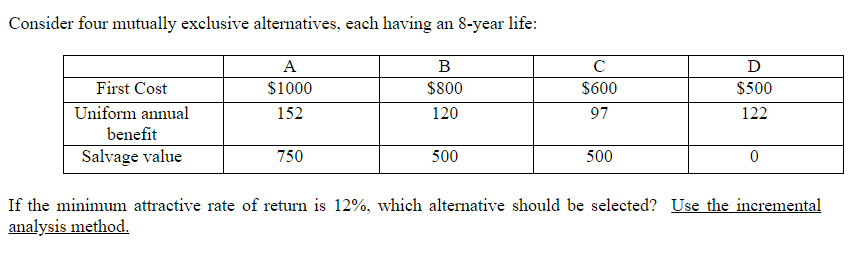

Consider four mutually exclusive alternatives, each having an 8-year life: А B C D First Cost $1000 $800 $600 $500 Uniform annual 152 120 97 122 benefit Salvage value 750 500 500 If the minimum attractive rate of return is 12%, which alternative should be selected? Use the incremental analysis method.

Q: You have identified 4 possible ways of meeting demand for your products. Option Fixed Cost…

A: Total cost = Total Fixed cost + (Total variable cost * number of units produced) Total cost means…

Q: 7. At price OG, the area of which rectangle represents total revenue for the profit-maximizing per-…

A: Firms in perfect competition are price-takers as they sell their output at the prevailing market…

Q: May Clothing is a retail men’s clothing store. May’s variable cost is $20 per shirt and the sales…

A: Formula:

Q: Costco can purchase a bag of Starbucks coffee for $20.00 less discounts of 20%, 15%, and 7%. It then…

A: 1.

Q: You work for the CEO of a new company that plans to manufacture and sell a new product, a watch that…

A: The ROE is the return earned on investments in the equity component. It pertains to equity…

Q: Given that: Sales = $300,000,000 Transportation cost = $15,000,000 Warehousing cost = $4,000,000…

A: Inventory carrying charge = 30% of average inventory = 30/100 x $15,000,000 = $4,500,000 Hence,…

Q: Margo borrows $1900, agreeing to pay it back with 2% annual interest after 16 months. How much…

A: Simple interest = Prt Here P= $1900 r= 2%= 0.02 t=16 months = 1year 6 month= 1 year 6 month/12…

Q: Jeremy Costa, owner of Costa Cabinets Inc., is preparing a bid on a job that requires $2,610 of…

A: Please go to next step for answer

Q: When product demand fluctuates and yet you maintain aconstant level of employment, some of your cost…

A: All the below mentioned elements are to be evaluated whereas deciding the labor planning policies.…

Q: 4. Suppose now that the proposal before the City Council contemplates imposing a price ceiling on…

A: This is because if there are price ceilings on the apartments, this may bring down the value or rent…

Q: In a situation where Mr. Hamza, who is a "buyer" of MADINS Company product, is only concerned with…

A: A partnership is a solitary business where at least two individuals share possession. Each partner…

Q: If the unit selling price is P16, the unit variable cost is P12, and fixed costs are P160,000, what…

A: The question is related to Cost Volume Profit Analysis.Breakeven sales is that level of sales at…

Q: It might be sensible for a company to benchmark each of its sales reps against: O its other sales…

A: Question 1 Benchmarking the company by estimating it against contenders is a significant way for any…

Q: Lauren, a florist, buys and sells flowers at her store. She purchases roses at $2.25 each, has…

A: Given - Purchasing Cost = $2.25 Operating expenses =26 % of Cost = 26100× 2.25= $0.585 Profit = 55%…

Q: With an overall cost of goods totaling $64,000 and sales of $181,000, what is the food cost…

A: Food cost percentage is a proportionate measurement between total inventory cost and total sales.…

Q: Elkins, a manufacturer of ice makers, realizes a cost of $250 for every unit it produces. Its total…

A: The variable cost refers to the cost which is not constant or same for a manufacturer. The variable…

Q: Assuming A&F’s gross profit margin is 60 percent and cost of goods sold represents the only…

A: Assuming A&F’s gross profit margin is 60 percent and cost of goods sold represents the only…

Q: Dr.Immanuel Johnson started his carreer as a private medical practitioner during later part of 1996.…

A: A company's stability strategy is a corporate strategy that focuses on retaining its current market…

Q: Perform a break-even analysis for the following scenario. Assume you sell widgets. You have total…

A: Formula for break-even point is given by,

Q: 1. For each of the following cost-output relationships, describe the shape (U-shape, decreasing,…

A: Marginal valueIn economic science, marginal value is that the modification within the total cost…

Q: If total available metal decreases by 1500 oz, the profit will be Unknown 6500 8000 9500

A: Objective Functions: Based on the given details, the Profit is Objective Function:…

Q: s the cost method of valuation always reliable? What can be done to make the aluations estimated…

A: Yes,The cost approach thinks about the expense of land, in addition to expenses of development, less…

Q: If Exxon uses FIFO for its inventory valuation, calculate the cost of ending inventory and cost of…

A: Inventory is the stock, items, and raw material that the company stores in the warehouse to use in…

Q: What is a stock out? a. When stocks run out b. When stocks are left out. c. When stocks go up in…

A: The answer is as follows:

Q: Your local BMW dealership is offering the following financing options on a new 3-Series. Option A…

A: In car loans, the principal is the amount that an individual customer borrows and must repay. The…

Q: If a stock's expected rate of return is less than the return the capital asset pricing model…

A: Answer:-false

Q: supports Frank's cafe is small and cant influence market price. If price is P=4 use the forumula for…

A: If P=4, in a competitive market, MC must be 4 at a profit maximizing level. So, Q/10000=4 or,…

Q: Many Firms offer a “Buy 4, Get 1 Free” card to encourage customer loyalty What is the price…

A: 1) Price segment concept that support such an offers - Price segment process is generally means when…

Q: i. Showing all the working clearly, prepare the payoff table if the states of demand are high (S.),…

A: THE ANSWER IS AS BELOW:

Q: Mary hopes to sell 10,000 pieces of chrysanthemum last November but she was able to sell 15,000…

A: As per the details in the question we have the following

Q: Relevant Cost Exercises Each of the following situations is independent:a. Make or Buy Terry Inc.…

A: Total cost to produce in-house =( +$28+$18+$16)/unit *2000 units =$124,000 Total costs to purchase…

Q: A company is expected to result 50$ savings first year then increase 50$ annually, if the rate of…

A:

Q: Illustration 6.3 The Bogleheads and Vanguard Asset Management Vanguard's culture of low-cost…

A: 1. The Vanguard's corporate culture maps with the social web components of worldview, stories,…

Q: Two competitors have the cost structure shown below. Which of the following statements are true…

A: Find the given details below: Given Details Firm A Firm B Product 1 Units 500 200…

Q: Trader Joe's Pestel analysis?

A: Pestel analysis helps to examine the various external factors that affects the business. Political…

Q: This game has two players: the employee (Homer) and the employer (Mr. Burns). Homer has to decide…

A: A payoff matrix is described as a visible symbol of all the desirable consequences that can happen…

Q: True or false 1. Interest Rate Parity allows a company to lock in profits by borrowing in the low…

A: 1- Interest Rate Parity allows a company to lock in profits by borrowing in the low interest rate…

Q: What is the rate if the base is 322 and the portion is 50 ?

A: We have, Base, B = 322 Portion, P = 50 To find, Rate R

Q: * 00 A toy manufacturer has three different mechanisms that can be installed in a doll that it…

A: The detailed solution is given in Step 2.

Q: You want to establish your own business and are thinking about releasing a new product. Customers…

A:

Q: Demand Probability 65 0.10 Stock 70 0.30 65 osts the bookstore $82 and sells for $112. Any unsold…

A: Sales Price = 112 Cost Price = 82 Profit = Sales Price - Cost Price = 112-82 = 30 Refund of…

Q: Read the case below and answer the questions that follow. You are shopping for a new printer…

A: Value shows the relationship between the cost of the product or service and value derived from using…

Q: Suppose mr. raahim want to start a business in his local community. Now Briefly explain mr.…

A: Minimal viable product focus on avoiding unnecessary and lengthy work. It have enough features to…

Q: The following is given: Price $7.00/unit Variable cost $5.00/unit Fixed cost $50,000 a) Based on the…

A: The break-even point is the point where total costs and total revenues are equal, with no benefit or…

Solve this now but correctly.

Not explain in excel work.

Typed or handwriting only.

Step by step

Solved in 3 steps with 1 images

- A new edition of a very popular textbook will be published a year from now. The publisher currently has 1000 copies on hand and is deciding whether to do another printing before the new edition comes out. The publisher estimates that demand for the book during the next year is governed by the probability distribution in the file P10_31.xlsx. A production run incurs a fixed cost of 15,000 plus a variable cost of 20 per book printed. Books are sold for 190 per book. Any demand that cannot be met incurs a penalty cost of 30 per book, due to loss of goodwill. Up to 1000 of any leftover books can be sold to Barnes and Noble for 45 per book. The publisher is interested in maximizing expected profit. The following print-run sizes are under consideration: 0 (no production run) to 16,000 in increments of 2000. What decision would you recommend? Use simulation with 1000 replications. For your optimal decision, the publisher can be 90% certain that the actual profit associated with remaining sales of the current edition will be between what two values?Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.Play Things is developing a new Lady Gaga doll. The company has made the following assumptions: The doll will sell for a random number of years from 1 to 10. Each of these 10 possibilities is equally likely. At the beginning of year 1, the potential market for the doll is two million. The potential market grows by an average of 4% per year. The company is 95% sure that the growth in the potential market during any year will be between 2.5% and 5.5%. It uses a normal distribution to model this. The company believes its share of the potential market during year 1 will be at worst 30%, most likely 50%, and at best 60%. It uses a triangular distribution to model this. The variable cost of producing a doll during year 1 has a triangular distribution with parameters 15, 17, and 20. The current selling price is 45. Each year, the variable cost of producing the doll will increase by an amount that is triangularly distributed with parameters 2.5%, 3%, and 3.5%. You can assume that once this change is generated, it will be the same for each year. You can also assume that the company will change its selling price by the same percentage each year. The fixed cost of developing the doll (which is incurred right away, at time 0) has a triangular distribution with parameters 5 million, 7.5 million, and 12 million. Right now there is one competitor in the market. During each year that begins with four or fewer competitors, there is a 25% chance that a new competitor will enter the market. Year t sales (for t 1) are determined as follows. Suppose that at the end of year t 1, n competitors are present (including Play Things). Then during year t, a fraction 0.9 0.1n of the company's loyal customers (last year's purchasers) will buy a doll from Play Things this year, and a fraction 0.2 0.04n of customers currently in the market ho did not purchase a doll last year will purchase a doll from Play Things this year. Adding these two provides the mean sales for this year. Then the actual sales this year is normally distributed with this mean and standard deviation equal to 7.5% of the mean. a. Use @RISK to estimate the expected NPV of this project. b. Use the percentiles in @ RISKs output to find an interval such that you are 95% certain that the companys actual NPV will be within this interval.

- You now have 10,000, all of which is invested in a sports team. Each year there is a 60% chance that the value of the team will increase by 60% and a 40% chance that the value of the team will decrease by 60%. Estimate the mean and median value of your investment after 50 years. Explain the large difference between the estimated mean and median.A common decision is whether a company should buy equipment and produce a product in house or outsource production to another company. If sales volume is high enough, then by producing in house, the savings on unit costs will cover the fixed cost of the equipment. Suppose a company must make such a decision for a four-year time horizon, given the following data. Use simulation to estimate the probability that producing in house is better than outsourcing. If the company outsources production, it will have to purchase the product from the manufacturer for 25 per unit. This unit cost will remain constant for the next four years. The company will sell the product for 42 per unit. This price will remain constant for the next four years. If the company produces the product in house, it must buy a 500,000 machine that is depreciated on a straight-line basis over four years, and its cost of production will be 9 per unit. This unit cost will remain constant for the next four years. The demand in year 1 has a worst case of 10,000 units, a most likely case of 14,000 units, and a best case of 16,000 units. The average annual growth in demand for years 2-4 has a worst case of 7%, a most likely case of 15%, and a best case of 20%. Whatever this annual growth is, it will be the same in each of the years. The tax rate is 35%. Cash flows are discounted at 8% per year.Suppose that a sales force has found 20 qualified buyers and has begun the salesprocess. The sales manager estimates that 10% eventually proceeds to make a purchase.Assume that a professional company offers three services, priced at $2,000, $7,000 and$20,000, respectively. Based on past results or the sales manager’s estimates, you projectthat 60% of first-time buyers will choose the cheapest option, 30% will choose the middleoption and 10% will choose the most expensive option. a. Calculate the size of a likely sale for any prospect that makes a purchase.

- Suppose that you want to invest $10,000 in the stock market by buying shares in one of two companies: A and B. Shares in company A though risky, could yield a 50% return on investment during the next year. If the stock market if conditions are not favorable (bear market) the stock may lose 20% of it value. Company B provides safe investments with 15% return in a bull market and only 5% in a bear market Ali the applications you have consulted are predicting a 60% chance for a bull market and 40% for a bear market. Where you invest your money? Construct a decision tree.I need a detailed explanation on how to solve this problem: A bagel shop buys each bagel for $0.08 and sells each bagel for $0.35. Leftover bagels at the end of the day are purchased by a local soup kitchen for $0.03 per bagel. The shop’s owner has observed for the daily demand, Q, the following probabilities, f(Q): Q 0 5 10 15 20 25 30 35 f(Q) 0.05 0.10 0.10 0.20 0.25 0.15 0.10 0.05 - What is the optimal daily order in multiples of 5 (include the model name and formula)? - If the daily demand is normally distributed (the mean and variance can be obtained from the table above), then what is the optimal daily order?A store owner must decide whether to build a small or a large facility at a new location. Demand at a location can be either small or large, which probabilities estimated to be 0.4 and 0.6, respectively. If small facility is built and demand proves to be high, the manager may choose not to expand (payoff=P235,000) or to expand (payoff=P275,000). If a small facility is built and demand is low, there is no reason to expand and the payoff is P220,000. If a large facility is built and demand proves to be low, the choice is to do nothing (P60,000) or to stimulate demand through local advertising. The response to advertising may be either modest or sizable, with their probabilities estimated to be 0.3 and 0.7, respectively. If it is modest, the payoff grows to P230,000 if the response is sizable. Finally, if a large facility is built and demand turns out to be high, the payoff is P900,000.a.) Draw a decision tree.b.) Determine the expected payoff for each decision and event node.c.)…

- Geoff Gullo owns a small firm that manufactures “Gullo Sunglasses.” He has the opportunity to sell a particular seasonal model to Land’s Start, a catalog retailer. Geoff offersLand’s Start two purchasing options.• Option 1: Geoff offers to set his price at $65 and agrees to credit Land’s Start $53 foreach unit Land’s Start returns to Geoff at the end of the season (because those unitsdid not sell). Because styles change each year, there is essentially no value in thereturned merchandise.• Option 2: Geoff offers a price of $55 for each unit, but returns are no longer accepted.In this case, Land’s Start throws out unsold units at the end of the season.This season’s demand for this model will be normally distributed with a mean of 200and a standard deviation of 125. Land’s Start will sell those sunglasses for $100 each.Geoff’s unit production cost is $25.a. How much would Land’s Start buy if it chose option 1? b. How much would Land’s Start buy if it chose option 2? c. Which option will…Cachora Dynamics Corp (CDC) has designed a new integrated circuit that will allow it to enter, if it wishes, the microcomputer field. Otherwise, it can sell its rights for $15 million. If it chooses to build computers, the profitability of this project depends on the company's ability to market them during the first year. Two levels of sales are foreseen as two possible outcomes: selling 10,000 computers in case of low demand, but if it is successful it can sell up to 100,000 units (high demand). The cost of installing the production line is $6 million. The difference between the selling price and the variable cost of each computer is $600. a) Develop a formulation for decision analysis and use the non-probabilistic decision rules: Maximin and Minimax. b) Assume that the probability of high demand (p) is 50% and for low demand (1 - p) is 50%, apply the probabilistic criteria: Maximum expected value, Minimum loss of opportunity. c) Determine the VEIP. d) Carry out a sensitivity…The Gorman Manufacturing Company must decide whether to manufacture a component part at its Milan, Michigan, plant or purchase the component part from a supplier. The resulting profit is dependent upon the demand for the product. The following payoff table shows the projected profit (in thousands of dollars): state of nature low demand medium demnad high demand Decision alternative s1 s2 s3 manufacture d1 -20 40 100 purchase d2 10 45 70 The state-of-nature probabilities are P(s1) = 0.35, P(s2) = 0.35, and P(s3) = 0.30. a. A test market study of the potential demand for the product is expected to report either a favourable (F) or unfavourable (U) condition. The relevant conditional probabilities are as follows: P(F|S1)=0.10 P (U|S1)=0.90 P(F|S2)=0.40 P (U|S2)=0.60 P(F|S3)=0.60 P (U|S3)=0.40 Decision tree leading to market study/ prediction of favorable…