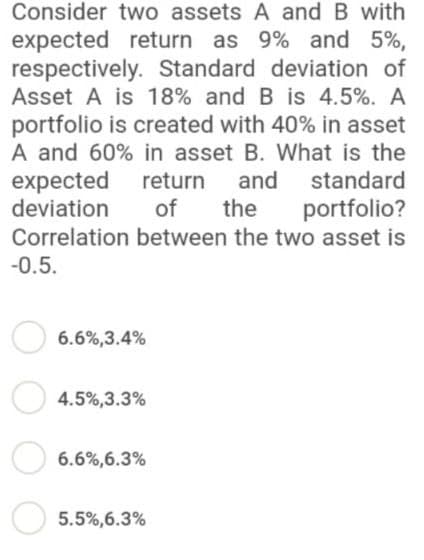

Consider two assets A and B with expected return as 9% and 5%, respectively. Standard deviation of Asset A is 18% and B is 4.5%. A portfolio is created with 40% in asset A and 60% in asset B. What is the expected return and standard portfolio? deviation of the Correlation between the two asset is -0.5. 6.6%,3.4% 4.5%,3.3% 6.6%,6.3% 5.5%,6.3%

Q: If a firm has a P/E ratio of 15, and a ROE of 14 %, what is the market to book value of equity?

A: Long-term Solvency: Long-term solvency shows the strength and the ability of the company to pay its…

Q: You purchased a laptop computer worth PhP 37,500 by a 30% down payment and agreed to repay the…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: Compare which alternative which prefer using multiple attribute individual analysis present worth…

A: Since the life of both alternatives are different, we cannot diretcly base our decision on Present…

Q: The common stock and debt of Northern Sludge are valued at $62 million and $38 million,…

A: Here, Value of Common Stock is $62 million Value of Debt is $38 million Return on Equity is 16.8%…

Q: nd yo What annual rate of return did you earn of your investment?

A: Annual Rate of Return: It represents the annual rate made on investment or charged annually on a…

Q: implicity it is nterest-only loan. Without using mortgages, the equity investment return rate is…

A: Rate of return is the profit generated on the investment in the property but there is payment of…

Q: Assume that the interest rate in the Japan is 6% and that the Yen is expected to depreciate by 2%…

A: Given: Interest rate in Japan = 6% Yen will depreciate 2% against AUD Amount invested = 1 AUD

Q: rate of return of the bond? W

A: Bond price refers to the amount which an investor is willing to pay at the time of existence of…

Q: step by step

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts…

Q: years and a t for the firs 201

A: On a financial statement, a capitalised cost is an item that is added to the cost base of a fixed…

Q: Red Fire has a Debt/Equity Ratio of .15, and Equity Multiplier of 1.15, a return on sales of 6.4,…

A: Here, Debt Equity Ratio is 0.15 Equity Multiplier is 1.15 Return on Sales is 6.4 Asset Turnover is…

Q: Assume that K=61, St =65, t = 0.25 (i.e. time to expiry is 3 months), and the risk-free rate is…

A: Strike price K is 61 Spot Price S is 65 Time t is 0.25 Risk free rate is 4% Current price of Put…

Q: Finance A financial instrument provides three future cash flows: $1,710.00 at the end of 3 years…

A: Duration of bond is amount of period required to recover the investment in bond considering the…

Q: 1) Mrs. Teresa bought P45.80 worth of groceries and P27.75 vegetables. How much change did she…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Consider the valuation of a share of common stock that paid a $2 dividend at the end of last year…

A: Dividend discount model refers to a stock valuation model which is used by the company for…

Q: money call option on a given stock must cost more than an at-the-money put option on that stock with…

A: The buyer is given the right, but not the responsibility, to purchase the underlying asset by a…

Q: Which ones are quantitative variables? Motel ID Indoor pool Competitor rooms Office space Distance…

A: Qualitative Variables : Variables that don't have measurement variables are called qualitative…

Q: The GBPUSD exchange rate was $1.4500 per pound on June 10, 2021. The GBPUSD exchange rate today is…

A: The foreign exchange rate is rate of one currency with respect to other currency and it will be also…

Q: Q2(a) There are two stocks in the market, Stock A and Stock B. The price of Stock A today is GHe 79.…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: What are the benefits of merging and diversifying one's assets in order to lower one's risk?

