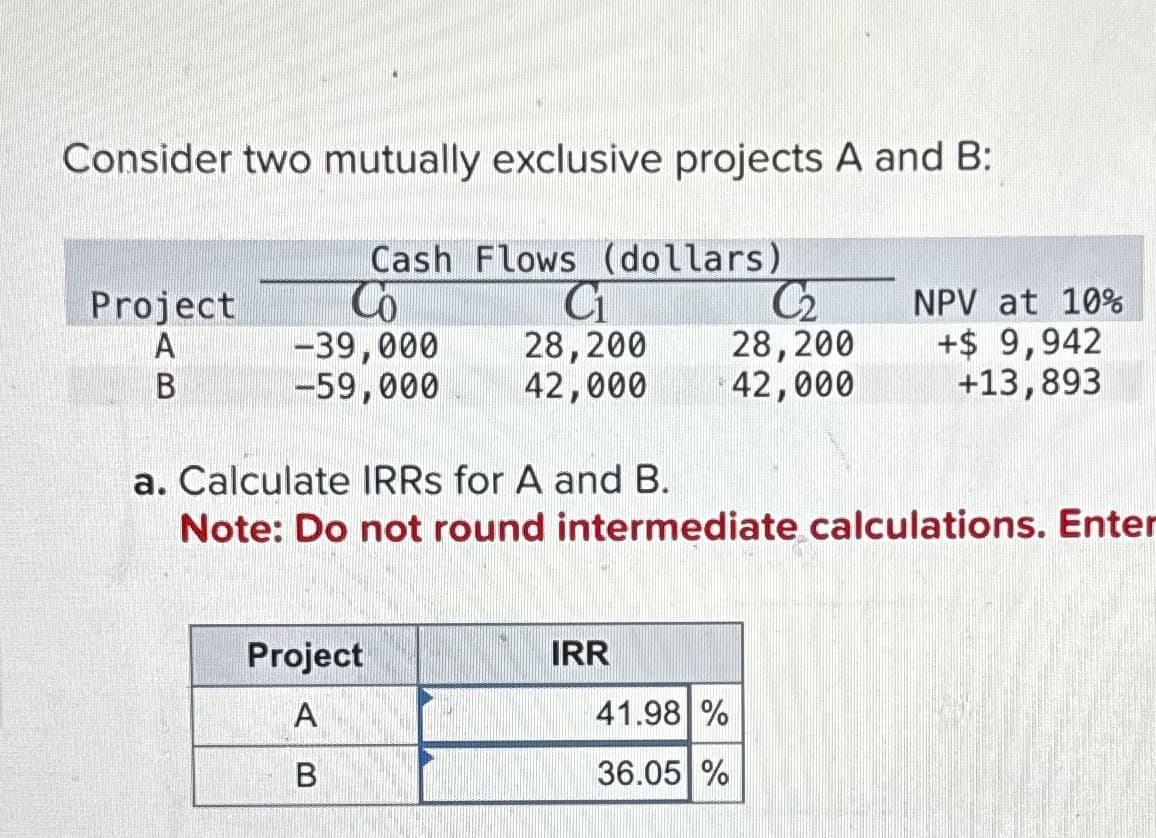

Consider two mutually exclusive projects A and B: Cash Flows (dollars) Project Co C₁ C₂ NPV at 10% A -39,000 28,200 28,200 +$ 9,942 B -59,000 42,000 42,000 +13,893

Q: am. 125.

A: The objective of this question is to determine the time it will take to pay off a student loan given…

Q: Mr. Deneau accumulated $103,000 in an RRSP. He converted the RRSP into a RRIF,and started to…

A: Present value of an annuity:The present value of the cash flow stream of an annuity is calculated by…

Q: We believe we can sell 90,000 home security devices per year at $150 per piece. They cost $130 to…

A: Net Present Value (NPV) is a measure used to analyze the profitability of an investment or project…

Q: You deposit $1,000 into an account every six months to help with your down payment savings for a…

A: Compound Interest = P(1 + r)nP = PrincipleR = Rate of Interest N = Period

Q: Please make an excel spreadsheet and show the formulas in the cells for the problem below and please…

A: To calculate how much money you will make in book after 3 years, we need to break down the…

Q: What would be the background of study for the following research topic: COVID-19 : A Threat to the…

A: The objective of this question is to identify and describe the background of study for the research…

Q: Present and future value tables of $1 at 3% are presented below: N FV S1 PV $1 FVA S1 PVA S1 FVAD S1…

A: Variables in the question:FV=$530000N=7 yearsRate=6% (compounded…

Q: a. Calculate the beta of each stock. (Do not round intermediate calculations and round your answers…

A: Systematic risk is the total risk resulting from global events such as political upheaval or changes…

Q: Cooperton Mining just announced it will cut its dividend from $4.12 to $2.53 per share and use the…

A: Share price refers to the price which is used for buying and selling the stock in the stock market…

Q: Last year, Jackson Tires reported net sales of $60 million and total operating costs (including…

A: The concept of economic value added (EVA), which is a cash basis tax adjusted measure of a…

Q: Stinnett Transmissions, Incorporated, has the following estimates for its new gear assembly project:…

A: Base CaseUnit Sales = 89,000 unitsUnit Price = $1,260Variable Cost = $480Fixed Cost = $4,990,000In…

Q: A 4 % coupon has a maturity of two years and a yield to maturity of 6%. For the first year, interest…

A: The objective of the question is to calculate the realized yield on a bond at its final maturity…

Q: An all-equity financed firm has after-tax cash perpetual flows of $0.3 million each year and the…

A: The WACC is a measure that computes the average cost that the company bears periodically, It…

Q: Approximately what percentage of U.S. corporate equities are held by households? Multiple Choice О…

A: As per the report U.S securities and exchange commission(SEC) approximately 38% of US corporate…

Q: You are a consultant to a large manufacturing corporation considering a project with the following…

A: The NPV of the project refers to the measure of the profitability of the project by discounting the…

Q: The Uptown Investment Club has $50, 000 to invest in the equity market. Chandler advocates investing…

A: A Treynor ratio is a ratio of the difference between the expected return and risk-free rate to the…

Q: XYZ Inc. is deciding whether to buy a new building. The building will increase cash flows by…

A: The Net Present Value (NPV) of the project, assuming it is started today, is $29,081,382.32. …

Q: The Papillon Corporation faces a 22 % income tax rate. First, find the project's estimated unlevered…

A: The unlevered cash flow is the money a business makes from its core activities before deducting…

Q: Lr 1+- r M = 12 1+ 12 12/ L the loan amount in dollars r the annual interest rate t=the number of…

A: Variables in the question:Cost of Jeep=$49530Down payment=5% of cost of JeepN=4 yearsRate=7.15%

Q: As an Investment Analyst who researches and analyses markets, companies, and stocks to be invested…

A: Apple Inc. is one of the most valuable and influential technology companies in the world. Known for…

Q: Ramos Land Management has a target debt - to - value ratio of .45. The pretax cost of debt is 7.4…

A: It is a financial concept that refers to the expected rate of return that a company's shareholders…

Q: Suppose you purchase a $1,000 TIPS on January 1, 2021. The bond carries a fixed coupon of 3 percent.…

A: Coupon paymentsCoupon payments refer to the periodic interest payments that bond issuers make to…

Q: Video Excel Activity: Nonconstant Growth and Corporate Valuation Taussig Technologies Corporation…

A: A stock is a financial instrument that offers the equity interest to the investors and gives them…

Q: Use the information given in Upper Midwest National Bank's balance sheet to answer the following…

A: A leverage ratio is a type of solvency ratio. It is calculated by dividing the total debt by the…

Q: he modified duration for the River Ferry Bond is

A: Modified Duration: The price sensitivity of a bond to changes in interest rates is gauged by its…

Q: A 99-unit apartment building that was acquired for $2.7 million generates a 7.5% before tax annual…

A: Debt service coverage ratio refers to the ratio which is used for measuring the availability of the…

Q: Pascal Company is considering a five-year project that would require a $1,100,000 investment and…

A: Initial investment = $1,100,000Life of the project = 5 yearsTax rate = 34%Discount rate =…

Q: assume an analyst has valued a stock at $59.75 per share. What was the NPV of the firm if there are…

A: Value of stock = $59.75 per shareNumber of shares outstanding = 3,500,000Value of debt = $24,000,000

Q: Multiple Choice Galvatron Metals has a bond outstanding with a coupon rate of 6.5 percent and…

A: Par value$2,000Coupon rate6.50%Years to maturity15Compounding frequency2Bond's price$1,905Tax…

Q: Fey Fashions expects the following dividend pattern over the next seven years: forever. What is the…

A: A stock is a financial instrument that offers equity interest in the company and entitles the…

Q: You want to buy a $243.000 home. You plan to pay 10% as a down payment, and take out a 30 year loan…

A: monthly payment refers to the payment made by the borrower at specified rate of interest until the…

Q: On April 8, Fat Tires Ltd. borrowed $7000.00 with an interest rate of 4.2 %. The loan was repaid in…

A: The objective of the question is to calculate the final payment made by Fat Tires Ltd. to repay a…

Q: You are considering a new product launch. The project will cost $1.675 million, have a four-year…

A: Here,Initial Investment is $1.675 millionsUnit Sales is 195 unitsSales Price is $16,300Cost per unit…

Q: APPL has 25 year semi-annuall coupon bond. If your required rate of return (YTM) is 6.5%, and the…

A: We are tasked with deter6.5mining the current yield (CY) of a 25-year semi-annual coupon bond. The…

Q: On September 30, 2024, the Techno Corporation issued 8% stated rate bonds with a face amount of $160…

A: Bonds payable is a type of instrument where by an amount is borrowed for a fixed period with fixed…

Q: The Taylor Company has an ROA of 9.1 percent, a profit margin of 10.5 percent, and an ROE of 16.5…

A: Total Asset Turnover measures how efficiently a company generates sales from its total assets.…

Q: A newly constructed water treatment facility costs $2 million. It is estimated that the facility…

A: Capitalized cost encompasses all expenses related to obtaining and operating an asset throughout its…

Q: Use the table of cash flows given below for problems 3 and 4. Year Cash Flow 1 $1,965 2 $1,235 3…

A: Present value refers to the current value of the future cash flow. It can be determined by…

Q: Your portfolio has two investments with a correlation of 0.4. Investment #1 is 35% of your portfolio…

A: The correlation coefficient of the two investments is 0.4Investment 1 is 35% of the portfolio and…

Q: For how long will Zack have to make payments of $114.00 at the end of every six months to repay a…

A: Loan amount = $3,460.00Semi-annual payment = $114.00Interest rate = 4%

Q: Imagine the current discount rate is 3%. In 75 years, there is an equally likely chance that th…

A: Certainty equivalent is that discount rate that is most likely and would be certain to be achieved…

Q: On average, the expected return on debt is lower than the expected return on equity because equity…

A: Expected return is the theoretical measure of future profitability calculated by the return of the…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: The NPV is the best tool among other under-capital budgeting techniques that can be used for finding…

Q: You have $3,000 on a credit card that charges a 20% interest rate. If you want to pay off the credit…

A: Compound = Monthly = 12Present Value of Payment = pv = $3000Interest Rate = r = 20 / 12 %Time = t =…

Q: A 20-year maturity, 6.5% coupon bond paying coupons semiannually is callable in five years at a call…

A: Yield to Maturity : Yield to Maturity refers to the rate of return of a bond. It is the percentage…

Q: Suppose you invest $4,000 in an account that pays 8.25% interest per year, compounded quarterly. (a)…

A: Time value of money is a financial concept which is used to analyze various investments and…

Q: You wish to evaluate a project req project earns $12,900 per year, wh The minimum annual cash inflow

A: Given: ParticularsAmountInitial investment (PV)$60,100Life (NPER)7Cost of capital (Rate)8.20%Amount…

Q: Gillette Corporation will pay an annual dividend of $0.61 one year from now. Analysts expect this…

A: The constant growth model is a stock valuation method used in finance to determine a stock's…

Q: Baghiben

A: The objective of this question is to find the optimal rent that the owner should charge to maximize…

Q: Cori's Dog House is considering the installation of a new computerized pressure cooker for hot dogs.…

A: The net present value is the difference between the PV of all cash flows and the initial…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project S requires an initial outlay at t = 0 of 17,000, and its expected cash flows would be 5,000 per year for 5 years. Mutually exclusive Project L requires an initial outlay at t = 0 of 30,000, and its expected cash flows would be 8,750 per year for 5 years. If both projects have a WACC of 12%, which project would you recommend? Explain.Projects A and B have the following cash flows: End-of-Year Cash Flows 0 1 2Project A − $1,000 $1,150 $100Project B − $1,000 $100 $1,300Their cost of capital is 10%.Q UESTIO NS:a. What are the projects’ NPVs, IRRs, and MIRRs?b. Which project would each method select if the projects were mutually exclusive?Calculate IRR of projects S and L, IRRS & IRRL IRRS IRRL UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFS ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360

- CRAYON corporation has identified the following two mutually exclusive projects: YEAR Cash flow ( A) Cash flow ( B) 0 -$300,000 -$300,000 1 68,950 135,000 2 83,900 105,500 3 93,200 75,000 4 105,600 55,600 5 115,600 45,600 What is the IRR for each of this project (range: 10-16%)? Using the IRR decision rule, which project should the company accept? How do you interpret IRR of a project? If the required return is 15%, what is the NPV of these projects? Which project will the company choose if it applies the NPV decision rule? How do you interpret NPV of a project? Calculate the Payback period and discounted pay back period of these projects! Which project should the company accept? What are the differences of payback period and discounted payback…Consider the following two mutually exclusive projects: Year Cash Flow Cash Flow B 0 -$318,844 -$27,476 1 27,700 9,057 2 56,000 10,536 3 55,000 11,849 4 399,000 13,814 The required return is 15 percent for both projects. Which one of the following statements related to these projects is correct? A. Because both the IRR and the PI imply accepting Project B, that project should be accepted.B. The profitability rule implies accepting Project A.C. The IRR decision rule should be used as the basis for selecting the project in this situation.D. Only NPV implies accepting Project A.E. NPV, IRR, and PI all imply accepting Project A.Consider the following two mutually exclusive projects: Year Cashflow (a) Cashflow (b) 0 - $318,844 -$27,476 1 $27,700 $9,057 2 $56,000 $10,536 3 $55,000 $11,849 4 $399,000 $13,814 The required return is 15 percent for both projects. Which one of the following statements related to these projects is correct?A. Because both the IRR and the PI imply accepting Project B, that project should be accepted.B. The profitability rule implies accepting Project A.C. The IRR decision rule should be used as the basis for selecting the project in this situation.D. Only NPV implies accepting Project A.E. NPV, IRR, and PI all imply accepting Project A.

- Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 28,000 −$ 28,000 1 13,400 3,800 2 11,300 9,300 3 8,700 14,200 4 4,600 15,800 a-1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. If the required return is 10 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. At what discount rate would the company be indifferent between these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 –$ 28,700 –$ 28,700 1 14,100 4,150 2 12,000 9,650 3 9,050 14,900 4 4,950 16,500 a-1 What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2 Using the IRR decision rule, which project should the company accept? Project A Project B a-3 Is this decision necessarily correct? Yes No b-1 If the required return is 12 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2 Which project will the company choose if it applies the NPV decision rule? Project A Project B c.…Consider the following two mutually exclusive projects: Year Cash Flow Cash Flow (X) (Y) 0 -$20,800 -$20,800 1 9,050 10,500 2 9,500 8,000 3 9,000 8,900 IRR Project X: 15.49% Project Y: 15.69% What is the crossover rate for these two projects? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Crossover rate ______%

- Consider two mutually exclusive projects, A and B, whose costs and cash flows areshown in the following table:Year Project A Project B1 $(14,000) $(22,840)2 8,000 8,0003 6,000 8,0004 2,000 8,0005 3,000 8,000Calculate the cross over rate. Please use equations and not excelA company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 01234 Project S-$1,000$869.10$260$5$10Project L-$1,000$0$250$420$831.87 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.Consider the following two sets of project cash flows:Project Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6DiscountRateX -903 175.6 169.8 201.4 251.5 299.2 305.2 0.1037Y -513 190.5 195.5 90.5 80.5 85.5 110.5 0.1037A) Assume that projects X and Y are mutually exclusive. The correct investment decision andthe best rational for that decision is to:i) invest in Project Y since IRRY > IRRX.ii) invest in Project Y since NPVY > NPVX.iii) neither of the above.B) What are the incremental IRR and NPV of Project X?C) Is the use of the incremental measures in B) appropriate to your evaluation of thepreferred project? Explain.D) Which is the preferred project? Explain and justify the basis for your choice.(6 marks)2) Due to the demands of the new ATO Single Tough Reporting System, a successful manufacturingcompany is assessing the introduction of a new computer system to improve regulatory reportingcompliance. The managing director wants to install a new Pay Perfect system, whereas the…