Consider Higgins Production which has the following information about its capital stru bt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.8 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently se $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. quired: Calculate the following if the company has a tax rate of 36 percent. Total Market Value for the Firm After-tax cost of Debt

Consider Higgins Production which has the following information about its capital stru bt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, percent of par, the bonds make semi-annual payments Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.8 Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently se $150 per share Market Information - 6 percent market risk premium and 4 percent risk-free rate. quired: Calculate the following if the company has a tax rate of 36 percent. Total Market Value for the Firm After-tax cost of Debt

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 15PROB

Related questions

Question

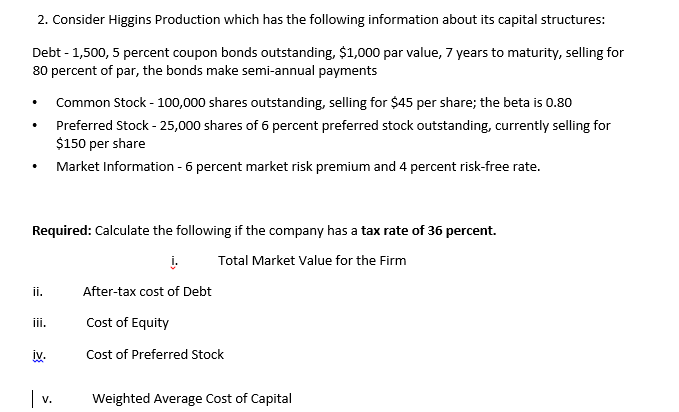

Transcribed Image Text:2. Consider Higgins Production which has the following information about its capital structures:

Debt - 1,500, 5 percent coupon bonds outstanding, $1,000 par value, 7 years to maturity, selling for

80 percent of par, the bonds make semi-annual payments

Common Stock - 100,000 shares outstanding, selling for $45 per share; the beta is 0.80

Preferred Stock - 25,000 shares of 6 percent preferred stock outstanding, currently selling for

$150 per share

Market Information - 6 percent market risk premium and 4 percent risk-free rate.

Required: Calculate the following if the company has a tax rate of 36|

ent.

į.

Total Market Value for the Firm

ii.

After-tax cost of Debt

ii.

Cost of Equity

iv.

Cost of Preferred Stock

|v.

Weighted Average Cost of Capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning