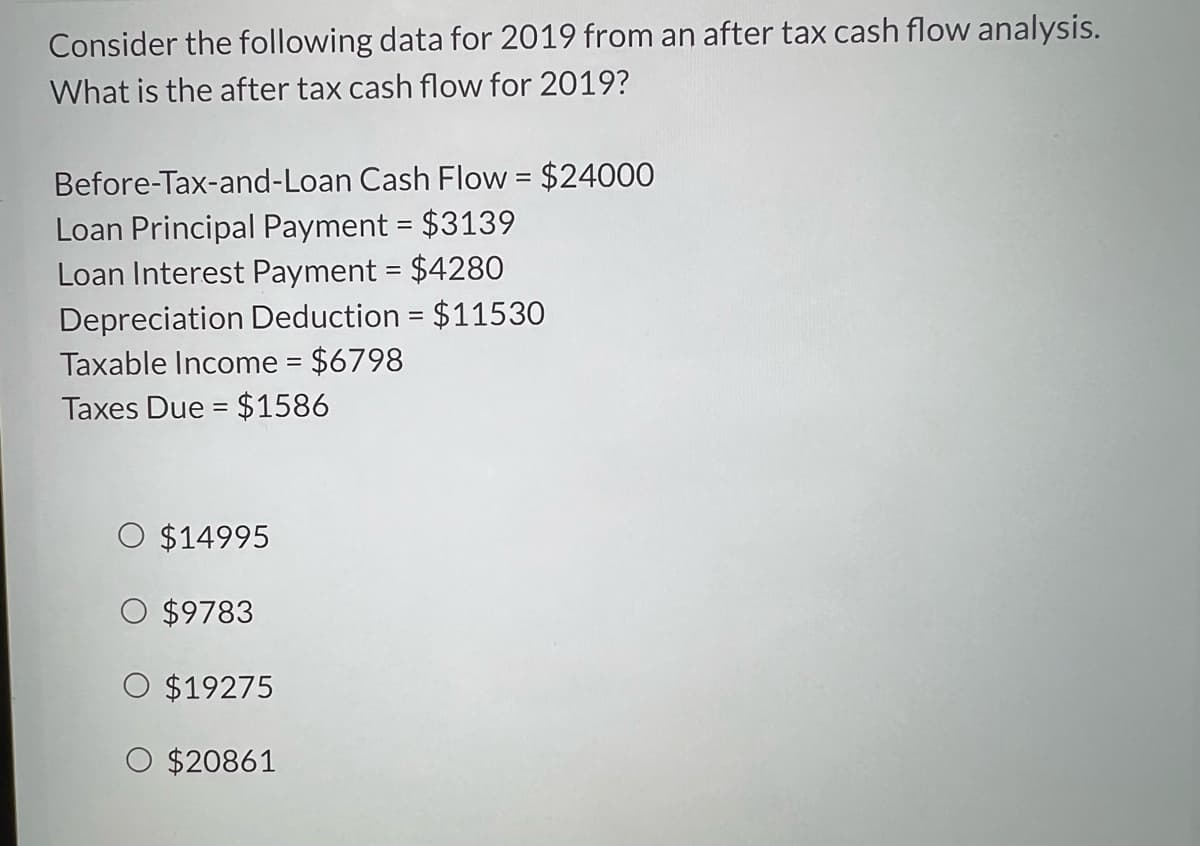

Consider the following data for 2019 from an after tax cash flow analysis. What is the after tax cash flow for 2019? Before-Tax-and-Loan Cash Flow = $24000 Loan Principal Payment = $3139 Loan Interest Payment = $4280 Depreciation Deduction = $11530 Taxable Income = $6798 Taxes Due = $1586 O $14995 O $9783 O $19275 O $20861

Q: Every year, management and labor renegotiate a new employment contract by sending their proposals to…

A: Nash equilibrium is the term for a strategy that is thought to be stable since it would not have a…

Q: Your bank has the following balance sheet: Assets Liabilites Reserves $50 million Checkable…

A: Reserves: Reserves are deposits that are not utilized by the bank in lending or investing…

Q: A bank branch experiences a 75% increase in output when increasing the number of loan officers from…

A: Profit maximization for a firm is at the level of output where marginal revenue equals marginal…

Q: Interior resources purchased land for 14,082,000 which their experts believe to contain 27.7 million…

A: One barrel of oil requires two tonnes of tar sands to be produced. Compared to traditional oil…

Q: Suppose that the monthly cost, in dollars, of producing x chairs is C(x)=0.005x³ +0.07x² + 19x +…

A: Marginal cost is the additional cost required in order to produce an additional unit of output.

Q: You are considering an apartment building project that requires an investment of $15, 000, 000. This…

A: Given information Initial investment=$15000000 The building has 30 units Maintenance cost per…

Q: How does a mutual fund lower transactions costs through economies of scale?

A: Mutual Funds The kind of investment in which the investors create a portfolio of stocks in the…

Q: The October 17, 2022 edition of The Wall Street Journal included an article titled “New England…

A: A method to define economic equilibrium in microeconomics is to simply look at the price at which…

Q: Assume that C(x) is in dollars and x is the number of units produced and sold. For the total-cost…

A: Marginal cost is the additional cost required in order to produce an additional unit of output.

Q: Perform these same calculations for 2021 and 2022, and enter the results in the following table.…

A: Price index measures the cost of market basket of goods and services

Q: You’ve been given a firm’s production and cost functions: p = 132 −2q MC = 12 + 4q (a) Assume this…

A: Equilibrium is where demand equals supply. In a competitive market, Equilibrium is where price…

Q: In each of the following cases, classify the person as cyclically unemployed, structurally…

A: The portion of overall unemployment that is specifically caused by cycles of economic expansion and…

Q: Consider a perfectly competitive firm in short run. If this firm faces a market equilibrium price…

A: A market is said to be perfectly competitive when the participants in the market are in large…

Q: thought that a consumer measures the utility, u(x, y), of possessing a quantity, z, of apples and a…

A: Utility is given as u=xαy1-α Budget Constraint is given as px+qy=M Applying Lagrange multiplier…

Q: Is UBI universal basic income a good idea to be implemented in Aghanistan?

A: A proposed government guarantee of a monthly payment to every citizen is known as universal basic…

Q: el is

A: Given real GDp = 20 trillion$ velocity = 4 quantity of money = 10 trillion $

Q: 4. Suppose you run the following regression log(Earnings) = ßo + B₁ Education + ß₂Experience +…

A: This is a multiple regression function with 0 expected value of the error term given the values of…

Q: The policy of average-inflation targeting will automatically make monetary policy expansionary…

A: Inflation targeting refers to a central banking policy that revolves around adjustment in the…

Q: Based on the criteria used by the Bureau of Labor Statistics (BLS), identify each person's status as…

A: Labor force includes people who are actively looking for the job and people who are working.

Q: Briefly discuss what consumer ( at least 2 sentences) and business ( at least 2 sentences)…

A: In an economy, both the consumer and producer play an important role as the consumer derives demand…

Q: A risk neutral insurer offers to insure an individual with a wealth of 25 dollars against a loss of…

A: Given information Initial wealth=25 Loss=21 For A-- Loss probability=0.33 and no loss=0.66 For B ---…

Q: According to the most recent survey conducted by Statistics Bureau of Metropolis, currently there…

A:

Q: Some MPs are more interested in education policies than in childcare programs. The MPs propose that…

A: Human capital refers to the investment in skills, education, and health care of the human being.…

Q: Two bidders compete in a sealed-bid auction for a single indivisible object. For each bidder , the…

A: Let the valuation of two bidders be : b1 & b2 Also the their valuations for the bid be : v1…

Q: You own a house worth $700,000 that is located on a river. If the river floods moderately, the house…

A: Estimated Cost: The estimated cost is the projected amount that may be arouse in completing a…

Q: Directions: Plot the following hypothetical market demand and supply schedules for commodity X in a…

A: Equilibrium quantity is when there is no lack or surplus of a product in the market. Supply and…

Q: The equation for a supply curve is P = 3Q - 8. What is the elasticity in moving from a price of 4…

A: Price elasticity of supply: It measures the percentage change in the quantity supplied for a 1%…

Q: A small business owner can invest any amount of effort e ≥ 0 to produce output valued at 2e. The…

A: Value of product = 2e Cost of production = e2 Government expropriates a fraction = 2e (1-t ) - e2 In…

Q: Which of the following indexes are best suited to adjusting medical spending for inflation for the…

A: Health economics is significant because it focuses on how stakeholders' and receivers' economic…

Q: The Office of the Auditor General is mandated to conduct audits of all public institutions in…

A: * SOLUTION :- Auditing means the concept of evaluating and checking all the desired transactions…

Q: 1) A monopolist firm produces and sells good X. The demand for X is X= 24-P, where P is the price.…

A: Introduction A monopolistic competition is a type of imperfect competition where many sellers try to…

Q: 2) Suppose that a furniture manufacturer is willing to supply x tablets at a P = S(x) = 2x²2 - 30x +…

A: Introduction The quantity of a commodity that a consumer is willing and able to buy at various…

Q: 10. If the reserve ratio is 20% and the banking system has excess reserves of $50 maximum amount of…

A: Money multiplier is the reciprocal value of the required reserve ratio.

Q: calculate the inflation rate for 2012 and 2013.

A:

Q: What is the Federal Reserve and what is its role in Monetary Policy?

A: The basic goal of monetary policy is to stabilise the money supply across the economy and avoid…

Q: In a closed economy, consumers spend $400 regardless of the level of income, and the marginal…

A: The GDP is the value of the goods and services produced within the boundaries of the nation. It…

Q: Define “economic rent” and identify the market structure that generates the highest economic rent.

A: Economic Activity: Numerous activities in an economy that revolve around the production, sales, and…

Q: Assume that the market supply curve for potatoes is Qs1 = 12 + 0.5P, and that there are two…

A: In any region or state the equilibrium is said to occur when demand is equal to its supply. Storage…

Q: Distinguish between a discretionary fiscal policy and a non - discretionary fiscal policy. Give…

A: The use of government spending and tax policies to influence economic conditions, particularly…

Q: Two bidders compete in a sealed-bid auction for a single indivisible object. For each bidder i, the…

A: In the sealed-bid auction, when bidders place their bids without being aware of the other…

Q: 1. Please explain why the marginal revenue curve for a perfectly competitive firm is horizontal.

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Complete the Table: Capital (K) Labor (L) Total Product Average Product Marginal Product (TP) (AP)…

A: The average product of labor is the total product divided by labor. i.e., AP = (TP / L) The…

Q: Which of the following is NOT a government protected cartel program: Farm support programs OPEC…

A: Cartel refers to the combination of independent industrial or commercial enterprises to reduce the…

Q: China and South Korea are two of the leading manufacturers of smartphones and laptops. While the…

A: A free trade agreement won't have much of an influence on the laptop market since it is very…

Q: A company is considering pursuing a project with an initial cost of $200,000 annual operating and…

A: To determine conventional payback period divide the initial cash outlay of a project with the amount…

Q: Consider a marriage market with three men and three women, all of whom prefer any match to being…

A: The stable marriage problem is to find stability between two different but equal sized data sets. In…

Q: Suppose the information in the table is for a simple economy that produces and consumes only four…

A: Nominal GDP is the value of goods and services produced within the boundaries of the nation. The…

Q: 104 100 LRAS, A LRAS₂ B SRAS, SRA AD,

A: Productive capacity is the maximum possible outcome a economy can produce from its resources and…

Q: Lesson 3.5-Price Elasticity of Demand and Straight-line Demand Curves 1. Using the graph provided,…

A: The relationship between the percentage change in a product's quantity demanded and the percentage…

Q: 12. suppose that the 2-year interest rates in the US(foreign) and KRW (domestic) are 1.5% and 3%,…

A: Interest rate parity is a situation or condition that states that the returns one generates from…

Step by step

Solved in 2 steps

- Omar Shipping Company bought a tugboat for $75,000 (year 0) and expected to use it for five years after which it will be sold for $12,000. Suppose the company estimates the following revenues and expenses from the tugboat investment for the first operating year: If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year? (a) $28,700(b)$81,200(c) $78,400(d) $25,900Given: Before -Tax Cash Flow (BT-CF) for Kal Tech Systems in 2012 for an equipment that will be depreciated using the SL method with salvage value of $10,000. Year 0 1 2 3 4 5 BT-CF -$120,000 32,000 32,000 32,000 32,000 32,000 Market value - $36,000 What is the after-tax return if the company is in the 34% income tax bracket? The incremental tax rate is 34%. Also, it is known that the before-tax return is 16.65% Group of answer choices 9.65% 11.29% 10.16% 10.99%Clarence received interest from BPI from her long-term deposit amounting to P25,000. What is the amount of final tax withheld from the interest income of Clarence? a. P0 b. P2,500 c. P5,000 d. P6,250 e. Answer not given

- Determine whether the following contract described below is worthwhile ofundertaking after taxes if at the end of the 3-year of ownership the contract, you expect to sellboth depreciable equipment and land. Use present worth analysis under MARR = 8% andeffective tax rate.Suppose for some year the income of a small company is $110,000; the expenses are $65,000; the depreciation is $25,000; and the effective income tax rate = 40%. For this year, the ATCF is most nearly (a) −$8,900 (b) $4,700 (c) $13,200 (d) $29,700 (e) $37,000.Juan DeBaptist purchased $10,000 in corporate stock on June 1 and sold the stock when its value reached $13,000 on October 26. Ignoring stock transaction fees, what federal taxes did Juan pay on this stock investment if his taxable income is $90,000? Assume a capital gains tax rate of 15%.

- The effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income taxes) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements.(a) What is the prospective rate of return before income taxes?(b) What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years?(c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation?The effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income taxes) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements. (a) What is the prospective rate of return before income taxes? (b) What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years? (c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation? please solve it step by stepOlivia’s asset is purchased for Php 25,000. Its estimated life is 12 years after which it will be sold for Php 15,000. Find the depreciation for the 5th year and book value at the end of 8th year using Straight Line Method. a. 833.33 - 18,333.36 b. 833.33 - 4,166.67 c. 4,166.67 - 18,333.36 d. 533.33 - 4,166.67

- In 2015, a firm has receipts of $8 million and expenses (excluding depreciation) of $4 million. Its depreciation for 2015 amounts to $2 million. If the effective income tax rate is 40%, what is this firm’s net operating income after taxes (NOPAT)?Income taxes are calculated based on gross income less certain allowabledeductions. They are also assessed on gains resulting from the disposal of property. What is a 10-word or less definition appropriate for a corporation, based on Wikipedia, for each of the following factors? a. Gross income. b. Expenses. c. Depreciation. d. Interest. e. Property (e.g., equipment) disposition.Acme Manufacturing makes their preliminary economic studies using a before-tax MARR of22%. More detailed studies are performed on an after-tax basis. If their effective tax rate is23%, what is the after-tax MARR? Choose the correct answer below. A. The after-tax MARR is16.94%. B. The after-tax MARR is4.04%. C. The after-tax MARR is5.06%. D. The after-tax MARR is19.29%.