Consider that you are evaluting the following projects to undertake as per your capital budgeting activity You have capital budget constarin of 10,000. Project #3 and Project#4 are mutually exclusive. You have extimated your WACC as 12%.

Q: CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y. Each project costs $10,000, and…

A: Hi, since there are multiple questions posted, we will answer first three questions. If you want any…

Q: 3,500 Calculate each project’s payback period, net present value (NPV), internal rate of…

A: The director of capital budgeting has asked you to analyze two proposed capital investments,…

Q: Senior management asks you to recommend a decision on which project(s) to accept based on the cash…

A: Calculation of payback period for three projects: Excel workings:

Q: Your division is considering two investment projects, each of which requires an up-front expenditure…

A: Under capital budgeting process, the company will be checking on projects through certain condition…

Q: What is Optimal Capital Budget and Capital Rationing? Explain briefly Calculate Optimal Capital…

A: Optimal Capital Budget The optimal capital budget refers to the investment contributing to the…

Q: Calculate the Payback Period of each project. Which project should you accept according to this…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: An investment center in Shellforth Corporation was asked to identify three proposals for its capital…

A: Given:

Q: You are a financial analyst for the H Company. The director of capital budgeting has asked you to…

A: Given information: Two projects with a cash flow stream over 4 years of life at a discount rate of…

Q: XYZ, Inc. is evaluating several capital budgeting projects which are summarized in the table below.…

A: Mutually exclusive means company can select only one project form the given options. Selection of…

Q: You have been asked by MPAC Ltd to analyse two projects, Xand Y. Each project costs £1,000,000, and…

A: We will analyze these projects by calculating Net Present Value of each of the projects. Calculation…

Q: The following data table shows the estimated cash flows for two mutually exclusive capital budgeting…

A: IRR is the rate at which NPV is zero

Q: Suppose that you are working as a capital budgeting analyst in a finance department of a firm and…

A: Given information: Discount rate is 11%,

Q: Calculate the net present value (NPV) for each project in excel. Which projects would you accept…

A: NPV is an abbreviation for Net Present Value. For example, NPV helps us to know the present value of…

Q: Your firm's CFO presents you with two capital budgeting proposals: one that involves buying a new…

A: The project should be accepted if the NPV is positive. The project should be rejected if the NPV is…

Q: XYZ Industries is considering two capital budgeting projects. Project A requires an initial…

A: Payback period: Payback period is the time in which an investment reaches its break-even point or…

Q: An investment center in Shellforth Corporation was asked to identify three proposals for its capital…

A: ROI is the return on investment that checks the entity's efficiency in generating returns from an…

Q: Winant Inc. is comparing several alternative capital budgeting projects as shown below:…

A: Profitability index = present value of future cash inflows/Initial investment A project with lower…

Q: The capital budgeting of aspaltow corporation is evaluating a project that costs P200,000, is…

A: Internal rate of the return at which the present value of cash inflows is equal to the present value…

Q: A firm with a 14% WACC is evaluating two projects forthis year’s capital budget. After-tax cash…

A: “Hey, since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Conventional Corporation is evaluating a capital budgeting project that will generate $600,000 per…

A: Computation:

Q: You are a financial analyst for the Brittle Company. The director of capital budgeting has asked you…

A: Given, The initial investment is $10,000 The cost of capital is 12%

Q: An investment center in Shellforth Corporation was asked to identify three proposals for its capital…

A: Formulas: Residual income = Net operating income - (Minimum required return * Cost of the asset) ROI…

Q: Kansas furniture Corporation (KFC) is evaluating a capital budgeting project that costs $34,000 and…

A: Given information: Project costs $34,000 After tax cash flow $14,150 for 3 years Rate of return is…

Q: The financial analyst at Carlo Products is evaluating two new capital budgeting proposals. Below is…

A: Payback Period: The payback period is the amount of time it will take for you to recoup the cost of…

Q: Project Cost (millions) NPV(millions) A 3.25 0.80 В 1.75 0.52 C 4.5 0.69 D 3.75 0.95 E 1.25 0.25 F…

A: With the given data, we first need to determine NPV to cost ratio. Then rank the projects based on…

Q: Stargate Corporation is considering two projects of machinery that perform the same task. The…

A: Net present value is the difference between Present Value of cash Inflows and Initial Investment.…

Q: Your company wants to determine the feasibility of two capital budgeting projects, and has given you…

A: Ans a] Pay back period of each project : Year Project A$ Project B$ 0…

Q: Jill Harrington, a manager at Jennings Company, is considering several potential capital investment…

A: Pay Back Period - It refers to the amount of time taken for recover of the cost of an investment. It…

Q: enior management asks you to recommend a decision on which project(s) to accept based on the cash…

A: Capital budgeting is the technique used to analysis whether to invest in a long term capital project…

Q: Suppose that you are working as a capital budgeting analyst in a finance department of a firm and…

A: Payback period: Number of years required to collect the initial investment. Payback period ignores…

Q: The net present value of a project with an initial outflow of $1,100,000 and annual cash income of…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: You are a financial analyst for the Waffle Company. The director of capital budgeting has asked you…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Siegel Industries is considering two capital budgeting projects. Project A requires an initial…

A: The cash payback period is calculated as initial investment divided by annual cash flows.

Q: You are a financial analyst for the Hittle Company. The director of capital budgeting has asked you…

A: Payback period is the number of years it would take for the company to recovers its cost. It is…

Q: Your division is considering two investment projects, each of which requires an up-front expenditure…

A: The regular payback period is the period at which the project is able to recover the expenditure or…

Q: Project A End of Year -$42,000 $14,000 $14,000 $14,000 $14,000 $14,000 IRRI 42,000 IRR - 19.9%…

A: Capital budgeting is the process by which a corporation examines potential large projects or…

Q: CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y. Each project costs $10,000, and…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: YOUR Directions: Evaluate the following projects. Which is the best among them using the different…

A: Calculation of Annual Rate of Return(ARR) Calculation of Average net income Project A Project B…

Q: You are a financial analyst for the Waffle Company. The director of capital budgeting has asked you…

A: Net present value: NPV: It is the difference in the cash inflows and outflows discounted at the…

Q: Suppose that you are working as a capital budgeting analyst in a finance department of a firm and…

A: (1) Computation of payback period of both the project is as follows: Project 1:

Q: Wandering RV is evaluating a capital budgeting project that is expected to generat $36,950 per year…

A: Computation:

Q: Five engineering projects are being considered for the upcoming capital budget period. The…

A: Capital budgeting is the process that helps determine which proposed purchases of a fixed asset will…

Q: CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y. Each project costs $10,000, and…

A: NPV is the sum of present value of cash flows in the project WACC= 12% Year Cash Flows - Project…

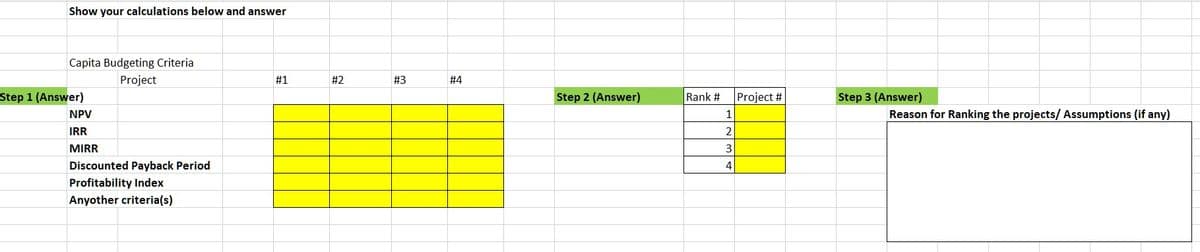

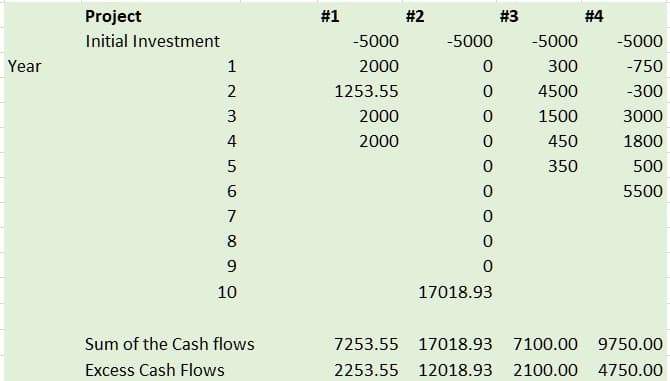

Consider that you are evaluting the following projects to undertake as per your capital budgeting activity You have capital budget constarin of 10,000. Project #3 and Project#4 are mutually exclusive. You have extimated your WACC as 12%.

Step by step

Solved in 5 steps with 3 images

- Particulars 31st Mar' 19 Amt (Rs) 31st Mar' 20 Amt (Rs) Land and Building 3600000 3600000 Cash 400000 320,000 Sundry Debtors 640000 800,000 Temporary Investments 400000 640,000 Stock 3680000 4320000 Prepaid Expenses 560000 24000 Plant and Machinery 1920000 3096000 Total Assets 11200000 12800000 Current Liabilities 1280000 1600000 Loans 3200000 3200000 Capital 4000000 4000000 Retained Earnings 936000 1624000 Statement of Profit for the Current Year 1st Apr to 31st Mar' 20 : Amt (Rs) Sales 8000000 Less: Cost of Goods Sold -5600000 Less: Interest -320000 Net Profit 2080000 Less: Taxes @ 50% -1040000 Profit after Tax 1040000 Profit Distributed 440000 Calculate Current Ratio Debtors Turnover Ratio Stock Turnover Ratio Return on Total AssetsCh 5. The following project has cash flows as follows: Year Project A 0 -$705,000 1 $225,000 2 $421,500 3 $275,000 What is the IRR? Round to one place past the decimal point and format as "XX.X"A4 9b A4 9a We find the following information on NPNG (No-Pain-No-Gain) Inc.: EBIT = $2,000,000Depreciation = $250,000Change in net working capital = $100,000Net capital spending = $300,000 These numbers are projected to increase at the following supernormal rates for the next three years, and 5% after the third year for the foreseeable future: EBIT: 20%Depreciation: 10%Change in net working capital: 15%Net capital spending: 10% The firm’s tax rate is 35%, and it has 1,000,000 outstanding shares and $8,000,000 in debt. We have estimated the WACC to be 15%. b. Calculate the CFA* for each of the next four years, using the formula CFA* = EBIT(1 – T) + Depr – ΔNWC – NCS.

- Breakdown 3/30/2022 3/30/2021 3/30/2020 Operating Cash Flow 90,480,000.00 91,630,000.00 76,230,000.00 Investing Cash Flow (17,280,000.00) (15,280,000.00) 17,910,000.00 Financing Cash Flow (80,150,000.00) (93,090,000.00) (68,190,000.00) End Cash Position 11,470,000.00 18,420,000.00 32,160,000.00 Changes in Cash (6,950,000.00) (16,740,000.00) 25,950,000.00 Beginning Cash Position 18,420,000.00 32,160,000.00 6,210,000.00 Other Cash Adjustment Outside Change in Cash - 3,000,000.00 - Capital Expenditure (12,280,000.00) (41,630,000.00) (8,620,000.00) Issuance of Capital Stock - - - Issuance of Debt - 1,880,000.00 - Repayment of Debt - (1,880,000.00) - Free Cash Flow 78,200,000.00 50,000,000.00 67,610,000.00 Can you make this indirect method of cash flow into a direct method of cash flow? Please donot provide solution in image format and it should be in step by step format and asapQuestion 2 Sunshine Corporation is reviewing an investment proposal. The initial cost of the investment isR52 500. The estimated cash flows and net profit for each year are presented in the schedulebelow. All cash flows are assumed to take place at the end of the year. year Net cash flows Net profit R20 000 R2 500 R17 500 R3 500 R15 000 R4 500 R12 500 R5 500 R10 000 R6 500 The cost of capital is 12%. Required:Calculate the following:1. Payback Period 2. Net Present value 3. Accounting rate of returnYear Cashflow Rat2 @ 12% 0 -15600 1 6800 2 8000 3 7600 4 6400 5 -3800 ========================= what is the discounting Approach? What is the reinvesting Approach? What is the Combination Approach? Please as detailed as possible with calculations

- QUESTION 4 (20 MARKS)REQUIREDUse the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December 2021.INFORMATIONThe following Information was extracted from the records of Nascar Limited for the past two years:STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER:2021 (R) 2020 (R)Sales 18 560 000 12 000 000Cost of sales (12 800 000) (7 500 000)Gross profit 5 760 000 4 500 000Operating expenses (2 912 000) (2 120 000) Depreciation 300 000 260 000 Other operating expenses 2 612 000 1 860 000Operating profit 2 848 000 2 380 000Interest on mortgage loan (240 000) (720 000)Profit before tax 2 608 000 1 660 000Company tax (782 400) (498 000)Profit after tax 1 825 600 1 162 000STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER:2021 (R) 2020 (R)ASSETSNon-current assets 24 641 600 24 440 000 Fixed assets 24 641 600 24 440 000Current assets 3 560 000 3 360 000 Inventories (all Trading inventory) 1 200 000 2 500 000 Accounts receivable…FNCE 623 – Financial Management Individual assignment Belgravia Petroleum Inc. is trying to evaluate a generation project with the following cash flows: Year Cashflow 0 -$300,000,000 1 $63,000,000 2 $85,000,000 3 -$50,000,000 4 $145,000,000 5 $175,000,000 6 -$50,000,000 7 $70,000,000 8 $72,000,000 Construct a spreadsheet and calculate the following (the required rate of return is 12%): Payback period Discounted payback period Modified IRR The discounting approach The reinvestment approach The combination approach Net present value (NPV) Based on your analysis, should the company take the project? Why? IMPORTANT: Use MS Excel functions (PV, FV, NPV, and IRR) in your spreads please show answer the answer on Excel and full description on Excel sheetThe project's NPV? WACC: 10.00% Year 0 1 2 3 Cash flows -$1,000 $450 $460 $470

- CF 1 2 3 4 5 W 100 200 200 300 300 X 600 - - - - y - - - - 1200 Z 200 - 500 - 300 Calculate the future value of each cash flow stream assuming a compound annual interest rate of 10%. Also calculate present value of each cash flow stream assuming a compound annual interest rate of 14%.Find 1. Payback 2. Discounted payback. Compare the two methods. WACC: 9.00% Year 0 1 2 3 4 5 6 Cash flows −$1,200 350.00 480.00 (10.00) 830.00 (20.00) 1,200.00Question content area top Part 1 (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year A B C 1 $ 20,000 $ 20,000 2 20,000 3 20,000 4 20,000 5 20,000 $ 20,000 6 20,000 100,000 7 20,000 8 20,000 9 20,000 10 20,000 20,000 (Click on the icon in order to copy its contents into a spreadsheet.) Assuming an annual discount rate of 23 percent, find the present value of each investment. Question content area bottom Part 1 a. What is the present value of investment A at an annual discount rate of 23…