Consider the Firm XYZ, with the following information, AND show all work to solve the subsequent parts: • Marginal corporate tax rate of XYZ is 34% • The company wants to maintain its current capital structure, which is 40% equity, 20% preferred stock, and 40% debt. • Firm XYZ has a beta of 0.8, the yield on Treasury bonds is 1.3%, and the expected return on the market portfolio is 6%. The current stock price is $44.37, and the firm has just paid an annual dividend of $1.28, which is expected to grow by 4% per year. New equity would come from retained earnings, which would eliminate flotation costs. The firm's preferred stock pays an annual dividend of $4.10 in perpetuity, and each share is currently priced at $135.26. New stock would be issued by private placement with no flotation costs. The firm has one bond issuance outstanding, with a coupon rate of 6%, paid semiannually, with 10 years to maturity, and $864.10 as the current price. New bonds would be issued by private placement with no flotation costs. a) What is the formula for WACC? b) What is the cost of debt for the firm?

Consider the Firm XYZ, with the following information, AND show all work to solve the subsequent parts: • Marginal corporate tax rate of XYZ is 34% • The company wants to maintain its current capital structure, which is 40% equity, 20% preferred stock, and 40% debt. • Firm XYZ has a beta of 0.8, the yield on Treasury bonds is 1.3%, and the expected return on the market portfolio is 6%. The current stock price is $44.37, and the firm has just paid an annual dividend of $1.28, which is expected to grow by 4% per year. New equity would come from retained earnings, which would eliminate flotation costs. The firm's preferred stock pays an annual dividend of $4.10 in perpetuity, and each share is currently priced at $135.26. New stock would be issued by private placement with no flotation costs. The firm has one bond issuance outstanding, with a coupon rate of 6%, paid semiannually, with 10 years to maturity, and $864.10 as the current price. New bonds would be issued by private placement with no flotation costs. a) What is the formula for WACC? b) What is the cost of debt for the firm?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3P

Related questions

Question

Thank you

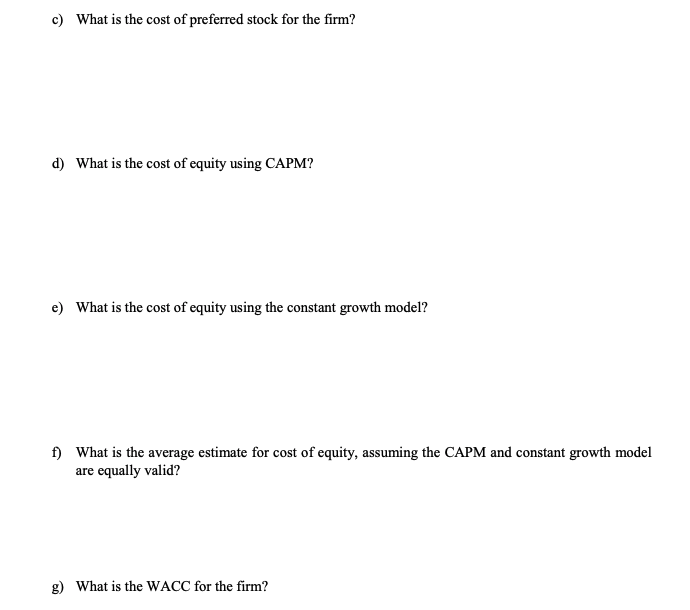

Transcribed Image Text:c) What is the cost of preferred stock for the firm?

d) What is the cost of equity using CAPM?

e) What is the cost of equity using the constant growth model?

f) What is the average estimate for cost of equity, assuming the CAPM and constant growth model

are equally valid?

g) What is the WACC for the firm?

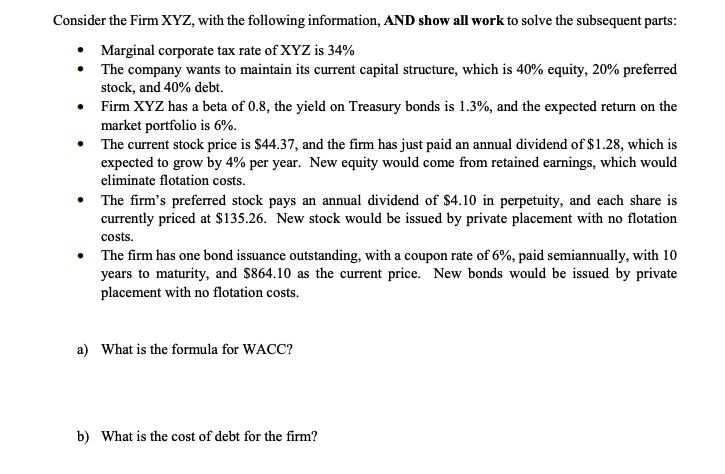

Transcribed Image Text:Consider the Firm XYZ, with the following information, AND show all work to solve the subsequent parts:

• Marginal corporate tax rate of XYZ is 34%

• The company wants to maintain its current capital structure, which is 40% equity, 20% preferred

stock, and 40% debt.

• Firm XYZ has a beta of 0.8, the yield on Treasury bonds is 1.3%, and the expected return on the

market portfolio is 6%.

The current stock price is $44.37, and the firm has just paid an annual dividend of $1.28, which is

expected to grow by 4% per year. New equity would come from retained earnings, which would

eliminate flotation costs.

• The firm's preferred stock pays an annual dividend of $4.10 in perpetuity, and each share is

currently priced at $135.26. New stock would be issued by private placement with no flotation

costs.

• The firm has one bond issuance outstanding, with a coupon rate of 6%, paid semiannually, with 10

years to maturity, and $864.10 as the current price. New bonds would be issued by private

placement with no flotation costs.

a) What is the formula for WACC?

b) What is the cost of debt for the firm?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning