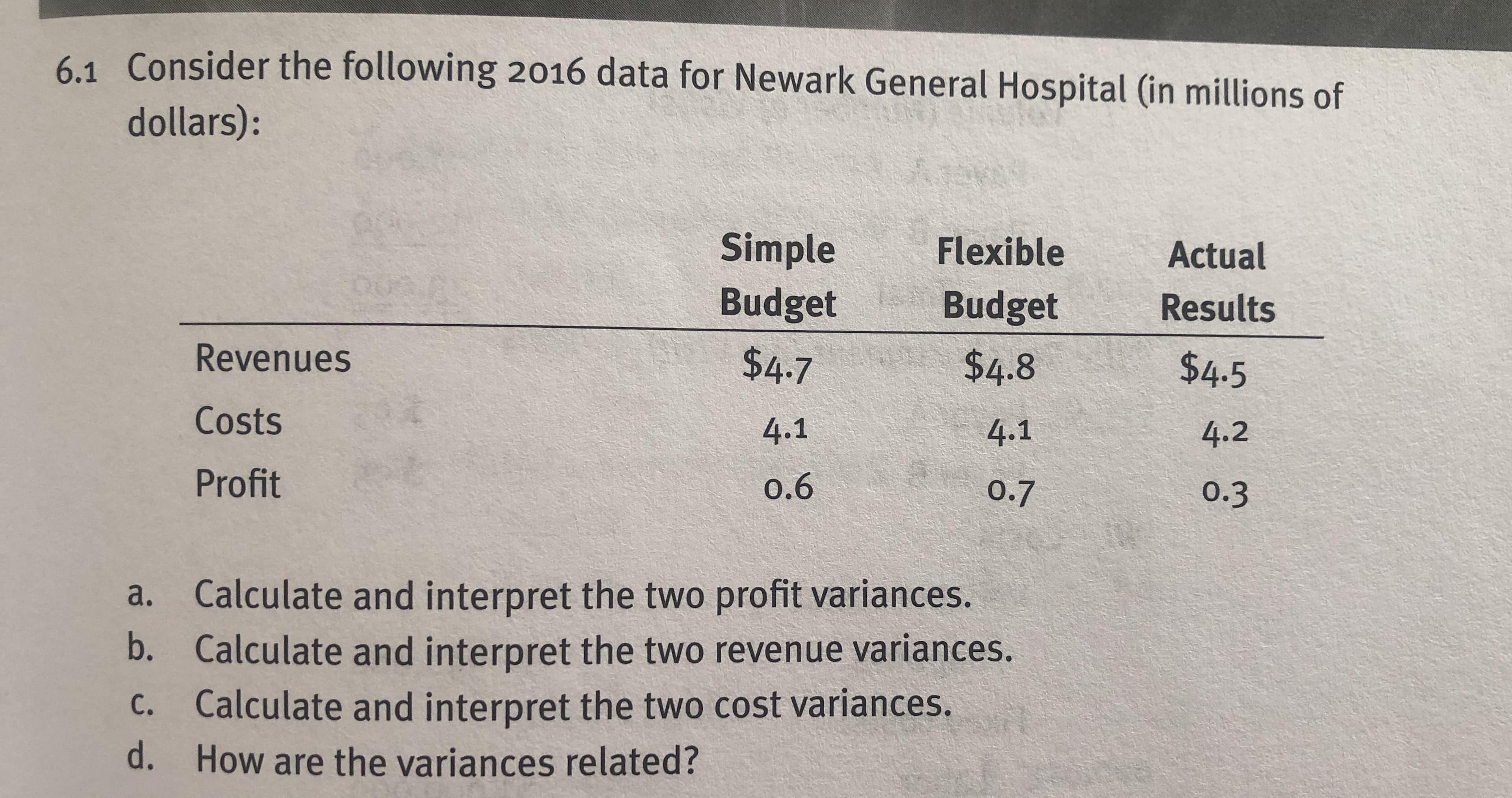

Consider the following 2016 data for Newark General Hospital (in millions of dollars): 6.1 Simple Flexible BudgetBudget Revenues Costs Profit $4.7 4.1 o.6 $4.8 4.1 0.7 Actual Results $4.5 4.2 0.3 a. b. c. d. Calculate and interpret the two profit variances. Calculate and interpret the two revenue variances. Calculate and interpret the two cost variances. How are the variances related?

Consider the following 2016 data for Newark General Hospital (in millions of dollars): 6.1 Simple Flexible BudgetBudget Revenues Costs Profit $4.7 4.1 o.6 $4.8 4.1 0.7 Actual Results $4.5 4.2 0.3 a. b. c. d. Calculate and interpret the two profit variances. Calculate and interpret the two revenue variances. Calculate and interpret the two cost variances. How are the variances related?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 22E

Related questions

Question

a-d. How do I calculate profit, revenue and cost variances and how are they related?

Transcribed Image Text:Consider the following 2016 data for Newark General Hospital (in millions of

dollars):

6.1

Simple Flexible

BudgetBudget

Revenues

Costs

Profit

$4.7

4.1

o.6

$4.8

4.1

0.7

Actual

Results

$4.5

4.2

0.3

a.

b.

c.

d.

Calculate and interpret the two profit variances.

Calculate and interpret the two revenue variances.

Calculate and interpret the two cost variances.

How are the variances related?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,