Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 23E

Related questions

Question

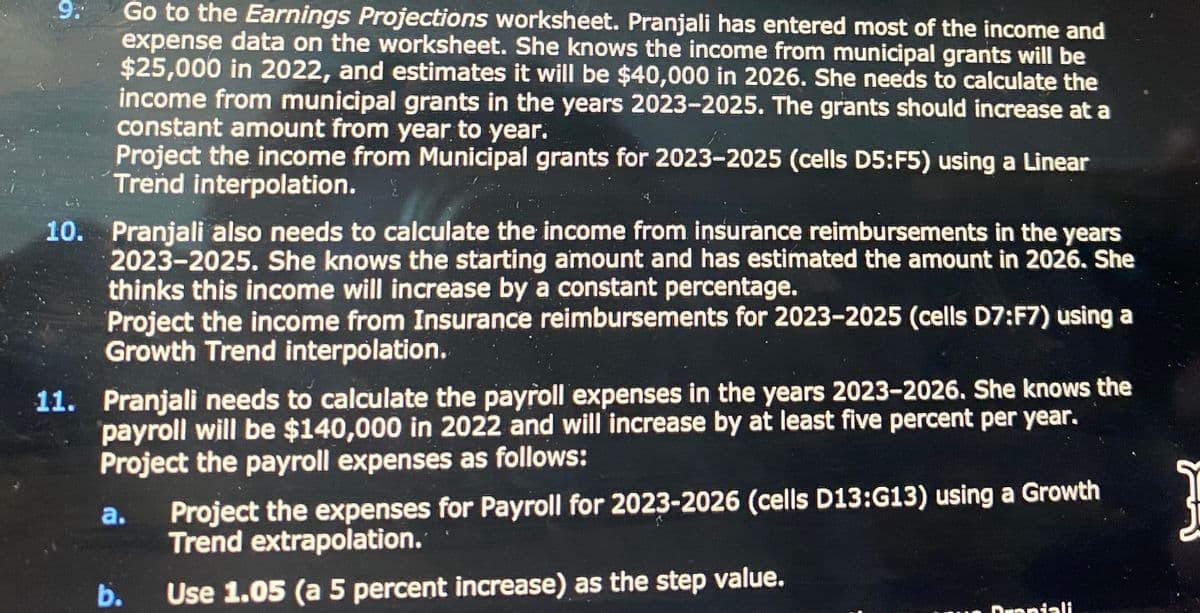

Transcribed Image Text:9.

Go to the Earnings Projections worksheet. Pranjali has entered most of the income and

expense data on the worksheet. She knows the income from municipal grants will be

$25,000 in 2022, and estimates it will be $40,000 in 2026. She needs to calculate the

income from municipal grants in the years 2023-2025. The grants should increase at a

constant amount from year to year.

Project the income from Municipal grants for 2023-2025 (cells D5:F5) using a Linear

Trend interpolation.

10. Pranjali also needs to calculate the income from insurance reimbursements in the years

2023-2025. She knows the starting amount and has estimated the amount in 2026. She

thinks this income will increase by a constant percentage.

Project the income from Insurance reimbursements for 2023-2025 (cells D7:F7) using a

Growth Trend interpolation.

11. Pranjali needs to calculate the payroll expenses in the years 2023-2026. She knows the

payroll will be $140,000 in 2022 and will increase by at least five percent per year.

Project the payroll expenses as follows:

a.

b.

Project the expenses for Payroll for 2023-2026 (cells D13:G13) using a Growth

Trend extrapolation.

Use 1.05 (a 5 percent increase) as the step value.

Praniali

Į

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College