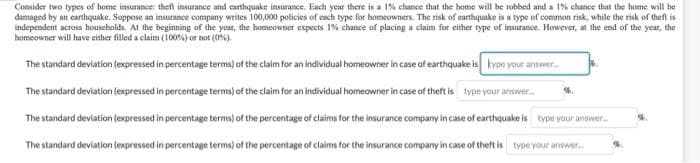

Consider two types of home insurance: theft insurance and carthquake insurance. Each year there is a 1% chance that the home will be robbed and a 1% chance that the home will be damaged by an earthquake. Suppose an insurance company writes 100,000 policies of cach type for homeowners. The risk of earthquake is a type of common risk, while the risk of theft is independent across households. At the beginning of the year, the homeowner expects 1% chance of placing a claim for either type of insurance. However, at the end of the year, the homeowner will have either filled a claim (100%) or not (0%). The standard deviation (expressed in percentage terms) of the claim for an individual homeowner in case of earthquake is kype your answer. The standard deviation (expressed in percentage terms) of the claim for an individual homeowner in case of theft is type your answer. The standard deviation (expressed in percentage terms) of the percentage of claims for the insurance company in case of earthquake is type your answer. The standard deviation (expressed in percentage terms) of the percentage of claims for the insurance company in case of theft is type your answer.

Consider two types of home insurance: theft insurance and carthquake insurance. Each year there is a 1% chance that the home will be robbed and a 1% chance that the home will be damaged by an earthquake. Suppose an insurance company writes 100,000 policies of cach type for homeowners. The risk of earthquake is a type of common risk, while the risk of theft is independent across households. At the beginning of the year, the homeowner expects 1% chance of placing a claim for either type of insurance. However, at the end of the year, the homeowner will have either filled a claim (100%) or not (0%). The standard deviation (expressed in percentage terms) of the claim for an individual homeowner in case of earthquake is kype your answer. The standard deviation (expressed in percentage terms) of the claim for an individual homeowner in case of theft is type your answer. The standard deviation (expressed in percentage terms) of the percentage of claims for the insurance company in case of earthquake is type your answer. The standard deviation (expressed in percentage terms) of the percentage of claims for the insurance company in case of theft is type your answer.

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section11.8: Probabilities Of Disjoint And Overlapping Events

Problem 2C

Related questions

Question

Transcribed Image Text:Consider two types of home insurance: theft insurance and carthquake insurance. Each year there is a 1% chance that the home will be robbed and a 1% chance that the home will be

damaged by an canhquake. Suppose an insurance company writes 100,000 policies of each type for homeowners. The risk of earthquake is a type of common risk, while the risk of theft is

independent across households. At the beginning of the year, the homeowner expects 1% chance of placing a claim for either type of insurance. However, at the end of the year, the

homeowner will have either filled a claim (100%) or not (0%).

The standard deviation (expressed in percentage terms) of the claim for an individual homeowner in case of earthquake is kype your answer

The standard deviation (expressed in percentage terms) of the claim for an individual homeowner in case of theft is type your answer.

The standard deviation (expressed in percentage terms) of the percentage of claims for the insurance company in case of earthquake is type your answer.

The standard deviation (expressed in percentage terms) of the percentage of claims tor the insurance company in case of theft is type your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL