Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.4.5P

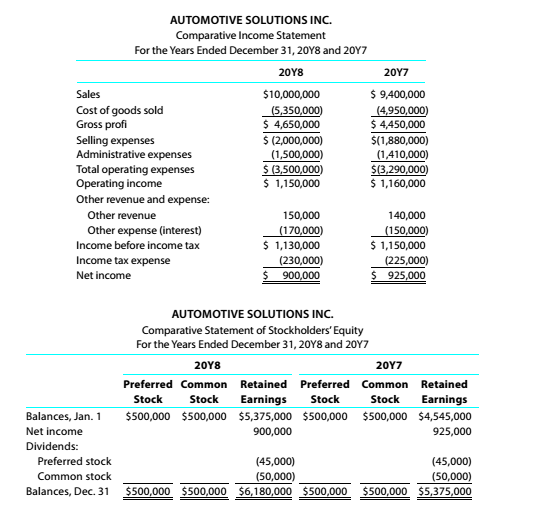

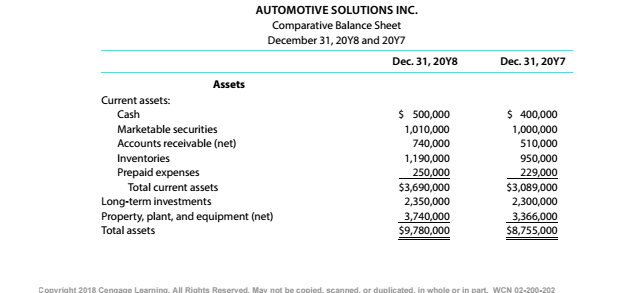

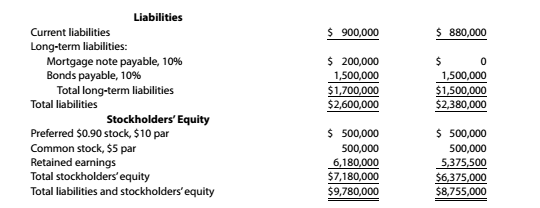

Twenty metrics of liquidity, solvency, and profitability

The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8

Instructions

Days’ sale in receivable

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Survey of Accounting (Accounting I)

Ch. 9 - What type of analysis is indicated by the...Ch. 9 - Which of the following measures indicates the...Ch. 9 - Prob. 3SEQCh. 9 - Prob. 4SEQCh. 9 - Prob. 5SEQCh. 9 - That is the difference between horizontal and...Ch. 9 - Prob. 2CDQCh. 9 - Prob. 3CDQCh. 9 - Prob. 4CDQCh. 9 - How would the current and quick ratios of a...

Ch. 9 - For Belzcr Corporation, the working capital at the...Ch. 9 - Prob. 7CDQCh. 9 - Prob. 8CDQCh. 9 - a. Why is it advantageous to have a high inventory...Ch. 9 - Prob. 10CDQCh. 9 - Prob. 11CDQCh. 9 - Prob. 12CDQCh. 9 - Prob. 13CDQCh. 9 - Prob. 14CDQCh. 9 - Prob. 15CDQCh. 9 - Favorable business conditions may bring about...Ch. 9 - Prob. 17CDQCh. 9 - Prob. 9.1ECh. 9 - Vertical analysis of income statement The...Ch. 9 - Common-sized income statement Revenue and expense...Ch. 9 - Prob. 9.4ECh. 9 - Prob. 9.5ECh. 9 - Prob. 9.6ECh. 9 - Prob. 9.7ECh. 9 - Current position analysis The bond indenture for...Ch. 9 - Accounts receivable analysis The following data...Ch. 9 - Prob. 9.10ECh. 9 - Inventory analysis The following data were...Ch. 9 - Inventory analysis Costco Wholesale Corporation...Ch. 9 - Ratio of liabilities to stockholders' equity and...Ch. 9 - Prob. 9.14ECh. 9 - Debt ratio, ratio of liabilities to stockholders'...Ch. 9 - Prob. 9.16ECh. 9 - Profitability metrics The following selected data...Ch. 9 - Profitability metrics Macy's, Inc. (M). sells...Ch. 9 - Seven metrics The following data were taken from...Ch. 9 - Prob. 9.20ECh. 9 - Prob. 9.21ECh. 9 - Prob. 9.22ECh. 9 - Unusual income statement items Assume that the...Ch. 9 - Horizontal analysis for income statement For 20Y3....Ch. 9 - Horizontal analysis for income statement For 20Y3....Ch. 9 - Prob. 9.2.1PCh. 9 - Prob. 9.2.2PCh. 9 - Effect of transactions on current position...Ch. 9 - Effect of transactions on current position...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Prob. 9.4.7PCh. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Twenty metrics of liquidity, solvency, and...Ch. 9 - Prob. 9.4.20PCh. 9 - Trend analysis Critelli Company has provided the...Ch. 9 - Trend analysis Critelli Company has provided the...Ch. 9 - Prob. 9.1CCh. 9 - Prob. 9.2CCh. 9 - Prob. 9.3CCh. 9 - Prob. 9.4.1CCh. 9 - Prob. 9.4.2CCh. 9 - Prob. 9.4.3CCh. 9 - Comprehensive profitability and solvency analysis...Ch. 9 - Comprehensive profitability and solvency analysis...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentages, except for per-share amounts: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forwardTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Accounts receivable turnoverarrow_forwardTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Quick ratioarrow_forward

- Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Price-earnings rationarrow_forwardTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Return on stockholders’ equityarrow_forwardTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Earnings per share on common stockarrow_forward

- Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Dividends per share of common stockarrow_forwardTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Return on common stockholders’ equityarrow_forwardTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Ratio of liabilities to stockholder.' equityarrow_forward

- Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instuctins Times preferred earnedarrow_forwardTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Return on total assetsarrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License