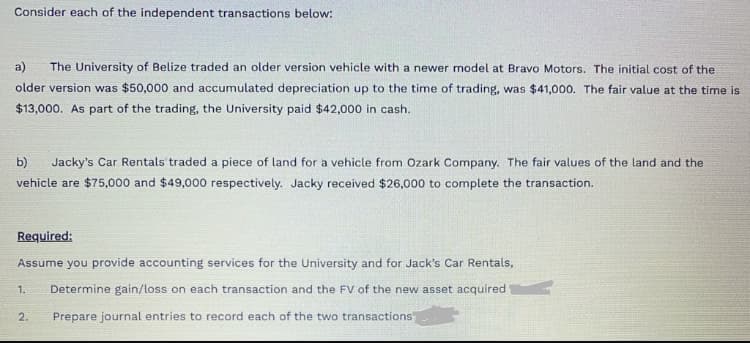

Consider each of the independent transactions below: a) The University of Belize traded an older version vehicle with a newer model at Bravo Motors. The initial cost of the older version was $50,000 and accumulated depreciation up to the time of trading, was $41,000. The fair value at the time is $13,000. As part of the trading, the University paid $42,000 in cash. b) Jacky's Car Rentals traded a piece of land for a vehicle from Ozark Company. The fair values of the land and the vehicle are $75,000 and $49,000 respectively. Jacky received $26,000 to complete the transaction. Required: Assume you provide accounting services for the University and for Jack's Car Rentals, 1. Determine gain/loss on each transaction and the FV of the new asset acquired 2. Prepare journal entries to record each of the two transactions

Consider each of the independent transactions below: a) The University of Belize traded an older version vehicle with a newer model at Bravo Motors. The initial cost of the older version was $50,000 and accumulated depreciation up to the time of trading, was $41,000. The fair value at the time is $13,000. As part of the trading, the University paid $42,000 in cash. b) Jacky's Car Rentals traded a piece of land for a vehicle from Ozark Company. The fair values of the land and the vehicle are $75,000 and $49,000 respectively. Jacky received $26,000 to complete the transaction. Required: Assume you provide accounting services for the University and for Jack's Car Rentals, 1. Determine gain/loss on each transaction and the FV of the new asset acquired 2. Prepare journal entries to record each of the two transactions

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 12PB: Farm Fresh Agriculture Company purchased Sunny Side Egg Distribution for $400,000 cash when Sunny...

Related questions

Topic Video

Question

Transcribed Image Text:Consider each of the independent transactions below:

a)

The University of Belize traded an older version vehicle with a newer model at Bravo Motors. The initial cost of the

older version was $50,000 and accumulated depreciation up to the time of trading, was $41,000. The fair value at the time is

$13,000. As part of the trading, the University paid $42,000 in cash.

b)

Jacky's Car Rentals traded a piece of land for a vehicle from Ozark Company. The fair values of the land and the

vehicle are $75,000 and $49,000 respectively. Jacky received $26,000 to complete the transaction.

Required:

Assume you provide accounting services for the University and for Jack's Car Rentals,

1.

Determine gain/loss on each transaction and the FV of the new asset acquired

2.

Prepare journal entries to record each of the two transactions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College