Consider the following situation. It costs $1.2900 to purchase £1 for immediate delivery. UK interest rates are 0.75% p.a. US interest rates are 1.5% p.a. What must be the 1 year forward rate at which you can purchase £ with $? Assume that there is no default risk, no transaction costs, no bid-ask spreads, etc. Provide your answer to 4 decimatplaces, for example, if you think the answer is 1.2900 $/£, enter '1.2900' Answer:

Consider the following situation. It costs $1.2900 to purchase £1 for immediate delivery. UK interest rates are 0.75% p.a. US interest rates are 1.5% p.a. What must be the 1 year forward rate at which you can purchase £ with $? Assume that there is no default risk, no transaction costs, no bid-ask spreads, etc. Provide your answer to 4 decimatplaces, for example, if you think the answer is 1.2900 $/£, enter '1.2900' Answer:

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 57QA

Related questions

Question

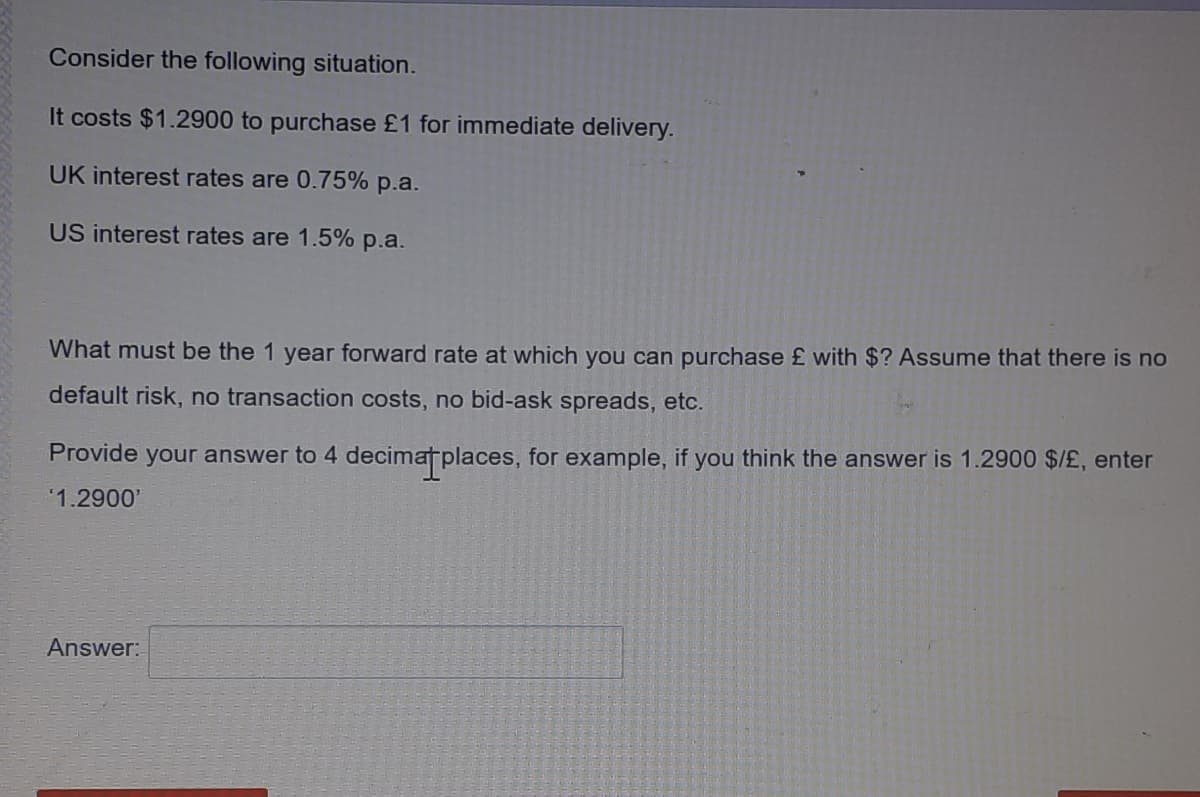

Transcribed Image Text:Consider the following situation.

It costs $1.2900 to purchase £1 for immediate delivery.

UK interest rates are 0.75% p.a.

US interest rates are 1.5% p.a.

What must be the 1 year forward rate at which you can purchase £ with $? Assume that there is no

default risk, no transaction costs, no bid-ask spreads, etc.

Provide your answer to 4 decimatplaces, for example, if you think the answer is 1.2900 $/£, enter

'1.2900'

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you