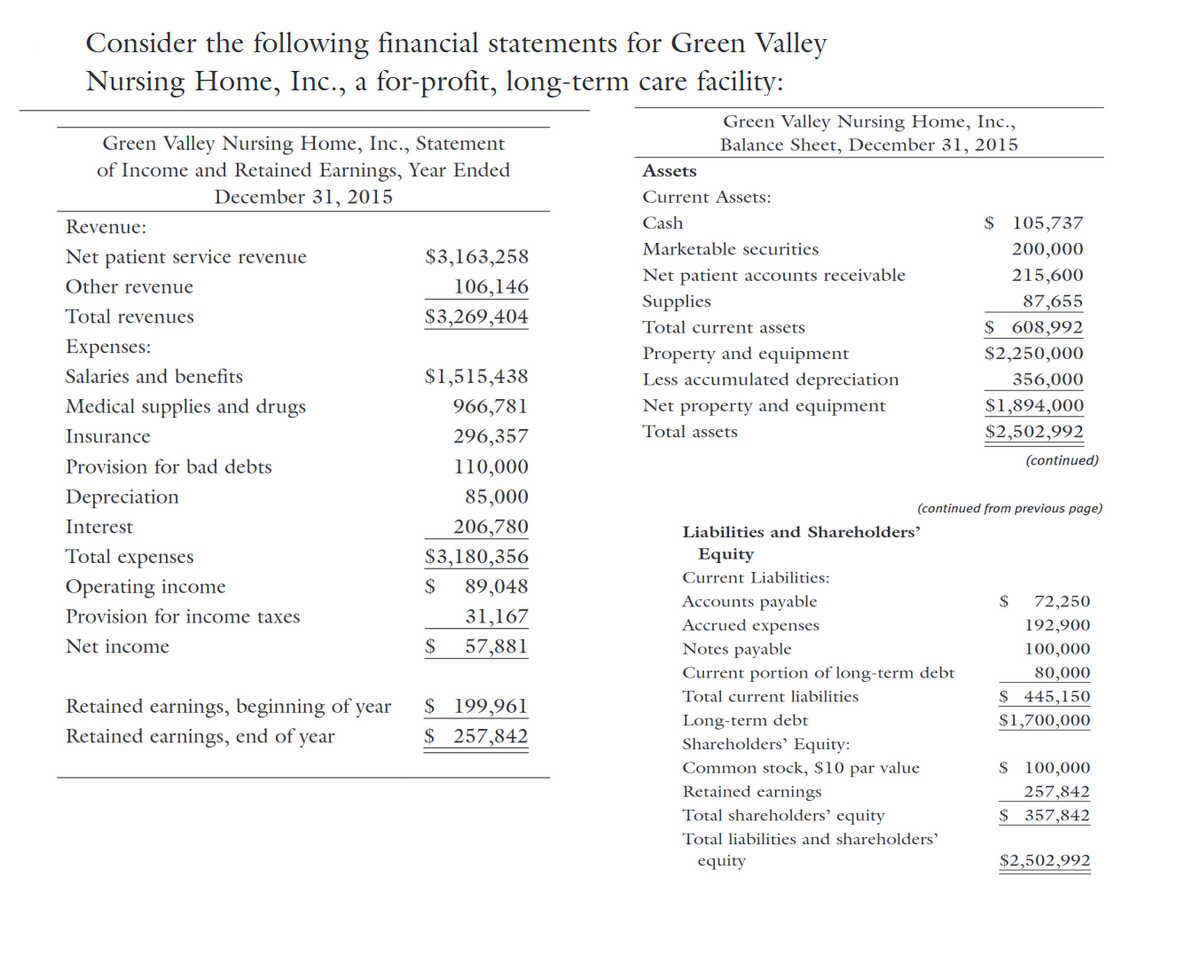

Consider the following financial statements for Green Valley Nursing Home, Inc., a for-profit, long-term care facility: Green Valley Nursing Home, Inc., Statement of Income and Retained Earnings, Year Ended December 31, 2015 Assets Green Valley Nursing Home, Inc., Balance Sheet, December 31, 2015 Revenue: Net patient service revenue $3,163,258 Other revenue Total revenues 106,146 $3,269,404 Expenses: Salaries and benefits $1,515,438 Medical supplies and drugs 966,781 Insurance 296,357 Current Assets: Cash Marketable securities Net patient accounts receivable Supplies Total current assets Property and equipment Less accumulated depreciation Net property and equipment Total assets $ 105,737 200,000 215,600 87,655 $ 608,992 $2,250,000 356,000 $1,894,000 $2,502,992 (continued) Provision for bad debts 110,000 Depreciation 85,000 (continued from previous page) Interest 206,780 Liabilities and Shareholders' Total expenses $3,180,356 Equity Operating income Current Liabilities: $ 89,048 Accounts payable Provision for income taxes 31,167 Accrued expenses Net income $ 57,881 Notes payable Current portion of long-term debt Total current liabilities $ 72,250 192,900 100,000 80,000 Retained earnings, beginning of year $ 199,961 Retained earnings, end of year $ 257,842 Long-term debt Shareholders' Equity: Common stock, $10 par value Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 445,150 $1,700,000 $ 100,000 257,842 $ 357,842 $2,502,992

Consider the following financial statements for Green Valley Nursing Home, Inc., a for-profit, long-term care facility: Green Valley Nursing Home, Inc., Statement of Income and Retained Earnings, Year Ended December 31, 2015 Assets Green Valley Nursing Home, Inc., Balance Sheet, December 31, 2015 Revenue: Net patient service revenue $3,163,258 Other revenue Total revenues 106,146 $3,269,404 Expenses: Salaries and benefits $1,515,438 Medical supplies and drugs 966,781 Insurance 296,357 Current Assets: Cash Marketable securities Net patient accounts receivable Supplies Total current assets Property and equipment Less accumulated depreciation Net property and equipment Total assets $ 105,737 200,000 215,600 87,655 $ 608,992 $2,250,000 356,000 $1,894,000 $2,502,992 (continued) Provision for bad debts 110,000 Depreciation 85,000 (continued from previous page) Interest 206,780 Liabilities and Shareholders' Total expenses $3,180,356 Equity Operating income Current Liabilities: $ 89,048 Accounts payable Provision for income taxes 31,167 Accrued expenses Net income $ 57,881 Notes payable Current portion of long-term debt Total current liabilities $ 72,250 192,900 100,000 80,000 Retained earnings, beginning of year $ 199,961 Retained earnings, end of year $ 257,842 Long-term debt Shareholders' Equity: Common stock, $10 par value Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 445,150 $1,700,000 $ 100,000 257,842 $ 357,842 $2,502,992

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter12: Liabilities: Off-balance-sheet Financing, Retirement Benefits, And Income Taxes

Section: Chapter Questions

Problem 22E

Related questions

Question

Refer back to Textbook Problem 17.5. Recast the financial statements for Green Valley into common size financial statements. Describe at least two advantages of a common size presentation of financial statements.

Transcribed Image Text:Consider the following financial statements for Green Valley

Nursing Home, Inc., a for-profit, long-term care facility:

Green Valley Nursing Home, Inc., Statement

of Income and Retained Earnings, Year Ended

December 31, 2015

Assets

Green Valley Nursing Home, Inc.,

Balance Sheet, December 31, 2015

Revenue:

Net patient service revenue

$3,163,258

Other revenue

Total revenues

106,146

$3,269,404

Expenses:

Salaries and benefits

$1,515,438

Medical supplies and drugs

966,781

Insurance

296,357

Current Assets:

Cash

Marketable securities

Net patient accounts receivable

Supplies

Total current assets

Property and equipment

Less accumulated depreciation

Net property and equipment

Total assets

$ 105,737

200,000

215,600

87,655

$ 608,992

$2,250,000

356,000

$1,894,000

$2,502,992

(continued)

Provision for bad debts

110,000

Depreciation

85,000

(continued from previous page)

Interest

206,780

Liabilities and Shareholders'

Total expenses

$3,180,356

Equity

Operating income

Current Liabilities:

$

89,048

Accounts payable

Provision for income taxes

31,167

Accrued expenses

Net income

$

57,881

Notes payable

Current portion of long-term debt

Total current liabilities

$

72,250

192,900

100,000

80,000

Retained earnings, beginning of year

$ 199,961

Retained earnings, end of year

$ 257,842

Long-term debt

Shareholders' Equity:

Common stock, $10 par value

Retained earnings

Total shareholders' equity

Total liabilities and shareholders'

equity

$ 445,150

$1,700,000

$ 100,000

257,842

$ 357,842

$2,502,992

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you