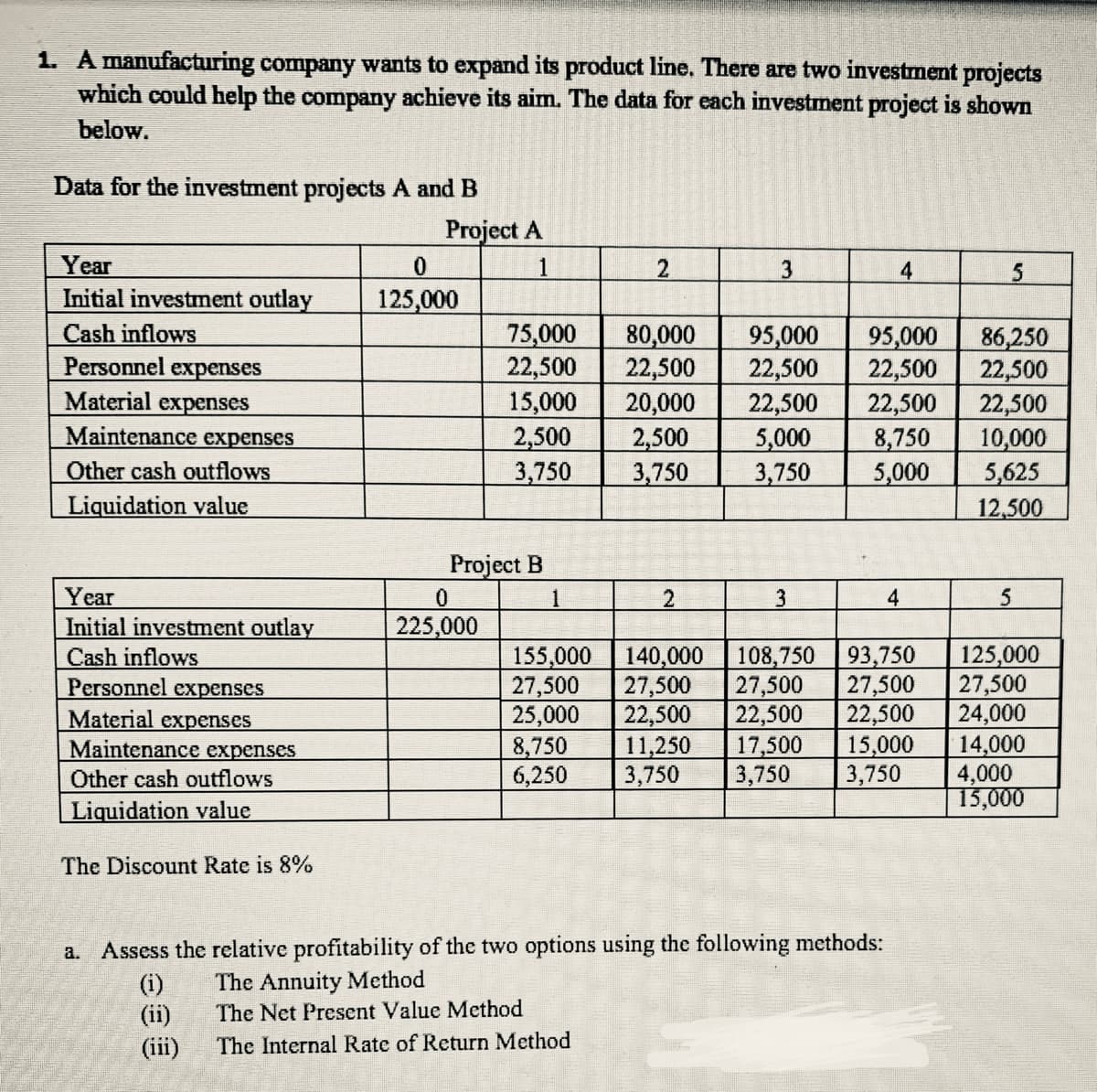

1. A manufacturing company wants to expand its product line. There are two investment projects which could help the company achieve its aim. The data for each investment project is shown below. Data for the investment projects A and B Project A Year Initial investment outlay Cash inflows Personnel expenses Material expenses Maintenance expenses Other cash outflows Liquidation value 1 2. 3 4 125,000 75,000 22,500 15,000 2,500 3,750 80,000 22,500 20,000 2,500 3,750 95,000 22,500 22,500 5,000 3,750 95,000 22,500 22,500 8,750 5,000 86,250 22,500 22,500 10,000 5,625 12,500 Project B 0. 225,000 Year Initial investment outlay Cash inflows Personnel expenses Material expenses Maintenance expenses 3. 4 155,000 140,000 27,500 27,500 25,000 22,500 11,250 8,750 6,250 3,750 108,750 93,750 125,000 27,500 24,000 14,000 4,000 15,000 27,500 27,500 22,500 22,500 17,500 15,000 Other cash outflows 3,750 3,750 Liquidation value The Discount Rate is 8% Assess the relative profitability of the two options using the following methods: (i) (ii) (iii) a. The Annuity Method The Net Present Value Method The Internal Rate of Return Method

1. A manufacturing company wants to expand its product line. There are two investment projects which could help the company achieve its aim. The data for each investment project is shown below. Data for the investment projects A and B Project A Year Initial investment outlay Cash inflows Personnel expenses Material expenses Maintenance expenses Other cash outflows Liquidation value 1 2. 3 4 125,000 75,000 22,500 15,000 2,500 3,750 80,000 22,500 20,000 2,500 3,750 95,000 22,500 22,500 5,000 3,750 95,000 22,500 22,500 8,750 5,000 86,250 22,500 22,500 10,000 5,625 12,500 Project B 0. 225,000 Year Initial investment outlay Cash inflows Personnel expenses Material expenses Maintenance expenses 3. 4 155,000 140,000 27,500 27,500 25,000 22,500 11,250 8,750 6,250 3,750 108,750 93,750 125,000 27,500 24,000 14,000 4,000 15,000 27,500 27,500 22,500 22,500 17,500 15,000 Other cash outflows 3,750 3,750 Liquidation value The Discount Rate is 8% Assess the relative profitability of the two options using the following methods: (i) (ii) (iii) a. The Annuity Method The Net Present Value Method The Internal Rate of Return Method

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.4E

Related questions

Question

100%

Transcribed Image Text:1. A manufacturing company wants to expand its product line. There are two investment projects

which could help the company achieve its aim. The data for each investment project is shown

below.

Data for the investment projects A and B

Project A

Year

Initial investment outlay

Cash inflows

Personnel expenses

Material expenses

Maintenance expenses

0.

1

3

125,000

75,000

22,500

15,000

2,500

3,750

80,000

22,500

20,000

2,500

3,750

95,000

22,500

22,500

5,000

3,750

95,000

22,500

22,500

8,750

5,000

86,250

22,500

22,500

10,000

5,625

12,500

Other cash outflows

Liquidation value

Project B

Year

Initial investment outlay

Cash inflows

Personnel expenses

Material expenses

Maintenance expenses

2.

3.

4

225,000

155,000 140,000

27,500

27,500

22,500

25,000

8,750

11,250

108,750 93,750

27,500

27,500

22,500

22,500

15,000

17,500

3,750

3,750

125,000

27,500

24,000

14,000

4,000

15,000

Other cash outflows

6,250

3,750

Liquidation value

The Discount Rate is 8%

a. Assess the relative profitability of the two options using the following methods:

(i)

(ii)

The Annuity Method

The Net Present Value Method

(iii)

The Internal Rate of Return Method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning