Consider the following table, which gives a security analyst's expected return on two stocks and the market index in two scenarios: Scenario 1 2 Probability Market Return 0.5 0.5 Beta A Beta D 5% 20 Rate of return on A Rate of return on D Aggressive Stock 2% Required: a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) 32 % % Defensive Stock 3.5% 14 b. What is the expected rate of return on each stock? (Round your answers to 2 decimal places.)

Consider the following table, which gives a security analyst's expected return on two stocks and the market index in two scenarios: Scenario 1 2 Probability Market Return 0.5 0.5 Beta A Beta D 5% 20 Rate of return on A Rate of return on D Aggressive Stock 2% Required: a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) 32 % % Defensive Stock 3.5% 14 b. What is the expected rate of return on each stock? (Round your answers to 2 decimal places.)

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 8PROB

Related questions

Question

100%

Subject :- Accounting

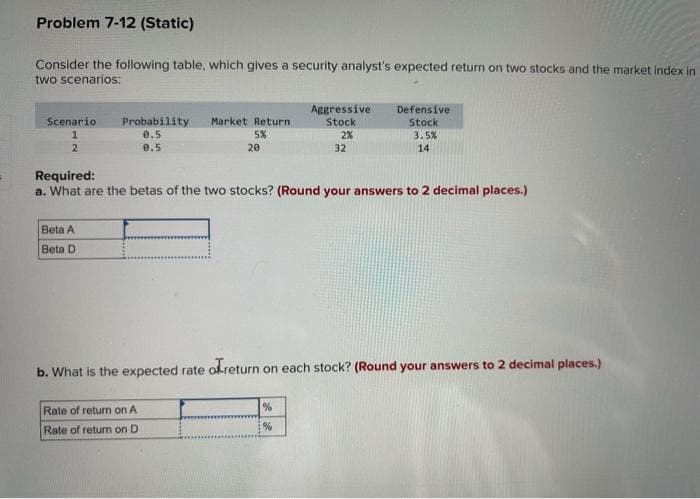

Transcribed Image Text:Problem 7-12 (Static)

Consider the following table, which gives a security analyst's expected return on two stocks and the market index in

two scenarios:

Scenario

1

2

Probability Market Return

0.5

0.5

Beta A

Beta D

5%

20

Rate of return on A

Rate of return on D

Aggressive

Stock

2%

Required:

a. What are the betas of the two stocks? (Round your answers to 2 decimal places.)

32

%

%

Defensive

Stock

3.5%

14

b. What is the expected rate of return on each stock? (Round your answers to 2 decimal places.)

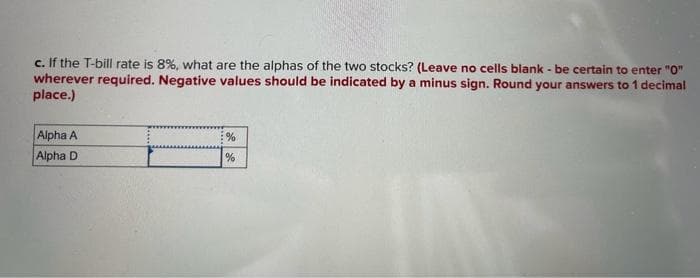

Transcribed Image Text:c. If the T-bill rate is 8%, what are the alphas of the two stocks? (Leave no cells blank - be certain to enter "0"

wherever required. Negative values should be indicated by a minus sign. Round your answers to 1 decimal

place.)

Alpha A

Alpha D

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you