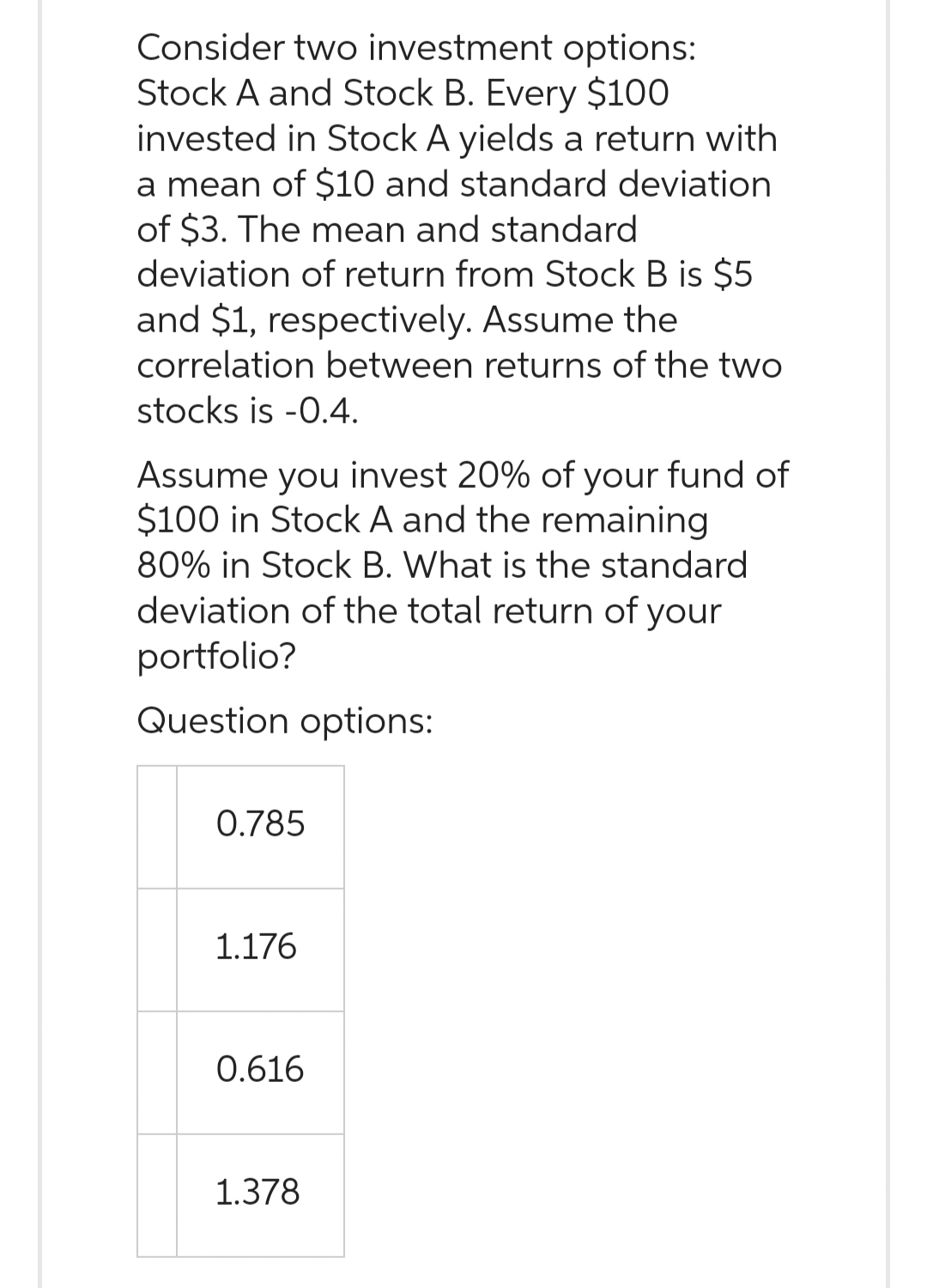

Consider two investment options: Stock A and Stock B. Every $100 invested in Stock A yields a return with a mean of $10 and standard deviation of $3. The mean and standard deviation of return from Stock B is $5 and $1, respectively. Assume the correlation between returns of the two stocks is -0.4. Assume you invest 20% of your fund of $100 in Stock A and the remaining 80% in Stock B. What is the standard deviation of the total return of your portfolio? Question options: 0.785 1.176 0.616 1.378

Consider two investment options: Stock A and Stock B. Every $100 invested in Stock A yields a return with a mean of $10 and standard deviation of $3. The mean and standard deviation of return from Stock B is $5 and $1, respectively. Assume the correlation between returns of the two stocks is -0.4. Assume you invest 20% of your fund of $100 in Stock A and the remaining 80% in Stock B. What is the standard deviation of the total return of your portfolio? Question options: 0.785 1.176 0.616 1.378

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Please do not give solution in image formate thanku.

Transcribed Image Text:Consider two investment options:

Stock A and Stock B. Every $100

invested in Stock A yields a return with

a mean of $10 and standard deviation

of $3. The mean and standard

deviation of return from Stock B is $5

and $1, respectively. Assume the

correlation between returns of the two

stocks is -0.4.

Assume you invest 20% of your fund of

$100 in Stock A and the remaining

80% in Stock B. What is the standard

deviation of the total return of your

portfolio?

Question options:

0.785

1.176

0.616

1.378

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill