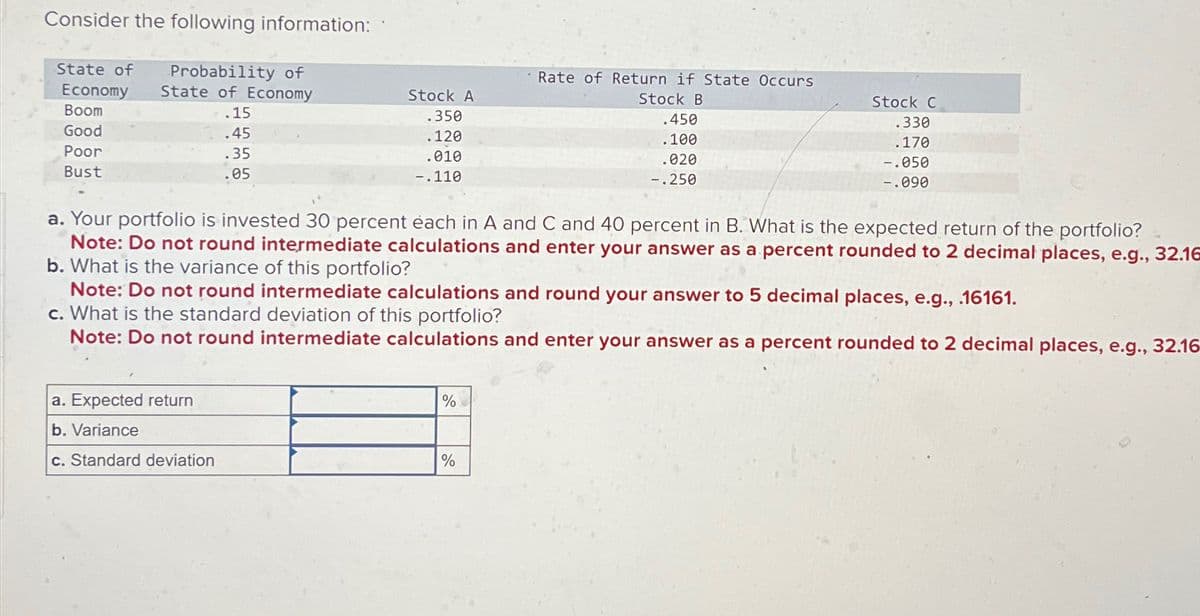

Consider the following information: State of Probability of Economy State of Economy Rate of Return if State Occurs Stock A Stock B Stock C Boom .15 .350 .450 .330 Good .45 .120 .100 .170 Poor Bust .35 .05 .010 -.110 .020 -.050 -.250 -.090 a. Your portfolio is invested 30 percent each in A and C and 40 percent in B. What is the expected return of the portfolio? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16 b. What is the variance of this portfolio? Note: Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161. c. What is the standard deviation of this portfolio? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16 a. Expected return b. Variance c. Standard deviation % %

Consider the following information: State of Probability of Economy State of Economy Rate of Return if State Occurs Stock A Stock B Stock C Boom .15 .350 .450 .330 Good .45 .120 .100 .170 Poor Bust .35 .05 .010 -.110 .020 -.050 -.250 -.090 a. Your portfolio is invested 30 percent each in A and C and 40 percent in B. What is the expected return of the portfolio? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16 b. What is the variance of this portfolio? Note: Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161. c. What is the standard deviation of this portfolio? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16 a. Expected return b. Variance c. Standard deviation % %

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9PROB

Related questions

Question

Please Give Step by Step Answer

Otherwise i give DISLIKES !!

Transcribed Image Text:Consider the following information:

State of

Probability of

Economy State of Economy

Rate of Return if State Occurs

Stock A

Stock B

Stock C

Boom

.15

.350

.450

.330

Good

.45

.120

.100

.170

Poor

Bust

.35

.05

.010

-.110

.020

-.050

-.250

-.090

a. Your portfolio is invested 30 percent each in A and C and 40 percent in B. What is the expected return of the portfolio?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16

b. What is the variance of this portfolio?

Note: Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.

c. What is the standard deviation of this portfolio?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16

a. Expected return

b. Variance

c. Standard deviation

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you