Consider the following investment projects for SDL Engineering. All of the projects have a three-year investment life: Project's Cash Flow ($) Time (n) Project A Project B Project C Project D -$1,500 -$1,200 $600 $800 $1,500 -$1,600 $1,800 $800 $2,500 -$3,100 $800 $1,900 $2,300 1 $3,000 a. Compute the net present worth of each project where interest is 9% b. Which project do you recommend based on the NPW? Other than the NPW, why else would you recommend this project? ( you will be using the same rate that was for part a for this part)

Consider the following investment projects for SDL Engineering. All of the projects have a three-year investment life: Project's Cash Flow ($) Time (n) Project A Project B Project C Project D -$1,500 -$1,200 $600 $800 $1,500 -$1,600 $1,800 $800 $2,500 -$3,100 $800 $1,900 $2,300 1 $3,000 a. Compute the net present worth of each project where interest is 9% b. Which project do you recommend based on the NPW? Other than the NPW, why else would you recommend this project? ( you will be using the same rate that was for part a for this part)

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 15P

Related questions

Question

PLEASE SOLVE THIS FINANCE QUESTION FAST

Transcribed Image Text:* Question Completion Status:

a. Compute the net present worth or each project where interest is 9%

b. Which project do you recommend based on the NPW? Other than the NPW, why else would you recommend this project? ( you

will be using the same rate that was for part a for this part)

As part of your answer show the Interest rate for

your calculations,

If you are using Excel Show all your calculations and Cut and Paste your answers below -I will only mark the answer that appears here

not the answer in your Excel Document that your are submitting. The Excel document is only going to be used in the event of incorrect

calculations for part marks.

For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

BIUS

Paragraph

Arial

14px

...

E E E

X: 深T. Te

用国

出周因

-

<>

{t}

III

!!!

Transcribed Image Text:9 points

Save A

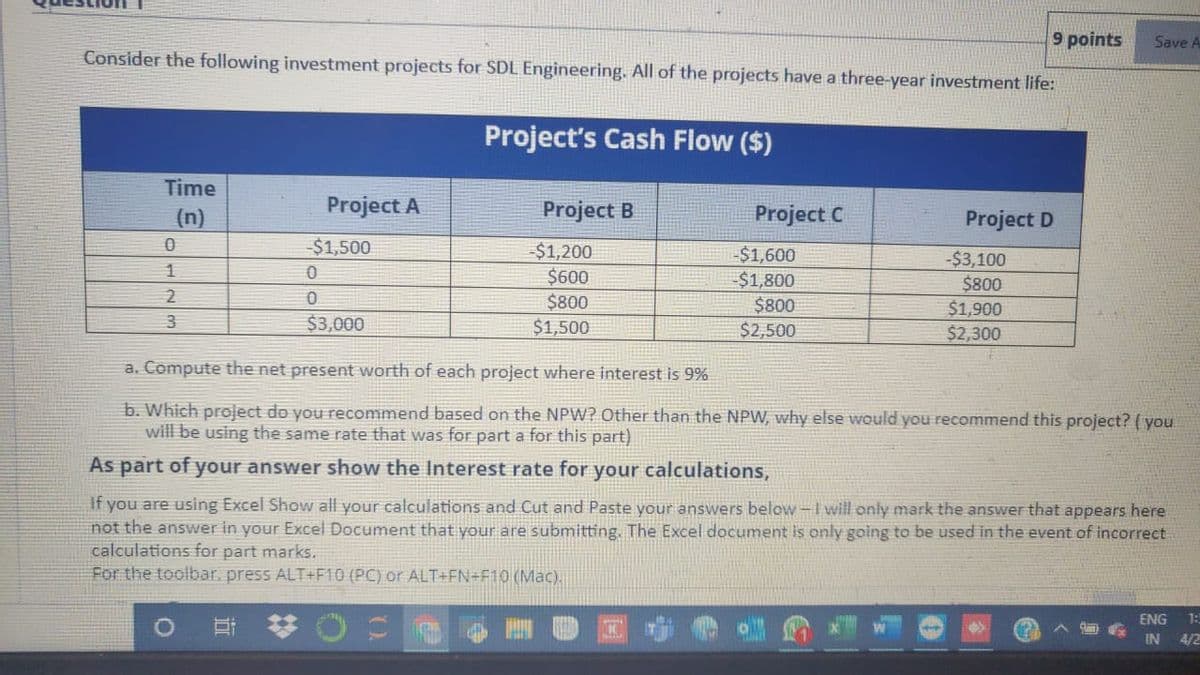

Consider the following investment projects for SDL Engineering. All of the projects have a three-year investment life:

Project's Cash Flow ($)

Time

(n)

Project A

Project B

Project C

Project D

$1,500

-$1,200

$600

$800

$1,500

-$1,600

$1,800

$800

$2,500

-$3,100

$800

$1,900

$2,300

1

$3,000

a. Compute the net present worth of each project where interest is 9%

b. Which project do you recommend based on the NPW? Other than the NPW, why else would you recommend this project? (you

will be using the same rate that was for part a for this part)

As part of your answer show the Interest rate for your calculations,

If you are using Excel Show all your calculations and Cut and Paste your answers below-I will only mark the answer that appears here

not the answer in your Excel Document that your are submitting. The Excel document is only going to be used in the event of incorrect

calculations for part marks.

For the toolbar. press ALT+F10 (PC) or ALT+FN+F10 (Mac).

ENG

1:

IN

4/2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning