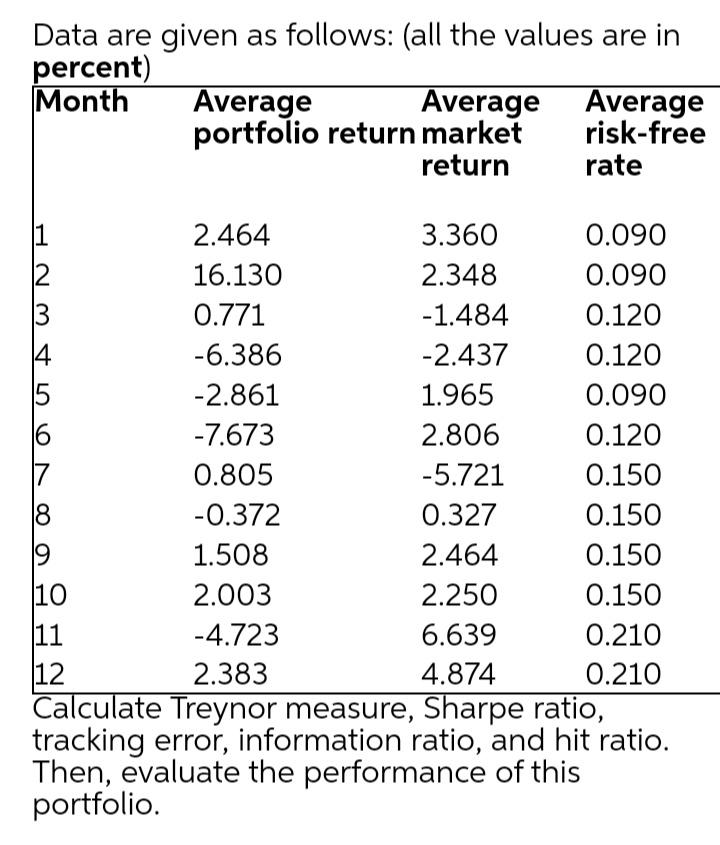

Data are given as follows: (all the values are in percent) Month Average portfolio return market Average Average risk-free rate return 2.464 3.360 0.090 2 16.130 2.348 0.090 0.771 -1.484 0.120 -6.386 -2.437 0.120 15 -2.861 1.965 0.090 6 7 -7.673 2.806 0.120 0.805 -5.721 0.150 -0.372 0.327 0.150 1.508 2.464 0.150 10 11 12 Calculate Treynor measure, Sharpe ratio, tracking error, information ratio, and hit ratio. Then, evaluate the performance of this portfolio. 2.003 2.250 0.150 -4.723 6.639 0.210 2.383 4.874 0.210

Data are given as follows: (all the values are in percent) Month Average portfolio return market Average Average risk-free rate return 2.464 3.360 0.090 2 16.130 2.348 0.090 0.771 -1.484 0.120 -6.386 -2.437 0.120 15 -2.861 1.965 0.090 6 7 -7.673 2.806 0.120 0.805 -5.721 0.150 -0.372 0.327 0.150 1.508 2.464 0.150 10 11 12 Calculate Treynor measure, Sharpe ratio, tracking error, information ratio, and hit ratio. Then, evaluate the performance of this portfolio. 2.003 2.250 0.150 -4.723 6.639 0.210 2.383 4.874 0.210

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 83E

Related questions

Question

Transcribed Image Text:Data are given as follows: (all the values are in

percent)

Month

Average

portfolio return market

Average Average

risk-free

return

rate

2.464

3.360

0.090

16.130

2.348

0.090

0.771

-1.484

0.120

-6.386

-2.437

0.120

15

-2.861

1.965

0.090

16

-7.673

2.806

0.120

0.805

-5.721

0.150

-0.372

0.327

0.150

1.508

2.464

0.150

10

2.003

2.250

0.150

11

-4.723

6.639

0.210

12

Calculate Treynor measure, Sharpe ratio,

tracking error, information ratio, and hit ratio.

Then, evaluate the performance of this

portfolio.

2.383

4.874

0.210

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage