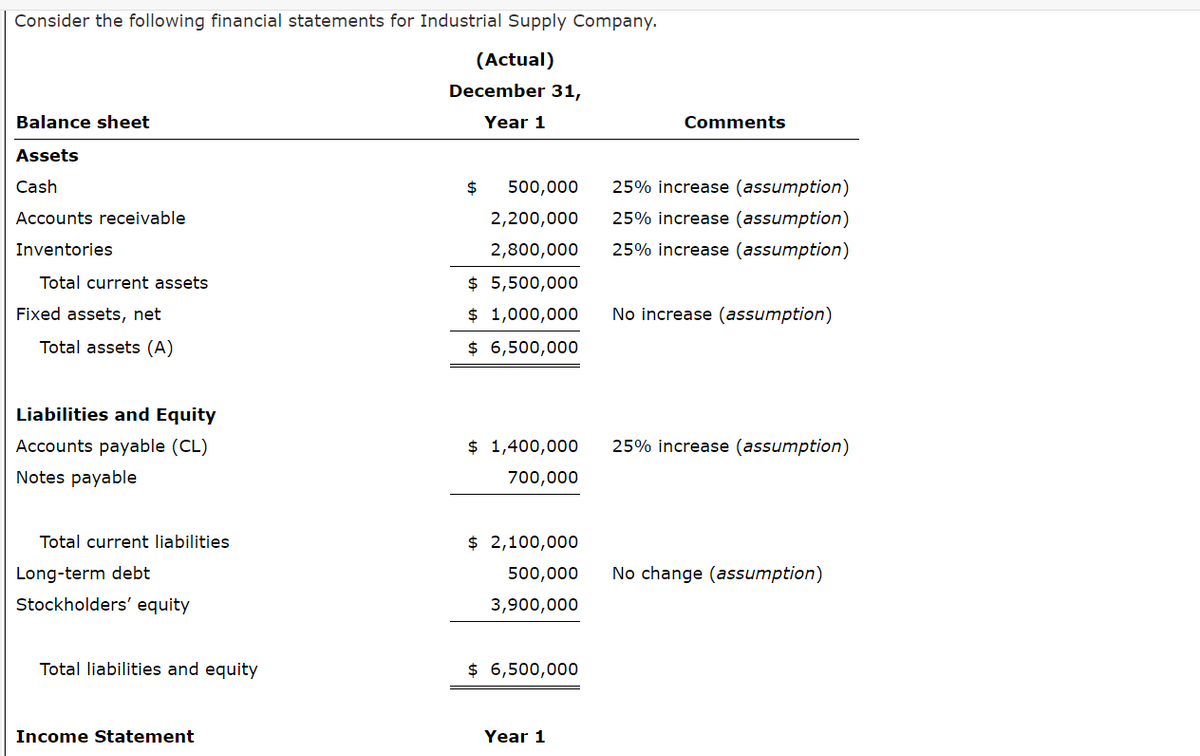

Consider the following financial statements for Industrial Supply Company. (Actual) December 31, Balance sheet Year 1 Comments Assets Cash 500,000 25% increase (assumption) Accounts receivable 2,200,000 25% increase (assumption) Inventories 2,800,000 25% increase (assumption) $ 5,500,000 $ 1,000,000 $ 6,500,000 Total current assets Fixed assets, net No increase (assumption) Total assets (A) Liabilities and Equity Accounts payable (CL) 1,400,000 25% increase (assumption) Notes payable 700,000 Total current liabilities 2,100,000 Long-term debt 500,000 No change (assumption) Stockholders' equity 3,900,000 Total liabilities and equity $ 6,500,000

Consider the following financial statements for Industrial Supply Company. (Actual) December 31, Balance sheet Year 1 Comments Assets Cash 500,000 25% increase (assumption) Accounts receivable 2,200,000 25% increase (assumption) Inventories 2,800,000 25% increase (assumption) $ 5,500,000 $ 1,000,000 $ 6,500,000 Total current assets Fixed assets, net No increase (assumption) Total assets (A) Liabilities and Equity Accounts payable (CL) 1,400,000 25% increase (assumption) Notes payable 700,000 Total current liabilities 2,100,000 Long-term debt 500,000 No change (assumption) Stockholders' equity 3,900,000 Total liabilities and equity $ 6,500,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 50E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Transcribed Image Text:Consider the following financial statements for Industrial Supply Company.

(Actual)

December 31,

Balance sheet

Year 1

Comments

Assets

Cash

2$

500,000

25% increase (assumption)

Accounts receivable

2,200,000

25% increase (assumption)

Inventories

2,800,000

25% increase (assumption)

Total current assets

$ 5,500,000

Fixed assets, net

$ 1,000,000

No increase (assumption)

Total assets (A)

$ 6,500,000

Liabilities and Equity

Accounts payable (CL)

$ 1,400,000

25% increase (assumption)

Notes payable

700,000

Total current liabilities

$ 2,100,000

Long-term debt

500,000

No change (assumption)

Stockholders' equity

3,900,000

Total liabilities and equity

$ 6,500,000

Income Statement

Year 1

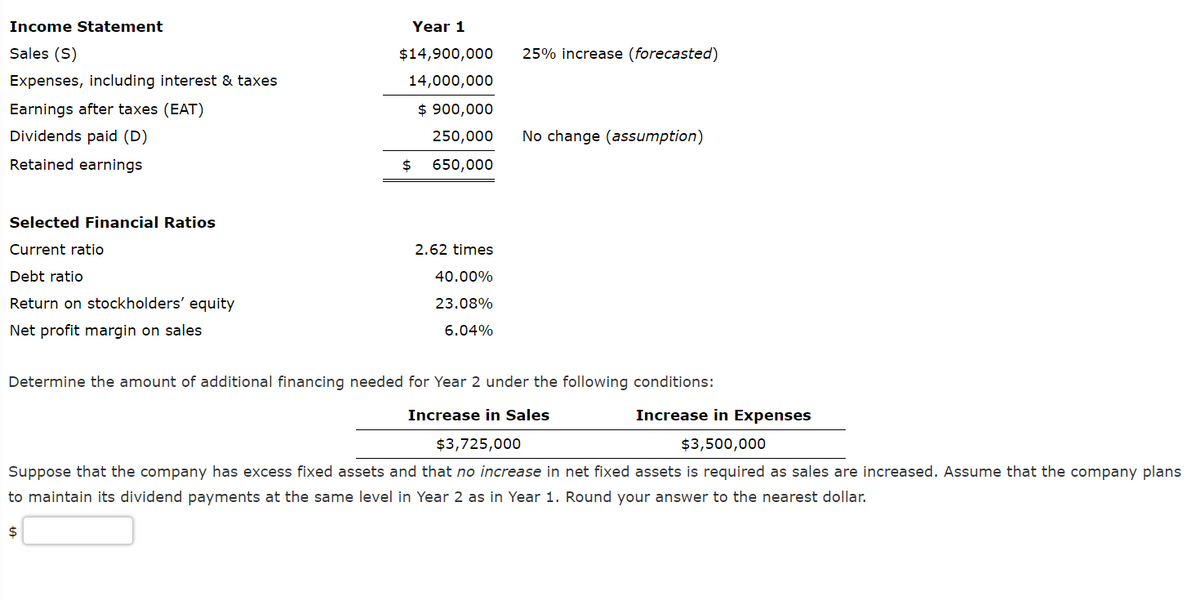

Transcribed Image Text:Income Statement

Year 1

Sales (S)

$14,900,000

25% increase (forecasted)

Expenses, including interest & taxes

14,000,000

Earnings after taxes (EAT)

$ 900,000

Dividends paid (D)

250,000

No change (assumption)

Retained earnings

2$

650,000

Selected Financial Ratios

Current ratio

2.62 times

Debt ratio

40.00%

Return on stockholders' equity

23.08%

Net profit margin on sales

6.04%

Determine the amount of additional financing needed for Year 2 under the following conditions:

Increase in Sales

Increase in Expenses

$3,725,000

$3,500,000

Suppose that the company has excess fixed assets and that no increase in net fixed assets is required as sales are increased. Assume that the company plans

to maintain its dividend payments at the same level in Year 2 as in Year 1. Round your answer to the nearest dollar.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning