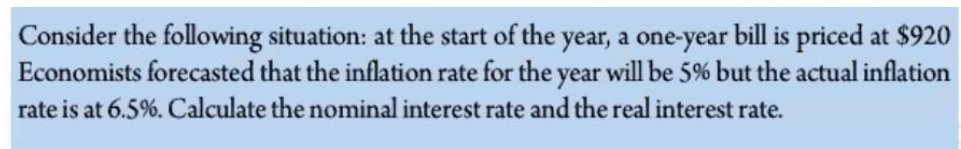

Consider the following situation: at the start of the year, a one-year bill is priced at $920 Economists forecasted that the inflation rate for the year will be 5% but the actual inflation rate is at 6.5%. Calculate the nominal interest rate and the real interest rate.

Q: Assuming you bought a 182-day Treasury Bill with a face value Ghc 20,000.00 and held it for 45days.…

A: Purchase price = Face value/(1+interest rate*days to maturity/360) Accrued interest = Purchase…

Q: You make $10,000 deposit 1 year from now, $15,000 deposit 3 years from now and $20,000 deposit 5…

A: A concept that implies the future worth of the money is lower than its current value due to several…

Q: Suppose the interest rate on a 3-year Treasury Note is 1.25%, and 5-year Notes are yielding a 3.50%.…

A: Answer: A 2 year treasuries will be yielding 3 years from now should be 6.97%

Q: If P12,000 is the present value of P12,600 due at the end of 9 months, then the annual simple…

A: Simple Discount refers to the discount in which the amount of interest is deducted. This is usually…

Q: If you borrow $5000 at an APR of r (as a decimal) from a lending institution that compounds interest…

A: Interest rate is the proportion of amount loaned on which a lender charger as interest to the…

Q: Today in the United States, the interest rate on 10-year government bonds was 1.65%, and the…

A: Inflation expectations among the general populace. These expectations determine how much of an…

Q: An economy is experiencing inflation at an annual rate of 8%. If this continues, what will P2000 be…

A: Given Annual Rate = 8% time = 3 years

Q: If current interest rate is 28%, a Treasury Bill with 91 days to maturity, and a face value of GH¢…

A: According to the rule, because you have posted multiple questions, we will answer the First question…

Q: Which one is the approximate periodic interest rate % on a Treasury bill that you purchase for 4,908…

A: Future Value = present Value * (1+ rate * time)

Q: Calculate the purchasing power of $80,000 in 15 years using an annual inflation rate of 6%. Round to…

A:

Q: You are paying a series of five constant-dollar (or real-dollar) uniform payments of $664.85…

A: The formula used for the computation is:

Q: You can purchase a 1 million treasury bill that is currently selling on a discount basis at 97 1/2 %…

A: Par value of T bill (F) = 1,000,000 Selling price (P) = 1,000,000*(97.50/100) = 975,000 Period (T) =…

Q: What would be your annualized discount rate% on the purchase of a 170-day Treasury bill for $4700…

A: Annualized discount rate can be calculated as: = (Maturity amount - Initial amount) / Initial amount…

Q: A series of five payments in constant dollars, beginning with $6,000 at the end ofthe first year,…

A: The current value of the cash flows or an asset after discounting is termed as the present worth.

Q: Consider a five-year floating rate loan with principal of $10 million and quarterly payments based…

A: Given information: 5 year floating rate loan of $10 million

Q: The annual inflation rate is expected to be 4.78% and the nominal (annual) interest rate is 5.75%.…

A: Inflation rate (π) =4.78% Nominal rate of interest (i)=5.75%. Using Fischer equation, real interest…

Q: a If current interest rate is 28%, a Treasury Bill with 91 days to maturity, and a face value of GH¢…

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: If the velocity of circulation is constant, real GDP is growing at 3 percent a year, the real…

A: Given, Real GDP growth = 3% Real Interest Rate = 2% Nominal Interest Rate = 7%

Q: (a) Calculate the perpetual equivalent annual worth in future dollars for years 1 through ∞ for…

A: (a) The calculation is shown as: The formulae snip is annexed below:

Q: A KIMEP BANK quotes you and interest rate of 12,5% per annum with semiannual compounding. What is…

A: Interest Rate per annum with semi annual compounding(r) = 12.5% Effective Interest Rate compounded…

Q: With an annual inflation rate of 1.45%, how much did an item that costs $8000 now cost 3 years…

A: A theory that helps to compute the present or future value of the cash flows is term as the TVM…

Q: An annuity pays $1000 per year for 12 years. Inflation is 6 percent per year. The annuity costs…

A: Internal rate of return is one of the modern techniques of capital budgeting which considers the…

Q: What is the annualized investment rate % on a Treasury bill that you purchase for 9310 that will…

A: Value at the maturity (F) = 9533 Purchase price (P) = 9310 n = 91 days

Q: If the inflation rate is expected to be 3% for the next 10 years, what annual income will be needed…

A: Expected inflation rate is 3% Time period is 10 years Current Annual Income "Present Value" is…

Q: A deposit of $1000 is made into an account that promises a minimum of 2% per year increase in…

A: The minimum value that will be in account at year 3 = Deposit amount *(1.02)^3 * (1.03)* (1.01)…

Q: A hundred thousand pesos now will become P341,655.49 in eight years at an interest rate of 9%…

A: Initial value = 100000 Final value = 341655.49 Real rate of interest = 9% Let nominal rate = r

Q: You deposited $10,000 today into a saving account for 5 years with a market rate of 8% per year. The…

A: Deposit amount = $ 10000 Period = 5 Years Interest rate = 8% Inflation rate = 2%

Q: the nominal interest rate per year is 12% and the inflation rate is 8%, what is the real rate of…

A:

Q: If the present value of $400 paid one year from now is $320, what is the one-year interest rate?…

A:

Q: An investor lends $10,000 today, to be repaid in a lump sum at the end of10 years with interest at…

A: The real rate of return of an investment is the rate of return an investment generates after taking…

Q: "If Treasury bills are currently paying 4.6 percent and the inflation rate is 1.9 percent, what is…

A: Nominal rate = 4.6% Inflation rate = 1.9%

Q: At present, you invest 10,000 pesos in a 15% security for 5 years. During the time, the average…

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified…

Q: if the simple interest discount rate is 9.681% , what is the future value of 45,907 after 9 years…

A: Simple interest method is a method of computing interest on borrowed amount where interest is…

Q: For prices that are increasing at an annual rateof 5% the first year and 8% the second year,…

A: Inflation Rate means the percentage increase in the average price level of a basket of selected…

Q: In year zero, you invest P10,000 in a 15% security for 5 years. During that time, the average annual…

A: Information provided in the given question: r = real rate of interest = (interest on the security -…

Q: What would be your annualized discount rate% on the purchase of a 150-day Treasury bill for $4700…

A: The discount rate in a discounted cash flow analysis is the interest rate used to determine the…

Q: The inflation rates for 4 years are forecast to be 3%, 3%, 4%, and 5%. The interest rate exclusive…

A: Time value of money- It is based on the concept that money earned today is worth more than similar…

Q: To buy a Treasury bill (T-bill) that matures to $10,000 in 6 months, you must pay $9720. What annual…

A: future value = $10000 Mature time = 6 months or 6/12 Principal = $9720 interest amount = future…

Q: The price of a 90-day Treasury bill is quoted as 10.00. What continuously compounded return (on an…

A: 2. Calculate continuously compounded return on Treasury bill

Q: A 91-day Treasury bill issued three weeks ago is quoted at 4.23. How much would you pay for a bill…

A: The calculation of the payment of the cash price.

Q: Suppose you have received a credit card offer from a bank that charges interest at 1.1% per quarter,…

A: The nominal rate is the rate that the financial institution quotes when giving out or receiving…

Q: Suppose the inflation rate is compounded annually at 3% APR. Do you prefer compounded semiannually…

A: Here, Inflation Rate is 3% APR compounded annually Nominal Interest Rate is 5% APR compounded…

Q: suppose that an investment promises to pay a real 9% annual rate of interest and inflation rate is…

A: Given, Real Rate of Interest 9% Inflation 3%

Q: The bank is paying 11.29% compounded annually. The inflation is expected to be 12.22% per year. What…

A: Real Rate: It is the rate which the investor would receive by investing the money. The real rate of…

Q: The future amount of $200,000 for a period of 5 years is equal to $391,886.33, considering money is…

A: according to time value of money, future value = present value×1+rateyears

Step by step

Solved in 2 steps

- Define the stated (quoted) or nominal rate INOM as well as the periodic rate IPER. Will the future value be larger or smaller if we compound an initial amount more often than annually—for example, every 6 months, or semiannually—holding the stated interest rate constant? Why? What is the future value of $100 after 5 years under 12% annual compounding? Semiannual compounding? Quarterly compounding? Monthly compounding? Daily compounding? What is the effective annual rate (EAR or EFF%)? What is the EFF% for a nominal rate of 12%, compounded semiannually? Compounded quarterly? Compounded monthly? Compounded daily?Suppose we have the following Treasury bill returns and inflation rates over an eight year period: Year Treasury Bills Inflation 1 10.45% 12.55% 2 11.36 16.00 3 9.06 10.29 4 8.34 7.97 5 8.88 10.29 6 11.23 12.77 7 14.11 16.98 8 15.97 16.90 a. Calculate the average return for Treasury bills and the average annual inflation rate for this period. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bills % Inflation % b. Calculate the standard deviation of Treasury bill returns and inflation over this period. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Treasury bills % Inflation %…Assume that, for a three year period, the yearly inflation rate is 10% in the firstyear, 12% in the second year and 6% in the third year. During these three years, if the yearlymarket interest rate is 15% compounded monthly, compute the average inflation-free interestrate per quarter for this three year period

- Suppose that you borrow $42,500 at 11.4%compounded monthly over seven years. Knowingthat the 11.4% represents the market interest rate, yourealize that the monthly payment in actual dollars willbe $736.67. If the average monthly general inflationrate is expected to be 0.6%, determine the equivalentequal monthly payment series in constant dollars.Suppose that you borrow $60,000 at 9% compounded monthly over five years. Knowing that the 9% represents the market interest rate, you compute the monthly payment in actual dollars as $1,245.51. If the average monthly general inflation rate is expected to be 0.25%, determine the equivalent equal monthly payment series in constant dollars.Consider the following table for an eight-year period: Year T-bill return Inflation 1 7.47 % 8.53 % 2 8.94 12.16 3 6.05 6.76 4 5.97 5.04 5 5.63 6.52 6 8.54 8.84 7 10.74 13.11 8 13.00 12.34 Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Average return for Treasury bills % Average annual inflation rate % Calculate the standard deviation of Treasury bill returns and inflation over this time period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Standard deviation of Treasury bills % Standard deviation of inflation % Calculate the real return for each year. (A negative answer should be indicated by a minus sign. Leave no cells…

- The annual inflation rate is expected to be 4.78% and the nominal (annual) interest rate is 5.75%. What is the real interest rate?1, Consider the following table for an eight-year period: Year T-bill return Inflation 1 7.47% 8.53% 2 8.94 12.16 3 6.05 6.76 4 5.97 5.04 5 5.63 6.52 6 8.54 8.84 7 10.74 13.11 8 13.00 12.34 a, Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. b, Calculate the standard deviation of Treasury bill returns and inflation over this time period. c, Calculate the real return for each year. d, What is the average real return for Treasury bills?Based on economists’ forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 0.90 % E(2r1) = 2.05 % L2 = 0.09 % E(3r1) = 2.15 % L3 = 0.12 % E(4r1) = 2.45 % L4 = 0.14 % Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

- Based on economists’ forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 2.00 % E(2r1) = 2.90 % L2 = 0.06 % E(3r1) = 3.30 % L3 = 0.08 % E(4r1) = 3.75 % L4 = 0.13 % Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Based on economists’ forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 2.00 % E(2r1) = 2.90 % L2 = 0.06 % E(3r1) = 3.30 % L3 = 0.08 % E(4r1) = 3.75 % L4 = 0.13 % Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Years Current (Long-term) Rates 1 % 2 % 3 % 4 %Which one is the approximate periodic interest rate % on a Treasury bill that you purchase for 4,908 $ that will mature in 270 days for 5,000 $? (Assume one year is 360 days)Based on economists forecasts and analysis, one-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: 1R1 = 0.50% E(21) = 0.88%L2 = 0.06%E(3г 1) = 0.98%L3 = 0.13%E(4r1) = 1.28%L4 = 0.16% Calculate the yield to maturity for four years