A: Diversification is a process of combining different types of assets with lower correlation in order…

Q: Payback period is the time in which the initial cost of an investment is expected to be recovered…

A: The payback period is the time it takes to repay the cost of an investment or to reach the breakeven…

Q: Compute the NPV for Project M if the appropriate co

A: Net Present Value: It is a measure of absolute profitability applied in the areas of capital…

Q: he yield-to-maturity of a typical corporate bond, relative to a US Treasury bond with the same…

A: Corporate Bond: It is a debt security issued by the company to raise capital from the investors.…

Q: What is financial intermediation. Provide a detailed example

A: In a financial market, apart from borrowers/ buyers and sellers/ lenders, other participants…

Q: ILLUSTRATE THE VARIOUS COST CLASSIFICATIONS. (PLEASE INCLUDE PHOTOS OR TEXT FOR THE EXPLANATION)…

A: Cost - Cost is that Value of any business / product which was directly or indirectly influenced with…

Q: pected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 Required: a. If…

A: The dividend discount model is a computational method for forecasting the value of a entity's…

Q: You bought 100 shares of stock at $25 each. At the end of year 1 you received $300 in dividends and…

A: Rate of return on stock In case of stock, the purchase price of stock is the investment or cash…

Q: 5-21. Determine the FW of the following engineering project when the MARR is 10% per year. Is the…

A: Future value of a present value is the value of that amount after taking into account the time value…

Q: yellow Fire had Net Income for the year just ended of $1,850, and the firm paid out $500 in cash…

A: Net Income is of $1,850 Cash dividend paid are $500 Common shares out standing are 10,000 Current…

Q: ree to repay with 5% one-time interest. H Ich will you have to repay?

A: Each loan carries the interest rate and that much interest is to be paid on the loan. That is one…

Q: ZLX is seeking a bank to place short-term deposits at a good rate. Bank A is offering 3.5% APR…

A: EAR stands for an effective annual rate, which is used to calculate the real adjusted necessary…

Q: Compute the payback period statistic for Project X and recommend whether the firm should accept or…

A: Payback Period: It is the period in which the project or investment returns its initial cost of…

Q: 1. Plans qualifying for preferential tax treatment must meet minimum participation and vesting…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: CAM Precision Sdn. Bhd. is an advanced manufacturing company listed in Top 100 hi- n global ranking.…

A: Investment RM(200*1,000)+15000 Interest Rate 8% Time Period 4 1b) Interest…

Q: What is a capital budgeting technique that generates decision rules and associated metrics for…

A: The capital budgeting technique help to evaluate the acceptibility and rejection of a particular…

Q: 7. A sports equipment company issued a $6 cumulative preferred stock issue. In 2010 the firm's board…

A: 7. Cumulative preferred stock-It is a type of preferred stock in which the holders are entitled to…

Q: The US inflation rate is steady at 6.1%. If John expects an amount of USD 200,000.00 for his…

A: Purchasing power is value of money today considering the impact of inflation today.

Q: yen would you n

A: Exchange of currency also called Forex exchange refers to the trading of one currency with…

Q: 3. Beverly and Kyle Nelson currently insure their cars with separate companies paying $450 and $375…

A: The future value of the annual savings needs to be computed over ten years at 6% annual interest…

Q: Project M requires an initial outlay at t = 0 of $66,607, its expected cash inflows are $12,000 per…

A: Internal rate of return (IRR) of an alternative refers to the rate at which the Net present value…

Q: (i) Determine how much will his daughter be able to withdraw each year starting in year 18 and…

A: In step 1, calculate the amount that is saved till year 17 .i.e the future value of the annuity of…

Q: Shortening the cash conversion cycle always enhances the shareholder value

A: The cash conversion cycle is simply a statistic that assesses how long it takes a firm to convert…

Q: Calculate the NPV for each case for this project

A: Net Present Value: It represents the project's or investment's profitability in absolute dollars.…

Q: With an interest rate of 5 percent per year, what is the present value on December 31, 2020 of…

A: Present value= amount/ (1+r)^n Therefore, Present value = 400/(1.05)^1 + 400/(1.05)^2 +…

Q: Today is the morning of Jan 2, Year 5. XYZ Inc has exchange-listed convertible bonds outstanding.…

A: Bonds are the debt obligations of a business on which it requires to pay regular interest to the…

Q: A stock price is currently $60. Over each of the next two six-month periods, it is expected to go up…

A: A binomial tree is a graphical depiction of the potential inherent values of an option at various…

Q: security pays the holder $100 per month. What is the present value of the security if the next…

A: Amount per payment= 100$ Rate = 9% i = 9/12 = 0.75 n = 36

Q: certain central bank from 2000 to from 2000 to 2016 the average price of a new home in a certain…

A: Solution:- Percentage increase means the rise in price in the base price.

Q: Carl Patterson ikes investing in stocks that pay dividends. Cari owns 100 shares of a local utility…

A: First we need to calculated future value of annuity factor by using this formula Future value…

Q: O Diversification; high equity returns

A: Financial intermediaries are the persons or institutions working as a third party between lender…

Step by step

Solved in 2 steps

- Four assets have the following distribution of returns. Probability Rate of return (%)Occurrence A B C D0.1 10.0 6.0 14.0 2.00.2 10.0 8.0 12.0 6.00.4 10.0 10.0 10.0 9.00.2 10.0 12.0 8.0 15.00.1 10.0 14.0 6.0 20.0 In each asset alculate The expected rate of return, standard deviation, variance coefficient of variationSuppose the returns on an asset are normally distributed. The historical average annual return for the asset was 6.4 percent and the standard deviation was 12.4 percent. A. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) B. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)Suppose the average return on Asset A is 6.6 percent and the standard deviation is 8.6 percent and the average return and standard deviation on Asset B are 3.8 percent and 3.2 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.25 percent. How likely is it that such a low return will recur at some point in the future? (Do…

- The expected value, standard deviation of returns, and coefficient of variation for asset A are 9.33%, 8% and 2.15 respectively 9.35%, 2.76% and 0.295 respectively 9.35%, 4.68% and 2 respectively 10%, 8% and 1.25 respectivelySuppose the returns on an asset are normally distributed. The historical average annual return for the asset was 5.7 percent and the standard deviation was 18.3 percent. a. What is the probability that your return on this asset will be less than –4.1 percent in a given year? Use the NORMDIST function in Excel® to answer this question. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations…If the profit margin is 0.1142, asset turnover is 0.5619 and financial leverage is 1.2937, what is the return on asset? Multiple Choice 0.1142 0.7269 0.0830 0.0642

- Over a particular period, an asset had an average return of 11.6 percent and a standard deviation of 20.0 percent. What range of returns would you expect to see 95 percent of the time for this asset? (A negative answer should be indicated by a minus sign. Input your answers from lowest to highest to receive credit for your answers. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)uppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…You have data on the following assets: asset Expected return Standard DeviationA 15.0% 21.0%B 15.5% 20.2%C 18.0% 25.0% Calculate the coefficient of variation for each of the assets. Which one is the best investment option?

- Assume that you have obtained the following information for Asset A: Rate of Return Probability 5.5% 25% 7.25% 55% 11% 20% Compute the expected rate of return for Asset A, using the information provided in thechart above Assume that the standard deviation of the expected returns for Asset A is 1.87%. With information and the expected rate of return that you calculated for Asset A in Part A of this problem, compute the co-efficient of variation for Asset A.Which of the following assets dominates Asset X that has 9% expected return andstandard deviation of 11% according to the mean-variance criterion? Asset V: 9.4% expected return, 10% standard deviation Asset R: 8.5% expected return, 7% standard deviation Risk-free asset: 3% expected return, 0% standard deviation Asset S: 11.2% expected return, 14% standard deviationConsider the case of two financial assets and three market conditions (states). The tablebelow gives the respective probability for each market condition and the return of each assetin each one of them. Market Conditions state Recession Normal Expansion Probability of state 30% 40% 30% Return of asset A -30% 20% 55% Return of asset B -10% 70% 0% Estimate the equation of the efficiency frontier.