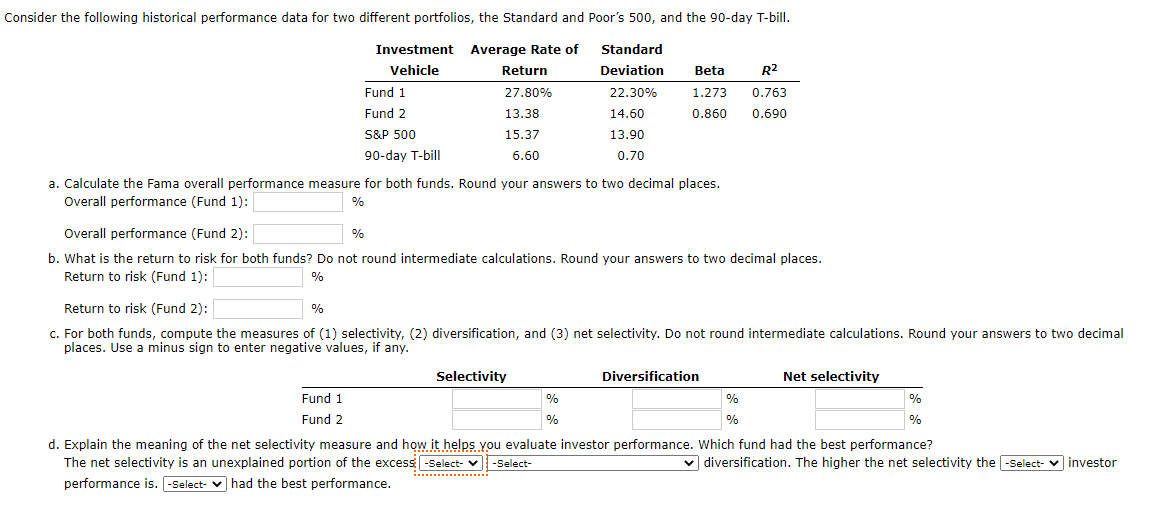

Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. Investment Average Rate of Standard Vehicle Return Deviation Beta R2 Fund 1 27.80% 22.30% 1.273 0.763 Fund 2 13.38 14.60 0.860 0.690 S&P 500 15.37 13.90 90-day T-bill 6.60 0.70 a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places. Overall performance (Fund 1): % Overall performance (Fund 2): % b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places. Return to risk (Fund 1): % Return to risk (Fund 2): % c. For both funds, compute the measures of (1) selectivity, (2) diversification, and (3) net selectivity. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. Selectivity Diversification Net selectivity Fund 1 % % % Fund 2 % % % d. Explain the meaning of the net selectivity measure and how it helps you evaluate investor performance. Which fund had the best performance? The net selectivity is an unexplained portion of the excess -Select- v performance is. -Select- v -Select- v diversification. The higher the net selectivity the -Select- v investor .... ..... | had the best performance.

Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. Investment Average Rate of Standard Vehicle Return Deviation Beta R2 Fund 1 27.80% 22.30% 1.273 0.763 Fund 2 13.38 14.60 0.860 0.690 S&P 500 15.37 13.90 90-day T-bill 6.60 0.70 a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places. Overall performance (Fund 1): % Overall performance (Fund 2): % b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places. Return to risk (Fund 1): % Return to risk (Fund 2): % c. For both funds, compute the measures of (1) selectivity, (2) diversification, and (3) net selectivity. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. Selectivity Diversification Net selectivity Fund 1 % % % Fund 2 % % % d. Explain the meaning of the net selectivity measure and how it helps you evaluate investor performance. Which fund had the best performance? The net selectivity is an unexplained portion of the excess -Select- v performance is. -Select- v -Select- v diversification. The higher the net selectivity the -Select- v investor .... ..... | had the best performance.

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9PROB

Related questions

Question

Transcribed Image Text:Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill.

Investment Average Rate of

Standard

Vehicle

Return

Deviation

Beta

R2

Fund 1

27.80%

22.30%

1.273

0.763

Fund 2

13.38

14.60

0.860

0.690

S&P 500

15.37

13.90

90-day T-bill

6.60

0.70

a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places.

Overall performance (Fund 1):

%

Overall performance (Fund 2):

%

b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places.

Return to risk (Fund 1):

%

Return to risk (Fund 2):

%

c. For both funds, compute the measures of (1) selectivity, (2) diversification, and (3) net selectivity. Do not round intermediate calculations. Round your answers to two decimal

places. Use a minus sign to enter negative values, if any.

Selectivity

Diversification

Net selectivity

Fund 1

%

%

Fund 2

%

%

d. Explain the meaning of the net selectivity measure and how it helps you evaluate investor performance. Which fund had the best performance?

The net selectivity is an unexplained portion of the excess -Select- v

performance is. -Select- v had the best performance.

-Select-

v diversification. The higher the net selectivity the -Select- v investor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning