Consider three securities that will pay risk-free cash flows over the next three years and that have the current market prices shown here: Security Name Price Today ($) Cash Flow in Cash Flow in Cash Flow in One Year ($) Two Years ($) Three Years ($) B1 $92.42 100 B2 $84.32 100 500 B3 $382.92 Calculate the no-arbitrage price, or the price that eliminates any arbitrage opportunities, of a new security, B4, that pays risk-free cash flows of $500 in one year and $1,000 in three years. The current no-arbitrage price of Security B4 is:

Consider three securities that will pay risk-free cash flows over the next three years and that have the current market prices shown here: Security Name Price Today ($) Cash Flow in Cash Flow in Cash Flow in One Year ($) Two Years ($) Three Years ($) B1 $92.42 100 B2 $84.32 100 500 B3 $382.92 Calculate the no-arbitrage price, or the price that eliminates any arbitrage opportunities, of a new security, B4, that pays risk-free cash flows of $500 in one year and $1,000 in three years. The current no-arbitrage price of Security B4 is:

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 22SP

Related questions

Question

Transcribed Image Text:uestion

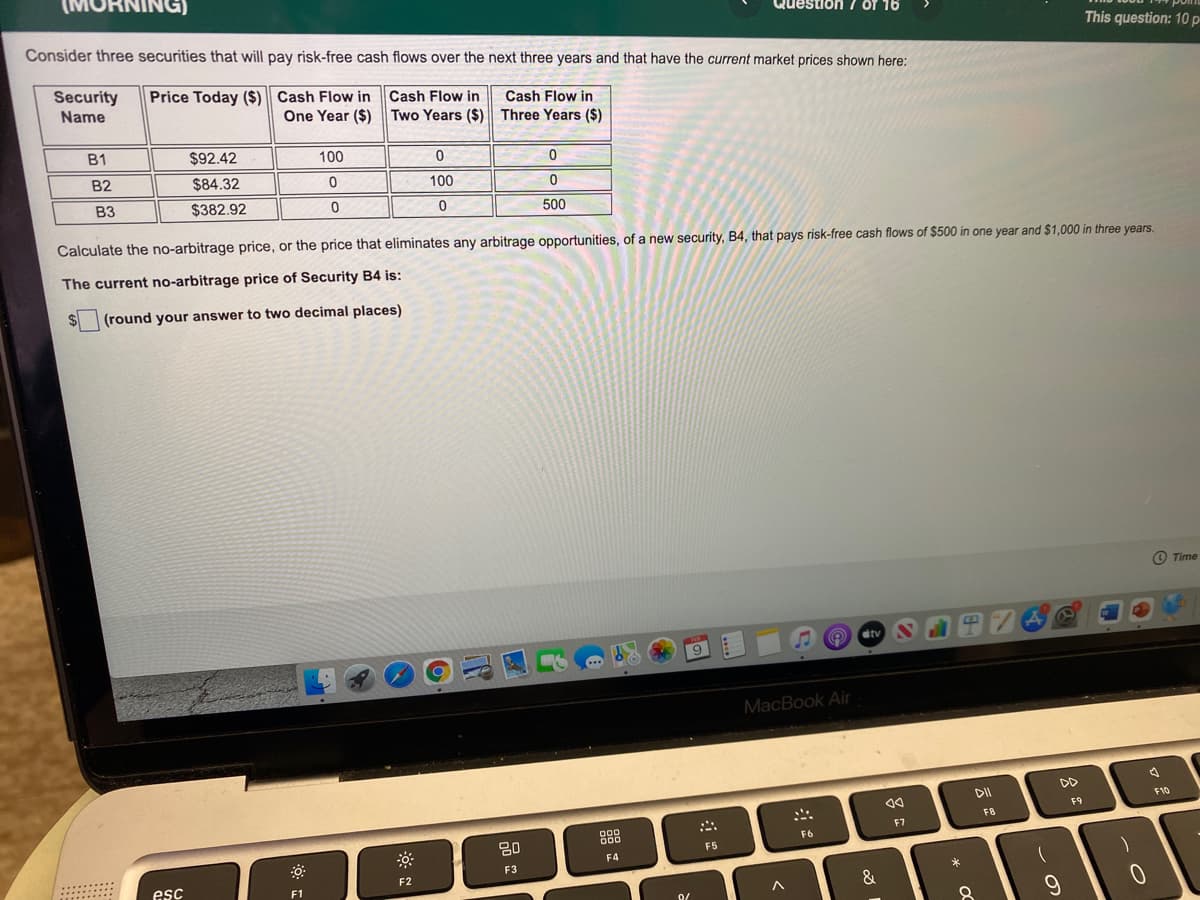

Consider three securities that will pay risk-free cash flows over the next three years and that have the current market prices shown here:

This question: 10p

Security

Price Today ($) Cash Flow in

Cash Flow in

Cash Flow in

Two Years ($) Three Years ($)

Name

One Year ($)

B1

$92.42

100

B2

$84.32

100

B3

$382.92

500

Calculate the no-arbitrage price, or the price that eliminates any arbitrage opportunities, of a new security, B4, that pays risk-free cash flows of $500 in one year and $1,000 in three years.

The current no-arbitrage price of Security B4 is:

(round your answer to two decimal places)

O Time

tv

9

MacBook Air

DD

DII

F10

F9

F8

888

F7

80

F6

F5

F4

F3

esc

F2

F1

&

* OC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning