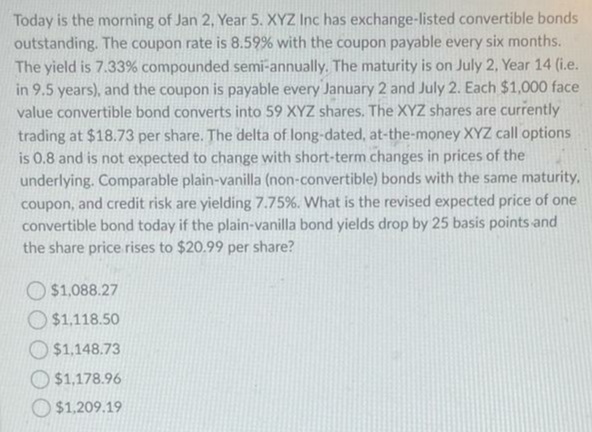

Today is the morning of Jan 2, Year 5. XYZ Inc has exchange-listed convertible bonds outstanding. The coupon rate is 8.59% with the coupon payable every six months. The yield is 7.33% compounded semi-annually. The maturity is on July 2, Year 14 (i.e. in 9.5 years), and the coupon is payable every January 2 and July 2. Each $1,000 face value convertible bond converts into 59 XYZ shares. The XYZ shares are currently trading at $18.73 per share. The delta of long-dated, at-the-money XYZ call options is 0.8 and is not expected to change with short-term changes in prices of the underlying. Comparable plain-vanilla (non-convertible) bonds with the same maturity. coupon, and credit risk are yielding 7.75%. What is the revised expected price of one convertible bond today if the plain-vanilla bond yields drop by 25 basis points and the share price rises to $20.99 per share? $1,088.27 $1,118.50 $1,148.73 $1,178.96 $1,209.19

Today is the morning of Jan 2, Year 5. XYZ Inc has exchange-listed convertible bonds outstanding. The coupon rate is 8.59% with the coupon payable every six months. The yield is 7.33% compounded semi-annually. The maturity is on July 2, Year 14 (i.e. in 9.5 years), and the coupon is payable every January 2 and July 2. Each $1,000 face value convertible bond converts into 59 XYZ shares. The XYZ shares are currently trading at $18.73 per share. The delta of long-dated, at-the-money XYZ call options is 0.8 and is not expected to change with short-term changes in prices of the underlying. Comparable plain-vanilla (non-convertible) bonds with the same maturity. coupon, and credit risk are yielding 7.75%. What is the revised expected price of one convertible bond today if the plain-vanilla bond yields drop by 25 basis points and the share price rises to $20.99 per share? $1,088.27 $1,118.50 $1,148.73 $1,178.96 $1,209.19

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:Today is the morning of Jan 2, Year 5. XYZ Inc has exchange-listed convertible bonds

outstanding. The coupon rate is 8.59% with the coupon payable every six months.

The yield is 7.33% compounded semi-annually. The maturity is on July 2, Year 14 (i.e.

in 9.5 years), and the coupon is payable every January 2 and July 2. Each $1,000 face

value convertible bond converts into 59 XYZ shares. The XYZ shares are currently

trading at $18.73 per share. The delta of long-dated, at-the-money XYZ call options

is 0.8 and is not expected to change with short-term changes in prices of the

underlying. Comparable plain-vanilla (non-convertible) bonds with the same maturity,

coupon, and credit risk are yielding 7.75%. What is the revised expected price of one

convertible bond today if the plain-vanilla bond yields drop by 25 basis points and

the share price rises to $20.99 per share?

O $1,088.27

O $1.118.50

$1,148.73

O $1,178.96

O $1,209.19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College